- The UAE and Saudi Arabia are rapidly digitizing logistics, creating strong opportunities for new delivery and fulfillment platforms.

- Winning in this market requires more than feature parity with Aramex; bilingual UX, COD handling, and PDPL compliance are essential.

- Advanced capabilities such as smart routing, micro-fulfillment hubs, and predictive analytics drive real operational efficiency.

- Arabic-first design, local payment gateway integration, and data residency requirements increase development complexity and cost.

- The most effective go-to-market approach starts with pilot cities, local partnerships, and sustainability messaging aligned with national visions.

Every parcel that leaves Dubai or Riyadh tells a story — one of speed, ambition, and digital transformation. The way goods move across the Middle East isn’t just changing; it’s evolving into a smarter, faster, and more connected ecosystem.

A decade ago, logistics in the region ran mostly on paperwork, phone calls, and long waits. Today, thanks to digital pioneers like Aramex, that picture looks entirely different. The company didn’t just improve delivery — it redefined the meaning of logistics itself. From real-time shipment tracking to mobile-first experiences, Aramex became the regional benchmark for logistics app development like Aramex, inspiring a wave of startups and enterprises across the GCC to modernize their operations.

The timing couldn’t be better. McKinsey points out that Saudi Arabia’s e-commerce market is on track to grow steadily over the next decade, potentially reaching around US $60 billion by 2035, and the region’s eB2B market has already crossed the US $70 billion mark. They also note that the next wave of growth won’t come from front-end shopping apps alone — it’s being driven by smarter logistics and fulfillment technology, with logistics-focused deals expected to pick up speed in 2025 and beyond.

In this guide, we’ll break down everything you need to know about transportation app development like Aramex — from choosing the right business model to ensuring regulatory compliance and estimating app development costs in AED and SAR.

By the end, you’ll have a clear roadmap to launch a next-generation logistics platform built for the Middle East.

Let’s design your logistics platform for Vision 2030 growth.

Designed for bilingual UX, COD workflows, and PDPL compliance from day one.

Market Opportunity: The ME Logistics Surge

The Middle East isn’t catching up in logistics — it’s quietly pulling ahead. Over the past five years, the UAE and Saudi Arabia have built something remarkable: a logistics network that’s evolved from scattered warehouses and phone calls into a fully digital ecosystem of fulfillment hubs, last-mile fleets, and AI-driven dispatch systems. What used to be a traditional supply chain has now become a smart logistics economy with the help of AI in logistics.

Independent analyses from Deloitte project a rapidly expanding GCC logistics market through 2030, led by the UAE and Saudi Arabia.This environment highlights the benefits of building an app like Aramex — faster fulfillment, seamless payments, and transparent customer experiences.

Companies investing in logistics and transportation app development in Dubai or courier app development in Saudi Arabia are not just meeting demand; they’re aligning with national digital goals.

The key players like Aramex, Fetchr, Shipa, and SMSA Express have already realigned the expectations of the consumers. Their applications have become normal, making real-time tracking, instant rate calculators, mobile payment and Arabic English interfaces.

For startups and enterprises, the reasons to create a logistics and transportation app similar to Aramex are clear. The region is scaling faster than ever, fueled by a young, digital-savvy population and government-backed innovation. Those who build now aren’t just entering a market — they’re stepping into the future of how the Middle East moves.

Step-by-Step Development Process of an App Like Aramex

When founders set out to create an app like Aramex, most imagine the screens first — tracking pages, driver maps, delivery status updates. But in reality, the journey starts long before design. You’re stitching together trust, compliance, and operations across cities and borders. Below are the practical steps to build a logistics and transportation app like Aramex in a way that works for both Dubai and Saudi Arabia.

Step 1: Market Research & Regional Compliance

Before your app hits a single download, you need to know the landscape. The Middle East logistics scene moves differently — it’s shaped by sprawling desert geographies, free zones, and fast-evolving data laws. This is the stage where market insight meets regulatory clarity.

What to validate

- Competitive scan (UAE vs KSA): Study how Aramex, Shipa, SMSA Express, and Fetchr handle deliveries, pricing, and customer experience. Understand the gaps: Does Saudi need more localized COD reliability? Are UAE users expecting faster app interfaces?

- Buyer segments: Define who you’re building for — SME exporters, retail marketplaces, or D2C sellers — each has a unique expectation from your platform.

- Service tiers: While same-day is a Dubai norm, next-day or two-day delivery still dominates intercity routes in Saudi Arabia.

Compliance must-haves

- Both UAE PDPL and Saudi PDPL enforce strict rules around consent, storage, and cross-border data transfers. Create consent flows in Arabic and English, set data retention schedules, and keep records of processing activities.

- If you’re hosting data outside the region, make sure you have contractual safeguards in place — or better yet, host in AWS UAE or Oracle Cloud Riyadh for compliance peace of mind.

Step 2: Define Your Business Model & Service Types

This is where the business model of transportation app like Aramex comes into play. Not every market needs the same offering — and not every merchant wants to pay the same way.

Choose one or more:

- B2B Express Delivery for enterprises with scheduled pickups.

- B2C Last-Mile for e-commerce and D2C brands.

- On-Demand Courier for pharmacies and food.

- Freight & Cross-Border Aggregation for GCC merchant exports.

Dubai leans toward precision and same-day convenience, while Saudi merchants prioritize COD reliability and predictable next-day windows. Pricing may shift between per-shipment fees and subscription credits based on merchant type.

Step 3: Design & User Experience

In a market where language, trust, and convenience shape adoption, design is everything. A well-designed interface can do what an ad campaign can’t — build confidence across two languages and five cities.

Language & layout

- Support Arabic and English, with right-to-left alignment and localized fonts.

- Include intuitive address fields that accept PO boxes, landmarks, and compound names.

Addressing reality

- Use smart location tagging and map prompts that let users drop pins, add landmarks, or attach notes for complex areas.

- Drivers in compounds or industrial zones need clear, voice-assisted navigation and building access instructions.

Accessibility for all roles

- Drivers need large buttons, offline capability, and route previews.

- Dispatchers require live maps, heat zones, and alert dashboards for delayed routes.

Step 4: Backend Architecture & Integrations

This is where reliable logistics and transportation app development in the UAE becomes visible. The backend orchestrates payments, ETAs, taxes, and live dispatch.

Core stack setup

- Build on microservices with container orchestration via Kubernetes.

- Host on AWS Middle East, Oracle Riyadh, or Azure UAE North for compliance and low latency.

- Use Kafka or Pub/Sub for event streaming (real-time delivery status updates).

Local integrations

- Payments: Network International and PayTabs for UAE; Mada and HyperPay for Saudi.

- Telecom/OTP: Etisalat and du (UAE); STC, Zain, and Mobily (KSA).

- Maps: Mapbox or Google Maps with custom GCC geofencing and local POI data.

- Tax/Customs: Integrate UAE’s 5% VAT and Saudi’s 15% VAT invoicing APIs.

For transportation and logistics app development in UAE, latency and uptime SLAs also influence merchant trust. Encrypt everything (in transit and at rest), manage roles via IAM, and ensure audit logs for PDPL compliance.

Step 5: Core Feature Development

Now comes the part users actually see — the features that define your app’s value. But behind every shipment tracker or pickup scheduler is a complex web of APIs, data syncs, and dispatch logic.

Customer features

- Shipment booking, rate calculator, pickup scheduling, live tracking, and COD options.

- Transparent duty/tax breakdown for cross-border shipments (popular for GCC trade).

- Seamless returns management with QR or no-label options.

Driver & admin tools

- Driver apps should support auto-routing, PoD capture, and cash ledger management.

- Admin consoles must include SLA dashboards, bulk uploads, and automated dispute resolution.

Optimization engine: Use predictive routing to navigate Dubai’s traffic corridors and Riyadh’s peak-hour clusters. Add AI-driven promise-date logic that dynamically updates delivery windows.

Step 6: Testing & Localization

A great app can fail fast if it doesn’t adapt to regional nuances. Testing in the Middle East means going beyond bugs — it’s about language accuracy, heat conditions, and telecom reliability.

Quality & localization

- Test both Arabic and English interfaces side by side.

- Validate GPS accuracy in compounds and new industrial zones.

- Simulate network drops and COD payment errors — real-world logistics rarely happen in ideal conditions.

Compliance & security validation

- Conduct a PDPL compliance audit — ensure all personal data flows are documented, encrypted, and access-restricted.

- Perform penetration tests and data masking checks before launch.

Cultural readiness

- Train support teams in bilingual communication.

- Ensure app performance during local holidays (Ramadan, Eid, Hajj), when usage spikes and service windows shift. You can integrate AI in warehouse management to make the process easy.

Step 7: Launch & Maintenance

A launch in Dubai or Riyadh is not the finish line — it’s the starting gate. Logistics platforms win not just by going live, but by staying fast, compliant, and adaptive.

Pilot smart, scale faster

- Start in Dubai and Riyadh, collect performance data — on-time delivery %, driver efficiency, first-attempt success rate.

- Gradually expand to Abu Dhabi, Jeddah, and Dammam once operational metrics stabilize.

Seasonal preparedness

- Adjust delivery slots during Ramadan (evening peaks) and Hajj (restricted access zones).

- Plan for regional weather challenges — sandstorms, high heat, or traffic diversions.

Continuous improvement

- Refresh routing data quarterly.

- Update tariff models, driver apps, and PoD flows every 6–8 weeks.

- Regularly re-audit PDPL compliance as regulations evolve.

Launching a logistics app in the Middle East isn’t about copying Aramex — it’s about learning from its precision and building for tomorrow’s economy.

Partnering with a mobile application development firm in Dubai helps ensure ongoing performance tuning, PDPL updates, and driver-app enhancements post-launch.

Core Features Every Aramex-Style Logistics App Needs

The true strength of any logistics platform isn’t hidden in its code — it’s revealed in the tiny moments that either frustrate a customer or earn their loyalty. When a driver finds the right compound without calling twice, when a cash-on-delivery payment settles without confusion, or when a merchant tracks returns without a spreadsheet — that’s where well-built features shine. These are the essential Features of Transportation and Logistics Apps Like Aramex that matter most in the UAE and Saudi Arabia.

Below is a clear breakdown of the four feature tiers that shape every successful delivery app like Aramex in the region.

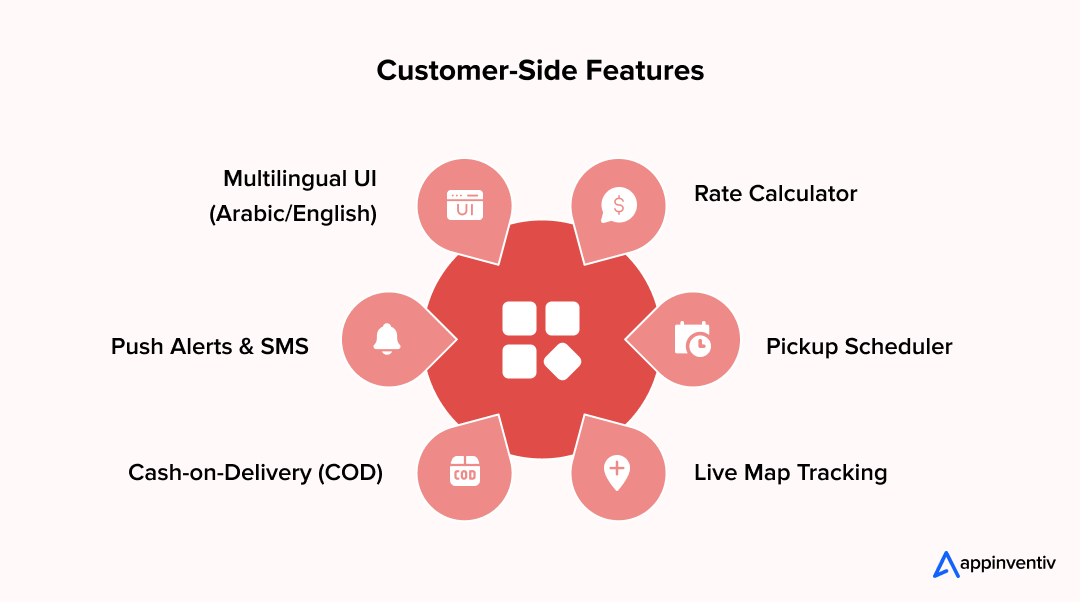

Customer-Side Features

Users in Dubai and Riyadh expect simplicity, clarity, and Arabic-English convenience. These are the interactions customers remember long after the parcel arrives.

- Rate Calculator: People want to know exactly what they’ll pay before booking. A smart calculator shows prices based on weight, service type, and cross-border routes — building trust upfront.

- Pickup Scheduler: Life here moves quickly. Let customers schedule pickups at convenient windows, and integrate real-time availability to avoid missed attempts.

- Live Tracking: In the Middle East, live map tracking has become standard. Customers should see driver movement, ETAs, and delay alerts in both languages.

- Cash-on-Delivery (COD) Support: With more than 60% of shipments in Saudi Arabia still relying on COD, smooth reconciliation and merchant settlement are essential. This alone affects retention.

- Push Alerts & SMS Updates: Delivery notifications through Etisalat or STC gateways keep customers informed, even without the app open.

- Multilingual UI: A fluent switch between Arabic ↔ English with right-to-left alignment makes the app feel “native” to the region.

When implemented properly, these features transform first-time users into loyal, repeat customers.

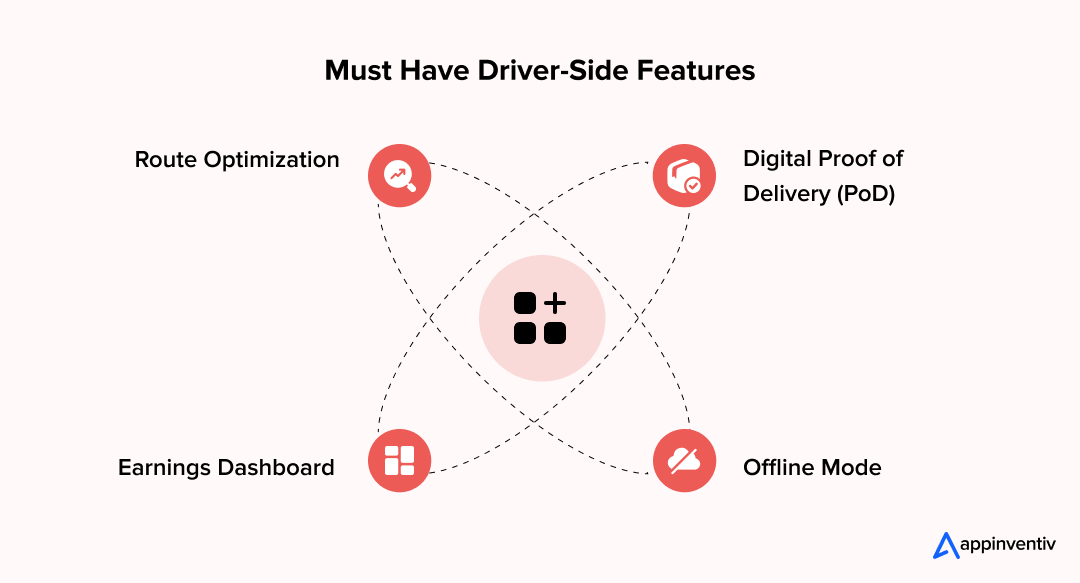

Driver-Side Features

Drivers operate in tough conditions — heat, compound restrictions, peak-hour zones. Empowering them directly improves delivery success rates.

- Route Optimization: Predict traffic on Dubai’s Sheikh Zayed Road or Riyadh’s ring roads, automatically rerouting drivers for faster runs.

- Digital Proof of Delivery (PoD): Instead of paper slips, capture e-signatures and photos that merchants can view instantly — fewer disputes, faster billing.

- Earnings Dashboard: Show drivers their daily totals, COD collections, upcoming bonuses, and settlement cycles. Transparency reduces churn.

- Offline Mode: Network gaps happen in industrial zones and remote compounds. Offline check-ins ensure deliveries don’t fail unnecessarily.

These features reflect thoughtful courier delivery app development — putting efficiency in the hands of the people on the road.

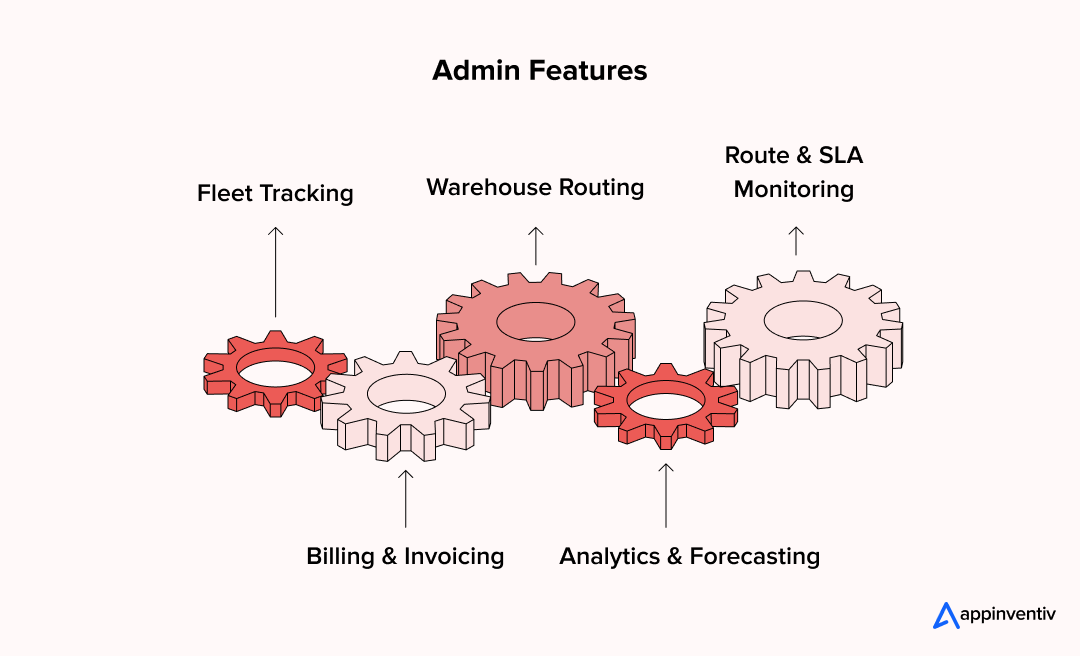

Admin & Business Console

If the customer app is the face, the admin console is the brain. This is where operations teams manage the real complexities behind thousands of daily deliveries.

- Fleet & Warehouse Management System: See all vehicles and shipments on a real-time map, and identify density clusters in free zones.

- Route & SLA Monitoring: Flag shipments at risk of missing delivery windows. Benchmark performance city-to-city — especially useful versus Vision 2030 KPIs.

- Billing & Invoicing: Automate invoices, reconcile COD flows, and support AED, SAR, and USD. Merchants appreciate clear financials.

- Analytics & Forecasting: Track cost-per-delivery, failed first attempts, and return rates. These numbers decide profitability.

This console embodies good delivery management app development — turning chaos into clarity.

Advanced Add-Ons for the Future

This region is evolving rapidly, so your platform should grow with it. Think beyond the basics.

- Green Delivery Slots: Offer eco-friendly windows and consolidated routes — ideal for sustainability-driven audiences.

- Micro-Fulfillment Integration: Connect to dark stores and urban warehouses for two-hour deliveries in dense areas.

- AI-Driven Demand Forecasting: Predict surges during Ramadan evenings or White Friday. According to McKinsey Middle East, AI forecasting can reduce delays by up to 25%.

- Drone & Autonomous Delivery Readiness: APIs today should be flexible enough to plug into autonomous dispatch workflows tomorrow.

These forward-looking features quietly differentiate companies that build a logistics and transportation app like Aramex from generic courier apps.

When all of the above comes together, your platform stops functioning like a piece of software and starts behaving like a calibrated logistics machine. This is where thoughtful transportation app development like Aramex turns into competitive advantage.

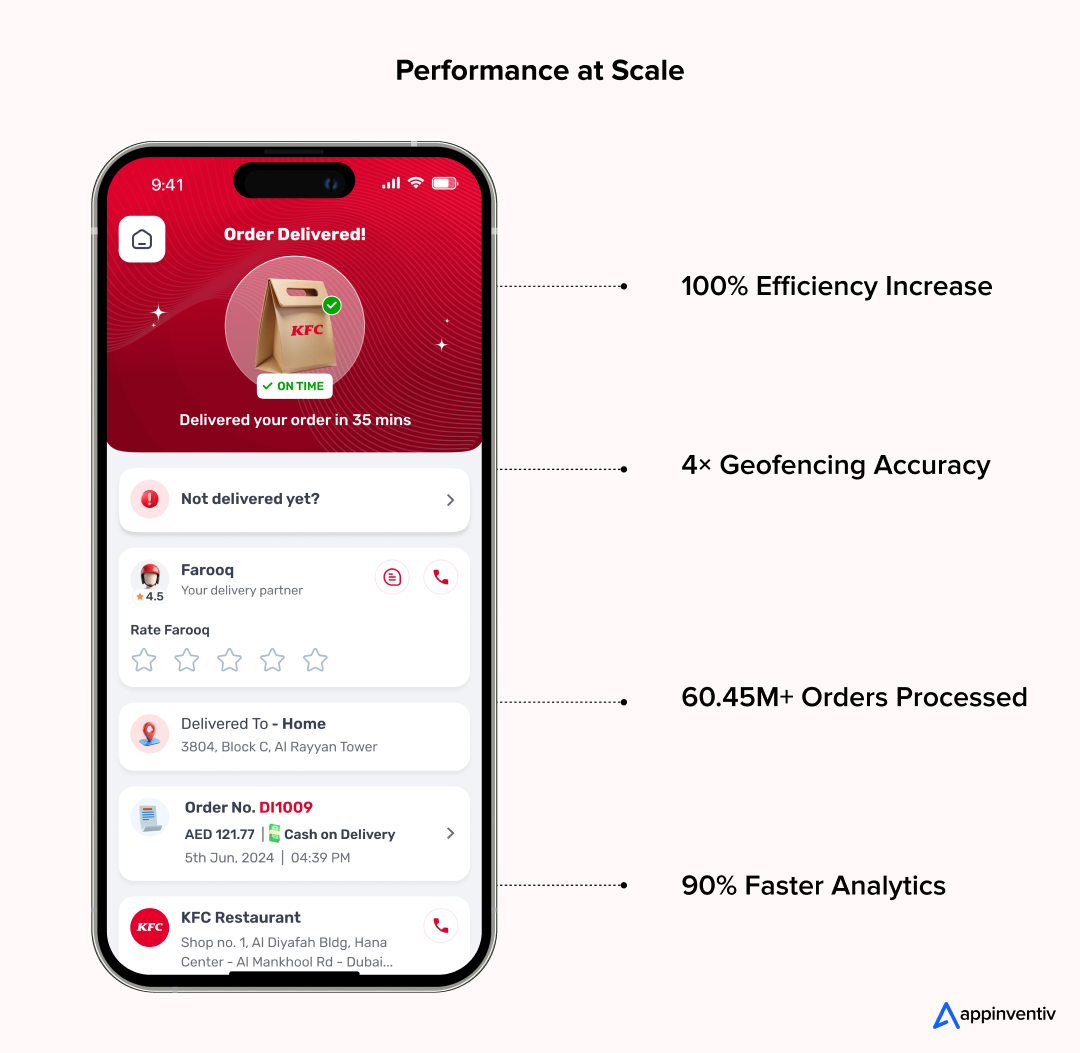

Real-World Example: Multi-Brand Dispatch at Scale

A clear example of how a modern logistics platform performs under pressure is our work with Americana Group, one of the largest restaurant operators in the region. With multiple brands, hundreds of outlets, and thousands of daily orders, their operations needed more than basic delivery tracking — they needed intelligence.

We built an integrated restaurant management and delivery orchestration platform that automatically assigns riders, aligns kitchen queue times, and gives operations teams real-time visibility across cities.

Once deployed, the impact was immediate:

Operational Results

- Auto-assignment accuracy jumped from 42% → 82%, cutting manual workload.

- Geofencing accuracy improved 4× (20% → 80%), reducing wrong turns and delays.

- 60.45M+ orders processed with zero downtime, even during seasonal surges.

- Reporting time reduced by 90%, from hours down to seconds.

Experience Improvements

- Riders spend less time navigating addresses.

- Kitchens dispatch orders at smarter intervals.

- Customers receive faster, more predictable deliveries.

By batching orders intelligently and routing riders based on live conditions, Americana shaved precious minutes off kitchen-to-door time. It’s a strong example of how intelligent logistics design can reshape high-volume delivery in the Middle East — quietly making every stakeholder’s day a little easier.

Optimize routes, warehouses, and drivers in one platform, with real-time tracking, automated invoicing, and predictive dispatch.

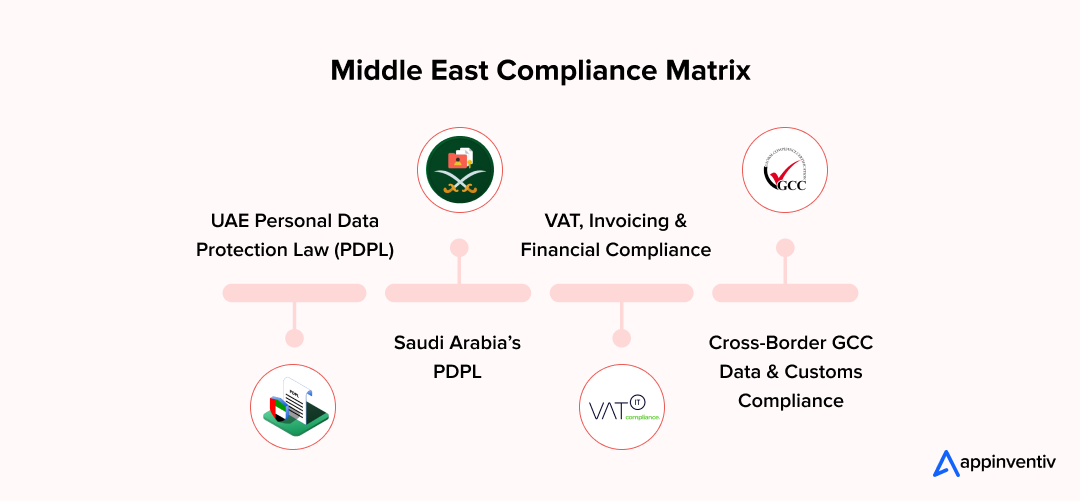

Data Privacy, Tax & Compliance Essentials for Logistics Apps in the Middle East

In the Middle East, logistics isn’t just about moving packages — it’s also about moving personal data responsibly. Every address, payment log, and timestamp is tied to real people, which means regional laws take privacy seriously. For anyone planning to make an app like Aramex, compliance becomes a business foundation, not a feature you add at the end.

Below is a practical, founder-friendly checklist to ensure your platform stays trusted and compliant across UAE and Saudi Arabia while adopting digital transformation in logistics.

UAE Personal Data Protection Law (PDPL): Building Trust Through Transparency

The UAE PDPL (Federal Decree-Law No. 45 of 2021) is the country’s first comprehensive data protection law. It reflects a simple principle: users should know how their data is collected, used, and shared.

For logistics apps, that means your user’s delivery history, real-time location, or payment details are all considered personal data — and must be handled transparently.

Key steps to comply:

- Consent Management: Add clear consent checkboxes in both Arabic and English during sign-up or address entry. Avoid “pre-ticked” permissions — the law treats them as invalid.

- Data Subject Rights: Make it easy for users to access, correct, or delete their data directly from the app settings. A simple “Request My Data” button can go a long way.

- Data Protection Officer (DPO): Appoint or assign a DPO — someone responsible for managing compliance, privacy incidents, and user requests.

- Data Localization: If you’re handling sensitive delivery or payment data, host it in UAE-based cloud regions like AWS UAE or Azure UAE North to reduce transfer risk.

The more transparent you are, the more confident your customers will feel when sharing their addresses, IDs, or payment details.

Saudi Arabia’s PDPL: Local Control, Global Standards

Saudi Arabia’s Personal Data Protection Law (PDPL) — now fully enforced after the 2023 Implementing Regulations — has turned data compliance into a national priority. The focus is on keeping personal data within the Kingdom and giving users control over how it moves abroad.

Here’s what matters most:

- Local Data Storage: Host servers and backups within Saudi Arabia unless you obtain official approval for cross-border transfers. This is crucial for logistics data (shipment tracking, driver logs, etc.).

- Explicit Transfer Consent: If your system integrates with non-KSA tools (e.g., third-party CRMs or cloud analytics), you must seek explicit user consent for data leaving the country.

- Breach Notification: In case of a security incident, notify the Saudi Data & AI Authority (SDAIA) and affected users promptly.

- Retention & Minimization: Keep only what’s necessary — don’t store old shipment data indefinitely. The law expects retention schedules and automatic purging after defined periods.

Platforms that create an app like Aramex for Saudi operations must treat data residency as a design decision, not an afterthought. By following these practices, you’re not just following regulations — you’re aligning your brand with Saudi Arabia’s Vision 2030 goal of a digitally confident, privacy-respecting economy.

VAT, Invoicing & Financial Compliance

In the Middle East, taxation compliance is tightly woven into logistics operations — especially for businesses handling cross-border GCC shipments or operating warehouses in multiple jurisdictions.

Here’s what to integrate:

- VAT Compliance:

- UAE: 5% VAT under the Federal Tax Authority (FTA).

- KSA: 15% VAT under the Zakat, Tax and Customs Authority (ZATCA).

- E-Invoicing APIs:

- Use Fatoora (KSA) or eInvoice (UAE) APIs to auto-generate compliant invoices. These should include VAT breakdowns and QR codes for B2B and B2C transactions.

- Multi-Currency Handling:

Ensure invoices dynamically reflect AED, SAR, or USD, depending on the shipment route. - Automated Settlement:

For COD payments, automatically log daily settlements, apply VAT, and reconcile reports in real-time.

By automating tax and invoicing compliance, you reduce human error and gain credibility with business clients who demand transparent billing.

Cross-Border GCC Data & Customs Compliance

For many logistics businesses, data doesn’t stop at the border — but regulations might. Cross-border shipments across the GCC introduce new legal and operational layers.

Best practices for GCC-wide operations:

- Maintain a unified compliance framework that aligns with both UAE and Saudi PDPLs.

- Use regional cloud zones (AWS Middle East or Oracle Riyadh) for data storage to satisfy both jurisdictions.

- For customs and trade, ensure integration with local e-customs portals for waybill validation and HS-code declarations.

- Disclose cross-border data transfers in your privacy policy — clarity builds trust.

These operational details quietly influence What is the Cost to Build a Transportation and Logistics App Like Aramex? — because compliance adds engineering hours, hosting requirements, and ongoing audits.

Even something as small as sharing a shipment update with an offshore CRM can count as a cross-border transfer — and must be documented.

Turning Compliance Into a Competitive Advantage

Customers and B2B partners in the GCC are becoming increasingly privacy-aware. By showing that your app respects data rights, tax transparency, and cross-border integrity, you gain more than compliance — you earn trust.

This is why a major factor affecting the cost to build a logistics and transportation app like Aramex is the regulatory complexity — bilingual consent screens, retention logic, local hosting, audit logging, and secure access control all increase development scope.

Companies that build compliance in from day one:

- close enterprise deals faster,

- onboard merchants with fewer delays,

- and avoid costly post-launch overhauls.

And that’s how smart brands quietly win market share — not with louder marketing, but with quieter compliance discipline.

Cost Breakdown: What It Really Takes to Build a Logistics App in the UAE and Saudi Arabia

One of the first questions founders ask is: “What is the Cost to Build a Transportation and Logistics App Like Aramex?” The honest answer is that there’s no single price tag — because the Middle East market demands features, compliance layers, and bilingual design that don’t exist everywhere else. If you’re planning to make an app like Aramex, your costs will reflect not just engineering hours, but operational nuance.

In both the UAE and Saudi Arabia, customers expect Arabic-English UX, mobile-first workflows, and cash-on-delivery settlement. Add data residency requirements from PDPL laws, and suddenly the backend needs more architecture than a typical western delivery app.

Overall Cost Range

- UAE: AED 147,000 – 1,468,000 (around $40,000 – $400,000)

- Saudi Arabia: SAR 150,000 – 1,500,000 (around $40,000 – $400,000)

This range reflects platforms that go beyond parcel tracking — including separate apps for customers, drivers, and administrators, plus smart dispatching, invoicing, and compliance safeguards.

If you’re comparing this to generic courier solutions, remember: logistics app development like Aramex demands deeper engineering and more regional optimization.

Cost by Development Stage

| Phase | AED Range (USD) | SAR Range (USD) | What’s Included |

|---|---|---|---|

| Discovery & Design | AED 18,000 – 55,000 ($5,000 – $15,000) | SAR 18,750 – 56,250 ($5,000 – $15,000) | Market research, wireframes, and bilingual design |

| App Development | AED 73,000 – 440,000 ($20,000 – $120,000) | SAR 75,000 – 450,000 ($20,000 – $120,000) | iOS and Android apps for customer, driver, and admin users |

| Backend & APIs | AED 73,000 – 440,000 ($20,000 – $120,000) | SAR 75,000 – 450,000 ($20,000 – $120,000) | Dispatch logic, live tracking, payment gateway setup |

| Optimization Engine | AED 36,500 – 220,000 ($10,000 – $60,000) | SAR 37,500 – 225,000 ($10,000 – $60,000) | Smart route planning, traffic analysis, ETA prediction |

| Compliance & Testing | AED 18,000 – 73,000 ($5,000 – $20,000) | SAR 18,750 – 75,000 ($5,000 – $20,000) | PDPL review, localization testing, performance optimization |

Why Costs Look Different in the Middle East

In this region, cost isn’t just about technology — it’s about context. Building for Dubai or Riyadh means designing for people who live in two languages, rely on mobile-first experiences, and often still prefer cash on delivery. That’s what sets your budget apart.

Here are the regional cost drivers most founders overlook when calculating the cost to develop an app like Aramex:

- Arabic-first design: Translating screens into Arabic is the easy part. Making the design work right-to-left, ensuring words fit naturally, and keeping it visually balanced takes extra time and testing. That alone can add 5–8% to your total design budget.

- COD workflows: Cash-on-delivery may sound simple, but it’s one of the most expensive features to implement. It requires tracking, reconciliation, and safety checks across multiple users and currencies. Expect an additional 7–10% of backend cost.

- Local payment gateways: Platforms like Network International and PayTabs follow local onboarding rules, documentation, and security audits. These aren’t plug-and-play — integration and certification often take extra development days.

- Cloud and compliance: UAE and Saudi data protection laws demand that all user and logistics data be stored locally. Hosting on AWS Middle East or Oracle Riyadh keeps you compliant but pushes your infrastructure cost slightly higher.

- Audits and updates: From VAT e-invoicing to annual PDPL reviews, these ongoing compliance checks are now part of the business routine. Most companies spend another 2–4% of yearly budgets just keeping up.

How to Spend Smart

Start small Build a pilot version that runs in one city — Dubai or Riyadh. Measure performance, gather real user feedback, then expand.

Use shared frameworks wherever you can — for instance, the driver and customer apps can share 60–70% of their core components.

And don’t treat compliance as a “later” task. It’s cheaper to build with PDPL in mind than to fix violations later.

Timeline to Expect

On average, it takes about four to six months to build an MVP and another few months to scale into a stable enterprise-grade release. Timelines stretch slightly if your project involves heavy customization or third-party integrations.

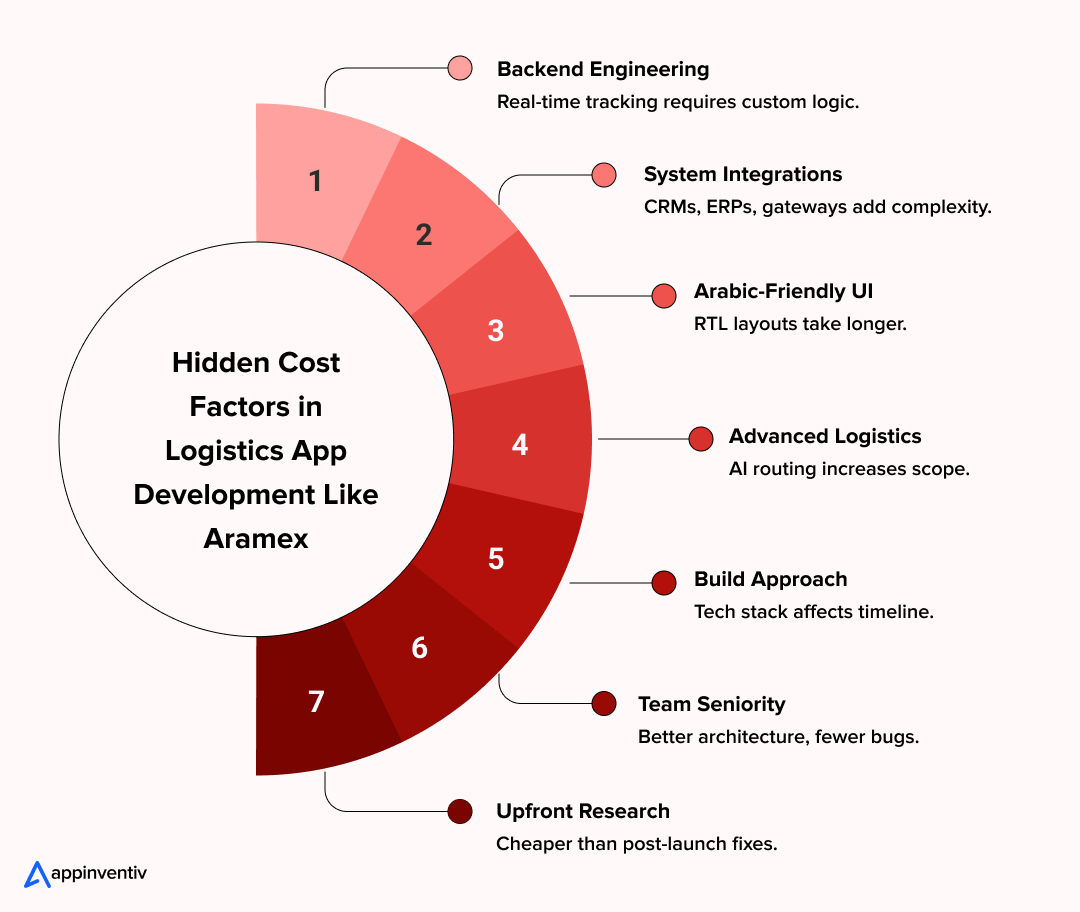

Hidden Cost Factors Most Founders Miss

A logistics app doesn’t just cost money to build — it costs money to connect. Beyond screens and tracking maps, several backend and ecosystem elements quietly push budgets higher:

- Backend Logic & API Work: Routing, live tracking, COD settlement, and notification flows require custom backend engineering. The programming language and frameworks you choose influence speed, security, and hours of work.

- System Integrations (CRM, ERP, Payment Gateways): Most Middle Eastern logistics apps connect to CRMs for merchants, ERPs for inventory management, and payment gateways for COD reconciliation. Each integration adds testing, documentation, and ongoing updates.

- Custom UI/UX Design: Bilingual Arabic–English layouts, right-to-left alignment, and culturally familiar workflows take more design time than a generic interface.

- Complex Features: AI-powered routing, real-time SLA dashboards, and warehouse visibility aren’t basic features. They require additional APIs, data models, and cloud services.

- Cross-Platform vs Native Development: Flutter or React Native reduce cost, while native iOS/Android builds improve performance. Choosing one affects both budget and timeline.

- Team Location & Experience: Senior engineers cost more upfront but make fewer architectural mistakes — saving money over time.

- Market Research & Competitor Analysis: Before writing code, teams analyze address patterns, COD behavior, and courier flows. This upfront planning avoids expensive pivots later.

On average, these backend and integration decisions can add 15–25% to the total budget — especially in Dubai and Saudi Arabia where compliance, localization, and system linkage are essential.

Market Entry Strategy for the UAE and Saudi Arabia

Expanding into the UAE and Saudi Arabia takes more than a product launch — it takes local insight, smart partnerships, and cultural fluency. The market here rewards businesses that build with the ecosystem, not around it.

- Start with your pilot zones: Dubai South and Riyadh Industrial City are some of the areas that are best suited in testing. They are able to provide access to developed infrastructure, logistic free zones, and flexibility in regulations. Doing this before scaling into cities allows you to adjust everything, from delivery routes to the performance of the drivers.

- Build partnerships early: Partner with other fulfilment centers, e-commerce aggregators, and 3PL providers that are already based in the area. They provide you with immediate access to networks of merchants, visibility of data, as well as on-ground assistance. Powerful domestic partnership also establishes goodwill with the regulators and investors.

- Localize your marketing approach: In the Middle East, how you launch matters as much as what you launch. Create bilingual campaigns (Arabic and English) that resonate with regional pride, sustainability, and progress. Highlight your ESG credentials like EV fleets or recyclable packaging, and tie your messaging to larger national goals such as Saudi Vision 2030 and the UAE Digital Economy Strategy 2031, which aims to double the digital economy’s contribution to GDP by 2031.

When the brand story fits into the economic vision of the region, it is no longer only an app you are introducing into the world, but a national push to be smarter, greener, and more connected with logistics.

Challenges in Middle East Logistics and How Smart Brands Are Solving Them

For all the progress made in the UAE and Saudi Arabia’s logistics sector, some hurdles still slow the race toward full efficiency. But every challenge also reveals a gap — one that forward-thinking brands are already turning into opportunity.

1. The Addressing Problem: PO Boxes, Compounds, and Incomplete Data

Unlike Western cities that use standard street addressing, the Middle East still relies heavily on PO boxes, landmarks, and compound names. For delivery apps, that means frequent wrong turns, missed ETAs, and costly reroutes.

The Solution: Smart logistics players are closing this gap with AI-powered geolocation and user-generated addressing.

For example, Aramex partnered with what3words to implement unique 3-word addresses in Dubai. According to the pilot, deliveries using those addresses were 42% faster and reduced driver travel distance by 22%.

The takeaway? Let customers help you define their address — it saves time, fuel, and frustration.

2. Cross-Border Customs and GCC Integration

Moving shipments across GCC borders is another major friction point. Despite regional trade agreements, each country enforces different customs clearance rules, documentation standards, and import timelines. That creates delays and inconsistent delivery costs.

The Solution: Tie your system directly into customs/e-clearance APIs and automate documentation.

For example, in Saudi Arabia, trials of drone parcel delivery by the General Authority of Civil Aviation (GACA) and other agencies show the territory is building digital linkages for logistics innovation.

By plugging directly into these APIs, logistics startups can reduce cross-border delays by days — and keep both customers and customs officers happy.

3. Sustainability and the High Cost of Last-Mile Delivery

Last-mile delivery in cities like Dubai and Riyadh can account for 40–50% of total logistics costs — mostly due to fuel, traffic, and fragmented drop-offs. Add to that rising global pressure for sustainability, and logistics firms face both an economic and environmental challenge.

The Solution: Go electric with vehicle fleets (EV) and green logistics.

As an example, Dubai has over 41,000 electric vehicles in its fleet by mid 2025, with the help of the large utility company Dubai Electricity and Water Authority (DEWA).

Even the large logistics providers such as DP World at the Jebel Ali Port are increasing electric yard vehicles in order to reduce emission by more than 10%.

This is a trend that is becoming evident: cost savings and sustainability are finally converging, eco-conscious logistics is quickly becoming a competitive asset.

4. Operational Peaks During Ramadan and Hajj

Every logistics operator in the GCC knows that Ramadan evenings and Hajj seasons come with surges, restricted movement, and irregular working hours.

Without careful planning, delivery times slip and customer satisfaction takes a hit.

The Solution: Local companies now rely on predictive analytics to anticipate seasonal spikes.

Platforms like Noon Noon use historical order data to reassign driver capacity dynamically during Ramadan’s late-night shopping peaks. On the other hand Amazon UAE ramps up micro-fulfillment centers near urban clusters to maintain same-day service levels.

Technology doesn’t eliminate the surge — but it helps companies prepare instead of panic.

Future Trends Reshaping GCC Logistics

While the challenges are real, the future of logistics in the Middle East looks electric — literally and figuratively.

From AI-driven dispatch to autonomous fleets, what’s emerging isn’t just new technology; it’s a new mindset built around speed, sustainability, and scale.

1. Electric Fleets and the Rise of Green Logistics

The Dubai Roads and Transport Authority (RTA) aims to have 30% of its own fleet vehicles become electric or hybrid by 2030, while Saudi’s NEOM is designing zero-emission logistics corridors.

The next frontier isn’t only fast delivery — it’s clean delivery. Expect electric bikes, solar-powered hubs, and EV-only delivery zones across major cities.

2. Drone and Autonomous Delivery Pilots

The Saudi General Authority of Civil Aviation (GACA) has already approved limited drone delivery trials for logistics companies. Aramex and Madar are exploring drone-based last-mile pilots for rural regions, cutting delivery times from hours to minutes.

In Dubai, regulators are finalizing frameworks for urban drone corridors — meaning that soon, a coffee order or pharmacy parcel could literally fly over Sheikh Zayed Road.

3. AI and Predictive Supply Chains

Middle East logistics is shifting from reactive to predictive.

Machine learning models now forecast order surges, route delays, and warehouse congestion before they happen.

- Noon are using AI to match driver routes with customer availability windows.

- DHL Middle East uses predictive analytics to reduce idle truck time across GCC distribution routes.

The result? Lower fuel costs, faster fulfillment, and happier customers.

4. Micro-Fulfillment and Urban Warehousing

Regional delivery platforms are pushing inventory closer to residential areas to meet rising same-day expectations.

According to consulting firm RedSeer, quick-commerce players in the UAE are expanding dark stores and micro-fulfilment hubs to cut delivery distances in dense districts — a model now spreading across Saudi Arabia as well.

These mini hubs shorten the delivery distance dramatically — and that’s a game-changer for both speed and sustainability.

5. Logistics as a Data Business

Data is fast becoming the most valuable cargo in logistics. Every scan, route, and transaction tells a story about consumer behavior, warehouse efficiency, and urban mobility.

Companies that treat logistics data as an asset — not an afterthought — will own the next decade of growth.

The Road Ahead

For logistics brands in the Middle East, the message is simple:

The market is ready. The technology exists. The advantage belongs to those who execute with precision and local insight.

From EV fleets to predictive dispatch, the GCC is no longer catching up with the world — it’s quietly building the blueprint for how global logistics will operate next.

Partner With Experts in GCC Logistics App Development

Launch faster, integrate smarter, and expand effortlessly across the Middle East

Partner with Appinventiv: Building the Next Generation of Logistics Solutions

Building a logistics and transportation app like Aramex takes more than engineering — it takes experience, scale, and an understanding of how digital ecosystems move goods, people, and data. That’s where Appinventiv comes in.

As a leading mobile application development firm in Dubai, Appinventiv has been helping enterprises across the GCC build end-to-end platforms that connect warehouses, fleets, and customers with precision and speed. To date, we’ve delivered 1,000+ digital projects across the Middle East, supporting brands in 35+ industries and successfully executing 12+ government-grade compliance programs in regulated environments.

Our work with a global logistics enterprise led to the creation of an intelligent supply chain & logistics management software featuring real-time tracking, smart routing, and data-driven dispatch planning. The platform reduced operational bottlenecks and improved on-time deliveries by double digits — a result of deep collaboration between our engineering and business strategy teams.

Whether you’re an enterprise looking for transportation and logistics platform development or a startup ready to scale your delivery operations, Appinventiv brings the strategic expertise of a mobile app development company in Saudi Arabia with the technical depth of a global innovation partner. From concept to compliance to growth, we help businesses design logistics platforms that perform — and scale — across the Middle East.

Ready to explore what your logistics platform could look like in the GCC? Our team will walk you through architecture options, compliance considerations, and the right feature roadmap.

FAQs

Q. Why are entrepreneurs and businesses investing to build a logistics and transportation app like Aramex?

A. Companies across the Middle East are doubling down on logistics apps because customer expectations have changed dramatically. People now want real-time tracking, flexible deliveries, multiple payment options, and bilingual support. An app modeled after Aramex helps businesses modernize operations, reduce dependency on manual coordination, and compete with larger delivery networks. It also opens doors to new merchant partnerships, higher delivery volumes, and better control over customer experience — all through a digital platform that scales faster than traditional fleets.

Q. How can a logistics and transportation app benefit large-scale enterprises?

A. For enterprise-level organizations, logistics apps do more than track parcels. They streamline multi-city dispatching, automate invoicing, improve warehouse routing, and cut down failed delivery attempts. Operations teams can monitor SLAs in real time and use analytics to optimize routes and fleet utilization. As a result, enterprises save on fuel, reduce labor overhead, and deliver faster across dense markets like Dubai and Riyadh.

Q. How can a logistics app like Aramex generate new revenue streams?

A. A well-structured platform unlocks monetization in multiple ways. Businesses can charge merchants per shipment, offer subscription-based delivery credits, enable paid add-ons like same-day service, or take a commission on COD collections. Some companies also monetize API access, allowing sellers to plug shipment data directly into their POS systems. As order volume grows, each of these channels creates compounding revenue without needing to expand physical fleet size.

Q. How can AI and automation enhance logistics app performance?

A. AI brings precision to the most expensive parts of delivery operations. Machine learning models can predict peak-hour demand, optimize routes to avoid congested zones, and suggest the ideal delivery window based on customer availability patterns. Automation also handles repetitive tasks like invoicing, settlement, and driver assignment. Together, these improvements reduce delays, lower operational costs, and increase first-attempt delivery success rates — which directly boosts customer satisfaction.

Q. Which technologies are used to make a transportation and logistics app like Aramex?

A. Typically, the backend is built on microservices using Node.js, Java, or Go for high-volume transaction handling. Real-time tracking relies on WebSockets, Kafka, or Pub/Sub event streaming. For the mobile experience, Flutter or React Native are common choices because they ship apps for Android and iOS faster. Mapbox or Google Maps handle routing and geofencing, while regional payment gateways like PayTabs, Mada, or Network International power secure checkouts. Cloud hosting in AWS Middle East or Oracle Riyadh helps meet local data regulations.

Q. How can a transportation app like Aramex generate new revenue streams?

A. Besides per-shipment charges, businesses can offer express delivery upcharges, logistics insurance, warehouse storage fees, and returns processing as premium services. Enterprise merchants are often willing to pay for bulk dashboards, API access, priority pickups, and custom SLAs. Over time, these “micro-revenues” add up and allow companies to grow without proportionally increasing fleet size.