Scalability is a crucial element in the FinTech sector as it is experiencing phenomenal growth due to the global population’s need for streamlined, on-demand security and instant financial services. With the rise in user bases and transaction volume, FinTech applications must manage the growing demand without compromising performance or security, while also providing a pleasant user experience.

But what would be the consequence of ignoring the scalability and security of a Fintech platform? These are some of the failures that one should learn:

- The Federal Trade Commission reported fraud losses of $12.5 billion, a 25% increase from the year 2023.

- According to ACS Information Age, 41.8% of fintechs suffered breaches due to third-party vulnerabilities, with 18.4% experiencing publicly reported incidents.

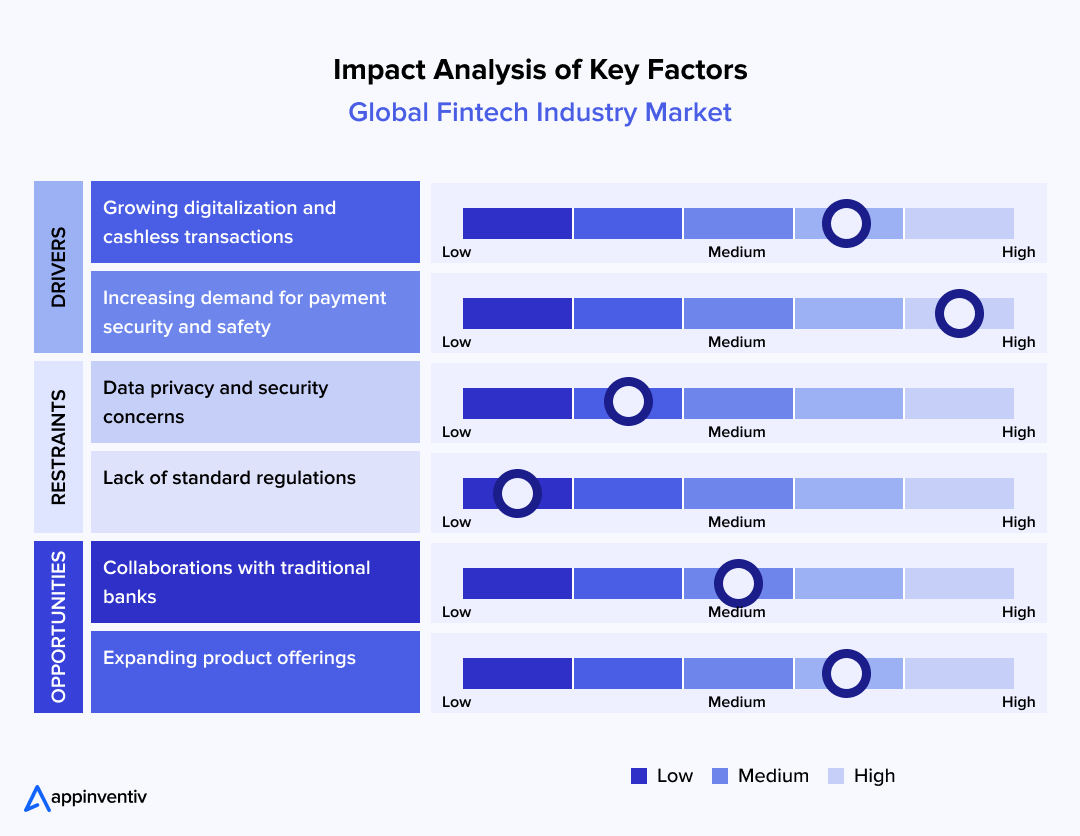

According to Coherent Market Insights, the Impact Analysis of key factors, as presented in the above graph, highlights that the security and scalability of financial technology are critical factors that determine the state of the industry. The rising need for security and safety in payment has been rated as having a high impact, as it plays a crucial role in building trust and development.

Additionally, opportunities such as increasing the number of products on offer ranked high, which implies the significance of scalability in accommodating the changing market’s requirements.

At Appinventiv, a reputable and well-established FinTech mobile app development company, we have effectively overcome these obstacles by utilizing proven strategies to develop scalable, secure, and user-friendly platforms, with an eye on the next big thing in the world of technology.

This blog offers insight into how Appinventiv has addressed the issue of scalability in FinTech platforms, leveraging its decade of expertise in delivering secure and scalable fintech solutions.

Unleash Your Fintech Potential

Embrace scalable, secure, and innovative fintech solutions to drive growth and deliver unparalleled value to your clients.

Understanding Enterprise-grade Fintech Scalability Challenges in FinTech and Appinventiv’s Battle-Tested Solutions

FinTech leaders agreed or strongly agreed that digitalization is disrupting the financial services sector. Such disruption is driving widespread digital transformation in FinTech initiatives, as financial institutions strive to innovate and stay ahead of the curve.

The FinTech industry is characterized by a high rate of change and a tightly regulated environment where the notion of scalability goes beyond technical needs to become a strategic requirement. With the increasing demand from users and the rise of rivalries, the ability to scale up in terms of elasticity, as well as performance, security, and cost-effectiveness, is paramount.

Let’s discuss the most important enterprise-grade fintech scalability issues that FinTech platforms could have by 2025 and how to address them with battle-tested Appinventiv’s Fintech Solutions.

Large Scale Transactions and Low Latency

Challenge

The volume of such transactions that need to be processed daily increases in tandem with the number of users of FinTech platforms, such as mobile banking applications or digital wallets. To provide clues, a payment application may require processing thousands of transactions simultaneously, such as during the holiday shopping season.

These transactions are expected to be performed in real-time, which means that the platform must provide low latency (allowing little time to pass) and high availability (it should always be online, even in the event of an extreme load). Delays or downtime can cause user annoyance, erode trust, and result in economic loss.

Reasons

- Volume Surge: A sudden increase in users (e.g., during a promotional campaign) can even overwhelm servers, resulting in slowdowns or crashes.

- Real-Time Expectations: Respondents expect immediate confirmation of their transactions, such as when they want to see a payment immediately.

- System Bottlenecks: Monolithic designs struggle to respond to large and simultaneous requests quickly.

Appinventiv’s Solutions:

Appinventiv addresses this issue with a microservices system and a cloud infrastructure that jointly allow them to guarantee scalability and performance.

1. Microservices Architecture: Rather than developing a single large application (monolith), we design our outputs into small, independent services (e.g., a payments service and another service that authenticates the user). Microservices architecture scales independently of each other, depending on demand. For instance, if payment transactions increase, only the payment service scales up, while the resources are saved.

a. How It Works: We create these services with the help of Docker and put them into containers. These containers are managed using Kubernetes, an orchestration tool that automatically distributes traffic and scales services according to requirements.

b. Advantage: This solution is isolated (when one service fails, others will not be affected) and enables accurate scaling to limit the latency.

2. Cloud-Based Infrastructure: We also leverage cloud technologies, such as AWS, Azure, or Google Cloud platforms, which can auto-scale resources to address the required problem. For example, the cloud utilizes additional servers during periods of increased traffic. Serverless computing (e.g., AWS Lambda) is also used, meaning that codes are run only when called, making serverless computing less costly and with guaranteed performance.

a. How It Works: AWS Lambda executes specific functionality (e.g., payment processing) without requiring a dedicated server, and automatically scales to meet demand.

b. Advantage: This ensures that the platform can handle a high volume of transactions with low latency, eliminating the need for manual work.

Example: Edfundo

One of the best examples of a build with scalability at its core is the partnership between Appinventiv and Edfundo, a financial literacy app that educates children and teenagers in the MENA region.

The project was designed to support high user growth in terms of users, institutions, and geography right from the start. The API-first approach and modular fintech backend architecture structure that we adopted enable the platform to remain fast, secure, and scalable, which can serve exponentially growing traffic, add new schools and levels of users, and support more advanced features without compromising fundamental functionality.

Approach to Enhancing Scalability for Functional Growth:

- Microservices, or Modular Architecture: Division of functionality by factoring functionality, e.g., user onboarding, gamified learning, parental controls, chatbots, into discrete services. Edfundo can scale particular modules independently based on demand.

- Horizontal Scaling: In peak scenarios (e.g., a sudden surge in learners), it is possible to add more servers (or containers) to the cluster to balance the load and mitigate performance bottlenecks.

- Optimized Data and File Storage: Queries can be optimized, and caching layers (such as Redis) will be implemented to improve response times and reduce load. Geo-distribution cloud file storage enables the efficient delivery of learning materials (e.g., images, videos) to specific geographies.

- Load-based Traffic Management: Rather than relying on a single point of failure, we recommend employing DNS rotation and load balancing in fintech systems, which are essential for managing traffic spikes and mitigating heavy usage behaviors in ed-tech environments.

- Spiky usage of Serverless Components: Serverless computing can be utilized where the usage of parts of the app is unpredictable, such as chatbots or quizzes, as these will scale up automatically as needed.

Security and Compliance Maintenance

Challenge

Being mass digital communicators, FinTech platforms deal with sensitive data (bank accounts or payment information) and are, therefore, an ideal target of a cyberattack. When the platforms operate under a larger number of users, they are more likely to become a source of data breaches or fraud.

They must also adhere to stringent laws, such as GDPR (data protection in Europe), PCI-DSS (payment card security), and AML (anti-money laundering), which are more difficult to enforce at scale.

Bonus Read: AML Software Development: Features, Benefits, and Costs

Reasons

- Higher Attack Surface: The more users and transactions, the more ways there are for hackers to enter.

- Regulatory Complexity: Regulatory controls vary by region and increase in complexity as platforms expand into global markets.

- Trade-offs: Incorporating security features may decrease performance (e.g., when not carefully added, as with encryption).

Appinventiv’s Solutions

We incorporate security-first protocols into the development process, providing application scalability without compromising safety or compliance.

- Encryption and Authentication: We utilize AES (Advanced Encryption Standard) and TLS (Transport Layer Security) to secure data when it passes through a network and when it is stored. Multi-factor authentication (MFA) provides an additional user verification.

- How It Works: AES encrypts sensitive data, such as the credit card number, and TLS encrypts data transmitted over the internet. A Multi-Factor Authentication (MFA) system prompts users to authenticate themselves using more than one credential (e.g., a password and an SMS code).

- Advantage: These precautions encrypt the data even as the number of transactions increases.

- Fraud Detection in real-time: We implement AI algorithms into the system to detect fraud in real-time, alerting to suspicious behavior (e.g., purchase patterns).

- How It Works: The machine learning models work by evaluating user behavior and purchases to identify anomalies immediately.

- Advantage: This platform is independent, allowing it to detect fraud without overloading processes.

- Compliance and Audits: Enforcement and regular security audits and regulations, such as PCI-DSS, will maintain compliance. Appinventiv also applies tokenization (replacing sensitive data with under-representation tokens) and access by role (no one authorized can have access to data).

- How It Works: Through the process of tokenization, the intercepted data cannot be used. Role-based access limits access to specific functions for a particular user group.

- Advantage: The platform will ensure compliance is observed across geographies, even as it scales.

Example: P2P Payment

For a P2P lending platform, we developed tokenization and fraud detection based on AI. The risk of fraud decreased by 40%, and the system’s capacity to support transactions, including cross-border payments, increased. The company remained compliant with current laws and regulations.

The performance of the Database

Challenge

The data produced by FinTech services is vast, encompassing transactional histories and user profiles. Databases must handle an increasing number of queries without deteriorating in performance or crashing as the number of users grows. Slow database performance results in delays, which can affect a user’s experience and trust.

Reasons

- Data Volume: The number of daily transactions is so large that traditional databases cannot handle it.

- Real-Time Processing: Users want quick access to information, such as account balances or stock prices, in real-time.

- Concurrency: When multiple users access the database simultaneously, it can lead to bottlenecks.

Appinventiv’s Solutions

We also utilize advanced database technologies and optimization techniques to achieve long-term scalability in fintech platforms.

- NoSQL and Distributed SQL Databases: Instead, they utilize NoSQL databases, such as MongoDB, HBase, or Cassandra, to manage unstructured data (e.g., user preferences), and distributed SQL databases, like CockroachDB, to handle structured data (e.g., transaction records).

- How It Works: NoSQL Databases efficiently manage large groups of diverse data, whereas distributed SQL databases duplicate data amongst several servers to achieve reliability.

- Advantage: All of these are horizontal databases (adding servers) to extend the load.

- Sharding, Replication, and Caching: Sharding refers to dividing the database into smaller parts, with each part hosted by a different server, thereby minimizing the impact on any single server. Replication produces replicas of information on multiple servers, ensuring accessibility in the event of a breakdown. Caching data refers to caching frequently accessed data so that queries may be performed faster.

- How It Works: Sharding is used to distribute transactional data, replication is used to create redundancy, and caching is used to provide real-time access to frequently requested items (e.g., account balances).

- Advantage: These methods reduce latency, and they are also reliable at scale.

Example: Stock Trading Applications

At Appinventiv, for Stock Trading Application Development, we utilized a sharded MongoDB solution that enabled real-time processing of market data across several thousand users per application, without any observable lag.

A Simplification of Third-Party Integrations

Challenge

Third-party services can be leveraged to support operations in the financial field, such as payment gateway integration or analytics. These tools must scale as the platform grows, which is not an easy task. The integration of services can be done poorly, resulting in bottlenecks that slow down transactions or cause failures.

Reason

- Dependency risks: When a third-party service is not functioning or unable to scale, it affects the entire platform.

- Integration of Complexity: Simultaneously linking multiple services without compromising performance is a highly technical task.

- Compliance: Third-party vendors will also be required to comply with FinTech regulations.

Appinventiv’s Solutions

Appinventiv develops API-based and modular integrations to ensure a smooth scaling implementation of third-party services.

- API-Driven Architecture: They can integrate services using standardized APIs, which makes the service recursive and autonomous.

- How It Works: APIs are one way the platform can integrate with other third-party services (e.g., Stripe), allowing for loose coupling so that changes in one system do not break another.

- Advantage: This allows scaling and maintenance to become easy.

- Vendor Selection: Appinventiv ensures that the third-party provider has scalable credentials and has a record of compliance.

- How It Works: They test vendors, such as Stripe, in terms of their capacity to manage a large volume of transactions and comply with PCI-DSS standards.

Bonus Read: How to Develop a PCI-Compliant Mobile App?

- Advantage: Dependable vendors avoid bottlenecks during periods of high usage.

- Custom Integration Solutions: Appinventiv develops custom integration solutions to address the complex needs of businesses, providing seamless communication between the platform and third parties.

- How it works: Middleware is used as an interface, making data passing faster and decreasing latency.

- Advantage: This guarantees a hassle-free scaling.

Example: Digital Wallet Payment

In the case of a digital wallet app, we added scalable payment interfaces to the platform, enabling it to support an unprecedented level of rise in transaction volume during peak shopping periods without fail.

Efficient Resource Programming

Challenge

The process can be costly due to the inability to scale the infrastructure (e.g., by adding new servers) when using it, since only the FinTech startups can afford it (their budgets are limited). Trading performance and cost are important, not to waste money, but to enable scaling.

Reason

- Expensive: Conventional on-premises servers require a significant initial investment and ongoing maintenance.

- Uncertain Demand: Irregular traffic spikes (e.g., during tax season) create uncertainty regarding the demand and resource requirements.

- Wasteful Overprovisioning: The tendency to assign excessive resources to peak loads results in the wasteful expenditure of funds during off-peak periods.

Appinventiv’s Solutions

Appinventiv also utilizes cloud platforms and serverless computing to achieve optimal cost efficiency, with opportunities for scalability.

- Cloud Platforms: Appinventiv utilizes pay-as-you-go pricing on AWS, Azure, or Google Cloud, where clients only pay for the resources they use.

- How It Works: Auto-scaling manages server capacity in real-time, scaling up or down to save money when traffic is low.

- Advantage: It does not require costly, fixed infrastructure.

- Serverless Computing: There are no dedicated servers to house the code; instead, one uses a tool such as AWS Lambda to execute the code as needed.

- How It Works: Lambda functions (e.g., processing a transaction) are launched on demand and are automatically scaled and pay only when the functions are executed.

- Advantage: This helps to save on the peak usage and serve high utilization.

- Cloud Migration: Appinventiv can assist clients in transitioning their operations from legacy systems to the cloud, helping them reduce operational costs.

- How It Works: They move data and software to the cloud in a cost- and performance-optimized way.

- Advantage: This guarantees scalability, which is not prohibitively expensive over the long term.

Example: AI-Powered Mobile Banking Application for a Global Bank

We have designed an AI-powered mobile banking application for a global banking institution. The purpose of finding the solution was to support more users visiting the system, with continuous, steady performance and reliability for data processing.

Strategies on Improving Scalability

In addition to the microservices-based solution, we have introduced a few strategies to support scalability and the expansion of functionalities in a wide range of areas across the banking sector:

- Cloud-Native Architecture: The utilization of cloud infrastructure to reinforce that the application is horizontally scalable to cope with an increase in user base and transaction throughput without affecting performance. However, the Cloud-Native Application Protection Platform (CNAPP) is considered the answer to your security Woes.

- API-First Integration: We are creating robust API architectures to connect the new generation of AI solutions to legacy financial systems, ensuring future-resilient application integration is possible.

- Data-Driven Personalization: Pursuit of AI algorithms to determine how users act and make transactions, which allows a personalized recommendation to move the financial process and increases user retention.

Results:

- 35% reduction in manual processes

- 20% increase in customer retention rate

- 92% increase in ATM service levels

Seizing the Market Needs

Challenge

To adapt to shifting user demand and market trends, FinTech platforms should introduce new functionalities (e.g., cryptocurrency payments) or expand their support to new territories. Without flexibility, scaling can lead to outdated systems.

Reason

- Rapid Innovation: The FinTech industry is a fast-paced one, and the need to integrate emerging technologies, such as blockchain or AI, is evident.

- User Feedback: The platforms need to adapt to the needs of users, which may include personalized financial recommendations.

- Downtime Risks: Adding functionality to a working site may also interfere with the system’s operation.

Appinventiv’s Solutions

Appinventiv employs agile development and continuous integration/deployment pipelines to ensure that gadgets are adaptable and scalable.

- Agile Development: They create platforms in a step-by-step system where smaller additions are posted depending on user feedback and market changes.

- How It Works: Agile means rapid development cycles (sprints) that test and release features in iterations, such as personalizing a page with the assistance of AI.

- Advantage: This enables the platforms to scale the functionality without having to restructure the entire system.

- CI/CD Pipeline: The continuous integration and continuous deployment (CI/CD) pipeline automates the checking and release of updates.

- How It Works: Changes in the code can be tested and deployed automatically, so that the new features (e.g., blockchain-based transactions) become available promptly and reliably.

- Advantage: This reduces downtime and enables quick scaling up.

Examples: Mudra Budget Management App

Mudra, an AI budget management app developed by us, demonstrates its scalability through a series of strategic design and technical choices. The architecture of the app is based on a cloud infrastructure that enables it to manage growing user numbers and data volumes easily. With the use of AI and automation, Mudra will recommend personalized financial tips that could follow the user’s behavior and preferences, thereby increasing user engagement and retention.

The strategies for increasing Scalability:

- Cloud-Based Infrastructure: The cloud environment enables scalable cloud services, allowing Mudra to dynamically increase or decrease resources, resulting in consistent performance even when the dashboard is under high load due to peak usage.

- The modular Architecture: Leverage future-ready architecture to solve scaling issues with security that allows for app updates and the incorporation of new features without altering other functionalities, ensuring better scalability.

- Personalization: Mudra could utilize AI and personalization to provide customized financial advice, leveraging AI algorithms and learning from user details. This will increase satisfaction and the likelihood of continued usage.

- Data Security Measures: Ensuring that sufficient data protection measures are established will foster user confidence, which is vital for the app’s expansion and scope in handling sensitive financial data.

Results:

These strategies help Mudra not only grow in terms of scale and support a larger number of users, but also expand its capabilities across 12+ countries, offering a superior and versatile solution in budgeting.

Dreaming of a Revolutionary Budget App that Rivals Mudra?

Join forces with our Fintech AI wizards to craft a cutting-edge, world-class solution that redefines wealth management.

User experience enhancing AI and Machine Learning

Challenge

On a large scale, FinTech platforms are compelled to offer individual, user-friendly experiences to retain their users. An example is the requests from users to have customized financial advisories or immediate notice regarding fraud, where a huge amount of data needs to be processed in real-time.

Reason

- Personalization at Scale: It requires a substantial computing capacity to personalize the experiences of a fintech app with millions of users.

- Real-Time Processing: Features such as fraud detection and loan approvals need to be processed in real-time, even under heavy traffic.

- Data Complexity: Analyzing multiple datasets (e.g., spending habits) on a large scale is resource-demanding.

Appinventiv’s Solutions

Appinventiv combines AI and machine learning (ML) to enhance user experiences and facilitate scalability.

- AI-Based Fraud Detection: ML-enhanced models analyze transaction patterns to identify anomalies in real-time.

- How It Works: Algorithms are trained on historical data to identify suspicious behavior, such as uncharacteristic withdrawals.

- Advantage: This increases with the number of transactions and does not cause delays.

- Predictive Analytics: AI forecasts the user’s needs, for example, by suggesting savings plans based on expenditure patterns. Predictive analytics also helps in closing business gaps and enables informed decision-making.

- How It Works: ML models analyze information provided by the user to deliver personalized insights, available in scalable cloud environments.

- Advantage: This enhances user satisfaction with the scale.

- Resource Optimization: AI streamlines operations at the back end, such as deploying server resources when demand is high.

- How It Works: Traffic spikes are predicted using predictive models, and scaling is carried out proactively.

- Advantage: This is more efficient and cost-saving.

Example: Financial Fraud Detection With Machine Learning

We leverage AI-driven analytics to achieve a significant reduction in loan approval time, and machine learning-based financial fraud detection to enhance user experience and increase capacity by supporting the growing number of users of fintech and banking applications, thereby improving the security and scalability of these applications.

Creating MVPs at scale

Challenge

FinTech startups must be agile in testing the viability of their business in the market, but at the same time, they must ensure that they can scale to meet their potential growth. An initially poorly designed product may result in expensive fixes in the future.

Reason

- Time Restrictions: Startups require time-restricted approaches to appeal to users and investors.

- Future-Proofing: The First product should be able to enable subsequent growth without radical revision.

- Budget Constraints: A startup has a limited budget, and it is important to plan for scalability.

Appinventiv’s Solutions

The design of Minimum Viable Products (MVPs) for enterprises is developed with scalability in mind, based on strong architectures and thorough testing.

- Scalable Architecture: Leverage microservices and cloud architecture to build it.

- How It Works: The MVP comprises prefabricated parts (e.g., Docker containers) and cloud infrastructures (e.g., AWS), enabling future scaling and growth.

- Advantage: This means the platform can scale at will without requiring a rebuild.

- Rigorous Testing: Appinventiv subjects MVPs to thorough testing, running them through simulated high loads to assess their performance, security, and scalability.

- How It Works: Applications such as JMeter are used to load-test thousands of users, ensuring that bottlenecks are identified and addressed before launch.

- Advantage: This ensures that the MVP is robust and can scale effectively.

- Iterative Development: An iterative development process is made possible by agile methods that enable the MVP to be modified and updated based on user feedback.

- How It Works: Features can be added gradually, including the introduction of new payment options without causing any inconvenience to the platform.

- Advantage: This helps achieve fast scaling and be user-centric.

Example: Scalable MVP – Edufundo

With Edfundo, Appinventiv adopted a scalable MVP that adhered to microservices and cloud computing, enabling rapid expansion to users and raising 500K pre-seed funding through investments due to its market viability and scalability.

Why Appinventiv is Your Tech Partner For Secure and Scalable Fintech Solutions?

The processes introduced by Appinventiv are tested in practice and supported by cutting-edge technologies, including microservices, cloud infrastructure, and AI, as well as pragmatic strategies such as agile development and CI/CD pipelines. These solutions are carefully tailored to address specific challenges in FinTech, focusing on security, performance, and cost-effectiveness at all levels.

Our rigorously tested approaches avoided pitfalls such as rewriting the system or compromising performance, with a primary focus on scalability that enables FinTech platforms to grow significantly and succeed in a competitive environment.

Thus, we are your best choice of partner if your enterprise-level FinTech application experiences issues with scalability, security, or performance. The experience they have with microservices, cloud-based infrastructure, and AI enables them to offer forward-thinking solutions that address the unique requirements of FinTech platforms, providing robust growth and unmatched user experiences.

Being a bespoke fintech app development services company, our technologies and methodologies are combined, making FinTech platforms safe, efficient, and low-cost. They specifically expect their downstream systems to be scalable, which means they do not need to resort to system renovation and avoid bottlenecks.

Get in touch with Appinventiv so that your FinTech platform receives an overhaul with proven, scalable solutions that meet your requirements.

FAQs

Q. What strategies should we adopt to balance performance, security, and cost as we scale our fintech platform?

A. Embrace cloud-native systems (e.g., AWS, Azure), and use load balancing to take advantage of loads and serverless computing to cut down on the unnecessary expenses of idle infrastructure.

Enhance its security by utilizing blockchain technology to facilitate transparent transactions, leveraging AI to detect fraud, and adhering to regulations such as GDPR and PCI-DSS. Periodically perform audits and resource optimization to achieve a balance, and with automation, minimize operational costs while maintaining strong security.

Q. How can FinTech platforms optimize database performance for growing data volumes?

A. When dealing with large volumes of data, consider using distributed databases on a horizontal scale (e.g., NoSQL databases like MongoDB or Cassandra). Use caching (e.g., Redis) to minimize latency, use streaming analytical processing of real-time data, and optimize queries by indexing. Automated scaling and cloud-based solutions ensure optimal performance in the event of expansion, while data observability tools ensure quality and compliance.

Q. How can Appinventiv’s scalable fintech solutions help my company handle peak traffic during high-demand periods (e.g., Black Friday, tax season)?

A. Appinventiv solutions are based on the capabilities of cloud-native architectures and microservices, which enable scaling resources to meet peak traffic surges. They are fully balanced in terms of load distribution and provide real-time insight, ensuring performance remains stable. Custom solutions also preserve uptime and user experience, even when demand is high, as seen in their collaborative activities with clients such as Domino and KFC.

Q. Can Appinventiv support fintech startups with MVPs that are scalable from day one?

A. Indeed, Appinventiv has fintech startups working on MVP business models designed in modular, cloud-based architecture (e.g., monolithic to SOA or microservices). Their priorities focus on addressing business needs, scalability, regulatory compliance, and cost efficiency, which is evident in their SaaS financial literacy platform and other initiatives.

Q. How does Appinventiv integrate AI and machine learning to enhance user experience at scale?

A. Appinventiv leverages AI/ML to personalize user experiences by utilizing predictive analytics, AI-powered chatbots, and customized financial recommendations. Their solutions utilize user data and transactional data to provide real-time insights, enhance fraud detection, and optimize user engagement.