Dental Service Organizations (DSOs) are growing quickly. More patients. More sites. Bigger networks. But under the surface, a different trend is emerging:

Turnover is rising and sentiment is dropping. In fact, some of the lowest employee sentiment scores overall our found in this industry.

If you are a CHRO, CEO, or investor in this space, ask yourself: Are we scaling operations faster than we’re scaling trust? And if so, what can we do to mitigate risk and protect performance value?

Real Risk Isn’t Competition

According to the Bureau of Labor Statistics, demand for dental hygienists and assistants is set to grow 19% by 2032. But many roles are going unfilled. In fact, the numbers are 1 in 4 in Canada, and more than a 21% vacancy rates in U.S. private practice.

Clinics are short-staffed and structurally exposed.

- 18,000 dentists have left private practice since 2021—burnout, stress, and lack of support.

- 31% of hygienists report burnout.

- 38% of assistants leave due to low wages and dead-end roles.

- And replacing one hygienist costs over 140% of their salary.

The takeaway: People aren’t leaving work. They’re leaving the system.

And it’s that system, how talent feel they are being led, developed, and trusted that will now have the greatest determination on Dental Service and Partner Operators performance.

Why Some DSOs Are Slowing Down (Even While Growing)

On paper, many Dental Service Organizations (DSOs) are expanding into more locations and securing more capital. But when we looked beneath the surface, we found another story that needs exploring.

Clinician sentiment is declining. Turnover is accelerating. And for many in the industry, patient satisfaction is slipping as well.

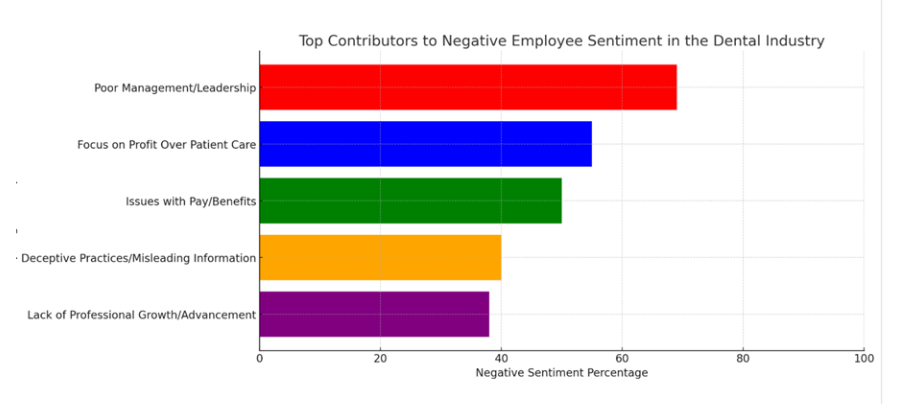

The Five Factors Contributing Most to Performance Drag

In our research, five systemic breakdowns consistently emerged among underperforming Dental Service Organizations. Each point to a widening gap between culture and optimal performance:

1. Weak leadership (69%)

1. Weak leadership (69%)

Field teams report inconsistent management, micromanagement, and lack of real mentorship. Many feel thrown into high-pressure environments without support, training, or protection from toxic behaviors. There’s no leadership presence—only oversight. Add to that an intense workload, frequent understaffing, and the expectation to juggle multiple roles—and it’s no wonder people are burning out and leaving.

2. Patients deprioritized for revenue (55%)

Across corporate Dental Service Organizations, a common thread from talent sentiment is an increasing pressure to upsell, overbook, or hit revenue quotas that conflict with their clinical judgment. Clinicians speak of being pushed to meet production metrics over doing what they feel is best for the patient.

3. Misaligned compensation (50%)

Despite reported pay increases in the last few years our research reveals compensation satisfaction is falling. And it is not just about the amount they are being paid, but how clearly, consistently, and fairly compensation is structured. Many commented there are confusing incentive plans, frequently shifting bonus criteria, and opaque performance rewards which is leaving people feeling undervalued and distrustful, even as wages rise.

4. Toxic Culture and Eroded trust (40%)

Communication for many is often misleading or absent. Several comment that promises of advancement have never materialized. Beyond metrics, many employees describe deeper cultural dysfunction: incivility, bullying, favoritism, and harassment which has eroded trust. Add to that an intense workload, frequent understaffing, and the expectation to juggle multiple roles, which is leading to burnout and turnover.

5. No meaningful path to growth (38%)

Many hygienists, assistants, and administrative staff claim to have no advancement opportunity. They see no roadmap for them to grow, lead, or expand their impact. Promotions are often seen as political, and learning is minimal.

What we’re seeing appears to be about execution. The trust breakdown is showing up in turnover. The leadership gaps are slowing scale. And the disconnect between what your organization promises and what your people experience is eroding retention, patient confidence and the overall brand reputation.

If there’s one place to start, it’s here: get clear on what your employer brand promises and then look closely at where it’s falling apart. Most often it is in how leaders show up, how compensation is perceived, and how growth opportunities are made visible. That gap is where you’re losing people, loyalty, and margin and it may be time to actively listen to understand and act.

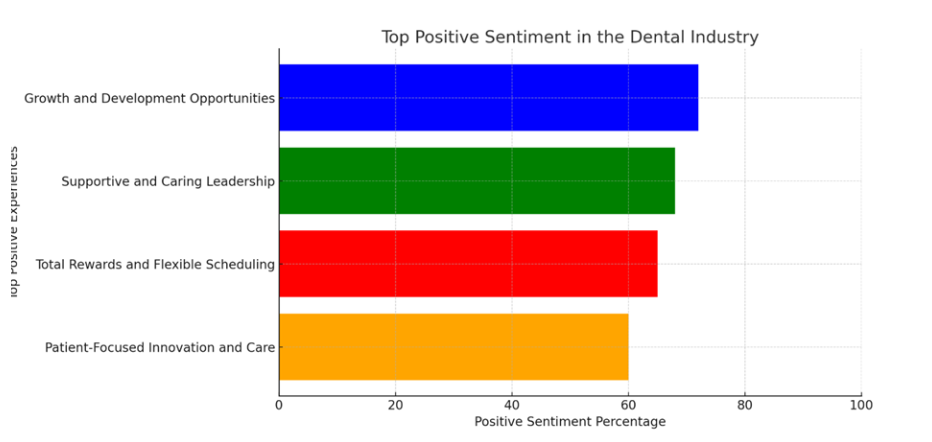

What High-Performing Dental Service Organizations Are Getting Right

High-performing DSOs have already operationalized culture as a business system. The results are measurable. Lower turnover, higher patient satisfaction, and stronger reputational pull. There also appears to be greater investment in and focus on HR as a driver of performance.

Across top performers, six behavioral markers consistently show up in employee sentiment and outcomes:

1. Growth is built into the employee experience (72%)

Structured onboarding, career-pathing, mentorship, and exposure to innovative technology are standard practice. Employees most often describe clear development plans and leadership that actively sponsors their progress.

2. Leadership shows up with purpose and consistency (68%)

Sentiment data reveals high trust in leadership where they feel the values of the company and teams are reinforced in daily decisions, rather than just in mission statements. Employees consistently cite transparent communications and more steady, human leadership styles at the regional level cultural anchors.

3. Rewards have been modernized for real life (65%)

One of the more significant shifts in sentiment for high-performing DSOs is that people believe the system is fair. Compensation isn’t confusing. Employees understand how incentives work, and they trust that their extra effort will lead to meaningful rewards. Flexibility is frequently treated as a standard part of the employment experience, with clinicians supported in balancing personal and professional demands. Benefits reflect what matters most to their teams: mental health access, parental leave, financial literacy support. People don’t just feel paid, they feel respected.

4. Care remains the central mission (60%)

Clinics in high-performing networks more often have sentiment that they operate with minimal production pressure and employees aren’t chasing quotas but focused on practicing care. Clinicians report having the autonomy to make treatment decisions based on clinical need, not upsell targets. That shift matters as it is restoring professional pride and building trust with patients, who pick up on the difference immediately and this comes across on their public reviews on Healthgrades and Google.

5. Operational friction has been removed (58%)

Frequently talent mentioned: “The systems here actually help me do my job.” In high-performing DSOs, operations aren’t just smoother, but talent feel they are designed to enable clinical care. From scheduling to staffing to patient handoffs, the infrastructure is described as reliable, clear, and responsive. Clinicians also report fewer last-minute scrambles, more time with patients, and less time fighting the process.

6. Micromanagement has been replaced with trust and ownership (55%)

Clinicians and staff describe a culture built on trust. They’re given the autonomy to make decisions, manage their time, and contribute meaningfully. In some cases, equity or shared-profit models reinforce that trust, but even without financial ownership, these teams feel a sense of accountability because their input is valued, and their expertise is recognized. Recognition is baked into leadership behavior, and how success is shared.

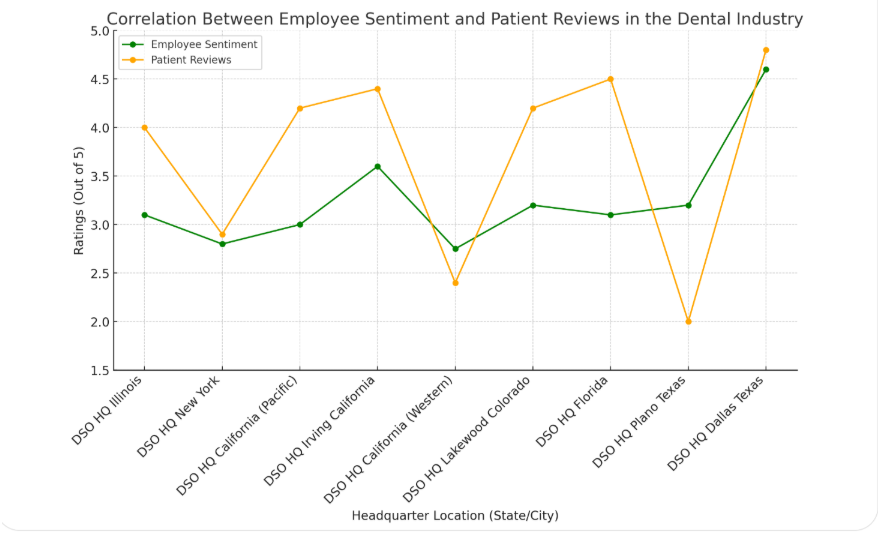

Culture Drives Throughput: The MB2 Data CEOs Can’t Ignore

Clinician sentiment, turnover, and patient satisfaction no longer operate in silos—they move in sync. Our analysis shows that when culture slips, performance follows.

- MB2 Dental, one of the fastest-growing DSOs in North America, holds a 4.6 employee rating and 4.8 patient satisfaction score. It’s not a coincidence. Their business model is rooted in autonomy, ownership, and cultural consistency.

- By contrast, Dental Service organizations (DSOs) with sub-3.0 employee sentiment consistently face plunging patient reviews, stalled growth, and rising rework costs.

- Clinics with high turnover consistently show lower per-patient revenue and higher operational drag—indicators investors can’t afford to ignore.

Where Growth Gets Fragile: A Conversation CEOs Don’t Hear Enough

Honest talk for leaders in this space.

You’re still growing, and your clinics are still expanding. On paper, most of your companies look quite solid. But inside? This research reveals that the cracks are forming. If they haven’t hit your financial performance yet, we predict that moment is coming soon. Turnover is creeping up. Burnout is becoming routine. Reputation is beginning to slip several firms that used to lead in their markets.

What we see in DSOs is that the problem isn’t growth slowing down. It’s that you don’t always know why. This is why you need to invest in your Culture and employer brand strategy. And you must shift in how it is managed, from being a tool for messaging, to a mechanism for growth.

A living system that will align leadership, culture, hiring, and reputation at every level.

If you recognize there may be an opportunity to accelerate performance, here are five places to look first:

1. Regional Leadership Behavior

Many respondents point to regional leadership as a point of breakdown. Inconsistency is the silent killer of retention and culture. If this level of leadership isn’t aligned and measured beyond growth, trust breaks and patients notice. Make leadership consistency a performance standard.

2. Clarity in Compensation and Rewards

Pay isn’t about numbers as we have seen from the above, it’s about trust. Confusing incentives and shifting targets erode motivation. Clarity and transparency here are as important as the amount. Take time to do road shows and build understanding and trust.

3. Feedback and Responsiveness Loops

In our sentiment data, trust was one of the more consistently raised concerns. That doesn’t just mean employees are unhappy, it means they don’t feel safe speaking up. And when people stop raising their hands, you stop seeing the truth of what’s happening on the ground. The fix isn’t complex, but it is urgent: listen actively, share back what you heard, and focus visibly on what matters most to them. Done well, this alone rebuilds trust and fast-tracks the loyalty you can’t afford to lose.

4. Cultural Consistency at Scale

As DSOs grow, many invest heavily in systems payroll, compliance, HR tech. But what often gets overlooked is the system that holds everything together: culture. When leadership behaviors, communication, and values are not consistent across clinics, growth creates confusion. Teams default to their own ways of working. Misalignment creeps in. And over time, that erodes trust, performance, and reputation. High-performing DSOs take a different approach. They build a clear culture story and employer brand narrative that is embedded into daily operations, not just recruiting. It shows up in how leaders lead, how teams recognize success, and how decisions get made.

5. Reputation as an Internal Alignment Engine

This is where employer brand matters most not exclusively to attract talent, but to build internal credibility and attract more acquisitions. It’s how the promise to your patients and teams gets delivered every day. Treat culture and sentiment as business metrics.

Are You Equipped to Use your Culture for Performance Driven Growth?

If you’re scaling fast but culture, trust, or retention are starting to slip, it may not be a hiring problem. It may very well be an employer brand-to-behavior gap. The truth is, even the best internal teams cannot see the full picture from the inside.

So, ask yourself:

Do we have a system in place that actively measures, manages, and aligns our leadership behaviors, employee experience, and employer reputation across every clinic, region, and function?

If the answer is no, or not clearly, now is a wonderful time to talk to Blu Ivy Group. We would be happy to help point you in a clear direction.

About Blu Ivy Group

Blu Ivy Group is a premier employer brand and culture consultancy specializing in the healthcare and dental services industries across the United States and Canada. We partner with CEOs, CHROs, Talent leaders, and Private Equity stakeholders to help organizations scale with integrity by turning employer brand reputation, leadership, and workplace sentiment into a competitive advantage.

With deep expertise in Dental Service Organizations (DSOs), hospitals, and multi-site healthcare networks, we deliver:

- Culture and leadership performance audits across locations

- Employer brand strategy is rooted in data and behavioral insight.

- Recruitment marketing elevates the quality of applicants and speed of hire.

- AI-powered sentiment analysis to track early signals of operational risk.

Whether you’re managing growth, preparing for investment, or navigating consolidation, Blu Ivy gives you the system and insights you need to scale culture and performance—clinic by clinic, leader by leader.

Learn more or connect with our founder at www.bluivygroup.com

The post Beyond the Chair: How Culture Is the Dental Service Industry’s Strongest Growth Lever appeared first on Blu Ivy Group.