Do you ever drive to a different part of town and say to yourself, “Wow, gas is so much more expensive here”?

Or maybe you’ve thought of waiting to buy tickets to a sporting event in hopes that they’ll drop in price.

Both of these are common examples of price discrimination and happen more often than you think. In fact, several businesses today use retail pricing software to manage and analyze their pricing strategies.

What is price discrimination in business?

Price discrimination is a pricing strategy where companies charge different prices for the same product or service, not because costs differ, but because customers have different willingness to pay. The aim is to capture more consumer surplus (the gap between what a buyer would pay and what they actually pay) by tailoring prices to segments.

Where you’ll see it (with examples):

- Travel: Airlines vary fares by booking time, route demand, and flexibility; hotels adjust nightly rates by season and occupancy.

- Entertainment: Theaters offer senior/student discounts; events price seats by section and timing (early-bird vs. last-minute).

- Streaming and software: Higher tiers bundle premium features (4K, extra seats, advanced tools) at a higher price.

- Telecommunications: Data plans priced by usage caps and speed; add-ons (international roaming) at premium rates.

- Healthcare: Provider pricing and patient out-of-pocket costs differ by insurance network and plan design.

- Retail and E-commerce: Dynamic online pricing, coupons, and loyalty discounts personalize offers across shoppers.

By adjusting price to segment, businesses can grow revenue without changing the underlying product, so long as the approach remains transparent, compliant, and fair to customers.

Why do companies use price discrimination?

The primary reason? Profit maximization.

By tailoring pricing to different segments, businesses can:

- Sell more to price-sensitive customers who might not buy at full price

- Charge premium prices to those with inelastic demand

- Better manage supply and capacity, especially in time-sensitive industries

It’s all about the market’s price elasticity. In elastic markets, small price changes greatly affect demand. In inelastic markets, consumers are less responsive, which is where businesses can charge more.

Let’s say the marginal cost of producing a good is the same across markets. If demand is less elastic, businesses can increase prices without losing customers. That’s why tools like demand planning software help sellers forecast pricing strategies more effectively.

Why is price discrimination important for selling?

Companies benefit from price discrimination because it encourages customers to buy more products while also luring in other customers who would not have been interested before.

The point of doing so is that a seller can capture the consumer surplus. The goal of price discrimination is to generate the most revenue possible for the product or service they are offering.

When sellers go about price discrimination, they look at the type of market their product or service is in – that is, whether it is an elastic or an inelastic market. In an elastic market, the price can change the demand for the product. But, in an inelastic market, the demand won’t change when the price changes.

When the elasticity of demand is different in one market than in another, price discrimination becomes profitable. This is why some firms utilize demand planning to prepare ahead of time.

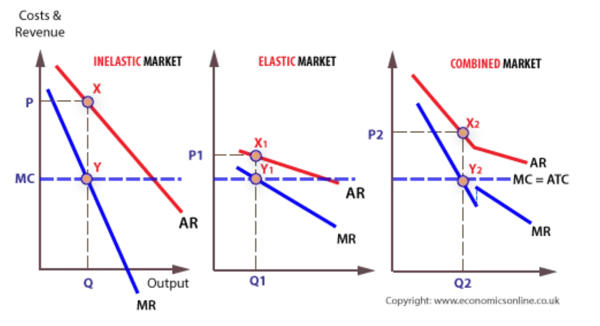

For those who are visual learners, let’s break it down.

If the marginal cost (MC) of a product or service is consistent across all markets, whether or not it’s divided, it will equal the average total cost (ATC). Maximum profit occurs at the price and output, where MC equals marginal revenue (MR).

However, if the market is separated, then the price and output of a product in an inelastic market will be P and Q, while P1 and Q1 in an elastic sub-market.

Image source: Economics Online

Is price discrimination legal?

In most countries, yes — with limits.

In the U.S.

Price discrimination is generally legal unless it violates antitrust laws (e.g., Robinson–Patman Act) by harming competition. It’s also illegal if it leads to:

- Racial, gender, or religious discrimination

- Consumer deception or false advertising

In the EU

Price discrimination is legal, but consumer protection laws are stronger. For example, companies must disclose if pricing varies by country or user profile.

Globally

Regulations vary, but as long as pricing isn’t deceptive or discriminatory based on protected traits, most forms of commercial price discrimination are allowed.

What are the types of price discrimination?

There are three types of price discrimination that you can encounter: first-degree, second-degree, and third-degree. These degrees of price discrimination sometimes go by other names: personalized pricing, product versioning or menu pricing, and group pricing, respectively.

1. First-degree price discrimination

First-degree price discrimination, or perfect price discrimination, happens when a business charges the maximum possible price for each unit.

Since prices vary for each unit, the company selling will collect all consumer surplus, or economic surplus, for itself. In many industries, a company will commit first-degree price discrimination by determining the amount each customer is willing to pay for a specific product and selling that product for that exact price. This can be done using market research strategies in addition to using budgeting and forecasting software.

2. Second-degree price discrimination

Second-degree price discrimination, otherwise known as product versioning or menu pricing, happens when a company charges a different price for varying quantities consumed, such as offering a discount on products purchased in bulk. Simply put, firms price their products in line with how much they can sell.

It doesn’t take much work to draw in customers and divide them up into niche markets, making this second-degree price discrimination incredibly straightforward to implement. This tactic is utilized by warehouse stores or by phone companies that charge extra for usage above a certain monthly cap.

3. Third-degree price discrimination

Third-degree price discrimination, or group pricing, is when a company charges a different price to specific customer segments such as students, military personnel, or older adults. This is the most common type of price discrimination.

Third-degree price discrimination helps companies minimize excess profits by adjusting prices based on individual customers’ willingness to pay. Last-minute travelers often encounter third-degree price discrimination in the tourism and travel industry.

EXAMPLE: Airlines often offer a certain capacity for different booking classes. Booking early with low-cost airlines often saves money. Most airlines raise prices as travel approaches because consumer demand becomes inelastic. Late bookers usually see travel as necessary and are willing to pay more.

What is the criteria for price discrimination?

Price discrimination is only possible under special market conditions.

Imperfect competition

The company must operate in a market with imperfect competition. There needs to be a certain degree of monopoly for successful price discrimination. In a market with perfect competition, there would be insufficient power to affect prices.

Preventing Resale

The company must be able to prevent resale. In other words, customers who have previously purchased an item at a discount cannot resell it to customers who are likely to have paid full price for the same product.

Elasticity of demand

Demand elasticities must differ among consumer groups (i.e., low-income individuals leaning toward inexpensive tickets compared to business travelers).

Market segmentation

Market segmentation (age, gender, interests, geography, product, time of year) must be ensured no two markets get intertwined.

What are some examples of price discrimination?

Coupons, age discounts, occupational discounts, retail incentives, and gender-based pricing are a few commonly seen price discrimination examples for business operations.

- Coupons: Retails assume that customers who collect coupons are more sensitive to a higher price than those who don’t. By offering coupons, a seller can charge a higher price to customers who don’t use coupons while also providing a discount to those who do.

- Occupational discounts: Many firms offer reduced prices to those who are currently serving in the military. The same can be said during a promotion such as “Nurses Appreciation Week” to those who work in the nursing field.

- Age discounts: In most cases, discounts are offered to certain age groups, such as children, students, adults, and seniors. Several establishments do not charge an age fee for children under a specified age. Restaurants, movie theatres, and other types of entertainment are just a few examples of businesses that regularly provide discounts to customers based on their age.

- Premium pricing: A product that has premium pricing is being sold far beyond its marginal value. For instance, you may see a “premium cup of coffee” at your local coffee shop that is priced at $3.50, while a regular cup is only $2.

- Retail incentives: These include rebates, buying in bulk, and seasonal discounts. They are used to increase market share or revenue on specific products.

- Financial aid: When college students apply for financial aid appeal letter, the amount they are offered is based on their parents’ economic and financial situation.

- Gender pricing: Certain marketplaces differentiate between genders and set prices accordingly. One example of this type of pricing discrimination is the practice of hosting a “ladies’ night” at a bar or club.

What are the benefits of price discrimination?

If you’re a business looking to utilize price discrimination, some advantages of price discrimination include:

- Maximizing a profit: When a price is matched to a specific character within the market, the profit is maximized. The business can utilize the consumer surplus within the market to its advantage.

- Economies of scale: Charging varying prices of a product can increase sales, thanks to new consumers entering the market.

- Efficient use of space: When used correctly, price discrimination can clear existing stocks of products faster, creating a better use of the store, shop, or factory space.

- Understanding the flow of customers: When a business makes the most of “happy hours” or “early bird specials”, it encourages customers to adjust their shopping times so that they’re not waiting in long lines or shopping during busy hours.

What are the challenges of price discrimination?

On the other hand, price discrimination can result in some disadvantages, too, especially for the consumer. They include:

- Taking advantage of specific markets: If a consumer lives in an inelastic market, it is very easy for them to be exploited and overcharged. An example would be a consumer paying a high price for a plane ticket during the holiday season.

- Limitations: For consumers, there are always limitations that go hand-in-hand with price discrimination, which can negatively impact the consumer experience. For example, there can be limits to which different prices can be applied, how many coupons a consumer can use if they fall into multiple groupings being discriminated against, and others.

How does price discrimination affect consumer behavior?

While businesses benefit, consumers often have mixed feelings about price discrimination.

Studies show that perceptions of fairness influence:

- Purchase intent

- Brand loyalty

- Word-of-mouth referrals

For example:

- Offering early bird discounts is seen as fair

- Charging more based on personal data (like location or device) often feels manipulative

Transparency matters. Businesses that explain their pricing logic (e.g., student discounts, loyalty pricing) tend to retain trust and reduce churn.

How is price discrimination evolving in the digital era?

Today’s pricing strategies are powered by data, AI, and automation, enabling companies to implement complex discrimination models at scale.

Here’s how digital transformation is reshaping the practice:

- AI pricing algorithms analyze behavior, demand, and historical data to personalize pricing in real time

- Retail pricing platforms adjust prices dynamically based on inventory, traffic, and competitor data

- A/B testing tools show different prices or offers to users and measure conversion lift

- SaaS pricing optimization tools offer multi-tier packages tailored to customer lifecycle and revenue potential

Frequently asked questions (FAQs) about price discrimination

Have more questions? Find the answers below.

Q1. What is price discrimination?

Price discrimination is a pricing strategy where a seller charges different prices for the same product or service based on the customer’s willingness to pay, location, or purchase timing. It includes first-degree, second-degree, and third-degree discrimination to maximize revenue and extract consumer surplus.

Q2. What are the 3 types of price discrimination?

The three types of price discrimination are first-degree, second-degree, and third-degree. First-degree charges each customer their maximum willingness to pay. Second-degree offers different prices based on quantity or product version. Third-degree sets prices based on customer segments like age, location, or income level.

Q3. What are real-life examples of price discrimination?

Real-life examples of price discrimination include airline tickets priced higher close to departure (third-degree), bulk discounts at wholesale stores (second-degree), and personalized pricing in online shopping based on browsing behavior (first-degree). Each example reflects how businesses adjust prices based on customer data or purchasing patterns.

Q4. Why do companies use price discrimination?

Companies use price discrimination to maximize profits by capturing more consumer surplus. By charging different prices based on willingness to pay, location, or demographics, businesses can increase revenue, manage demand efficiently, and expand access to different market segments.

Q5. What are the advantages and disadvantages of price discrimination?

The advantages of price discrimination include higher profits, better market segmentation, and improved access for price-sensitive customers. Disadvantages include potential unfairness, customer dissatisfaction, and legal risks. While it boosts revenue, it can harm brand reputation if perceived as exploitative or discriminatory.

Q6. What industries use price discrimination?

Industries that use price discrimination include airlines, telecommunications, hospitality, software, and entertainment. These sectors adjust prices based on factors like booking time, usage levels, customer location, or demographics to maximize revenue and efficiently target different consumer segments.

Q7. How do companies prevent resale in price discrimination?

Companies prevent resale in price discrimination by using product differentiation, digital rights management, purchase limits, and legal agreements. These strategies ensure that low-priced goods cannot be easily resold to high-paying customers, preserving segmented pricing across markets.

Q8. How does price discrimination affect consumer trust?

Price discrimination can reduce consumer trust if customers feel prices are unfair or inconsistent. When buyers discover they paid more than others for the same product, it may damage brand perception, lower satisfaction, and discourage repeat purchases, especially if transparency is lacking.

Q9. What role does AI play in modern price discrimination?

AI plays a central role in modern price discrimination by analyzing consumer data, predicting willingness to pay, and automating dynamic pricing. It enables businesses to personalize prices in real time based on behavior, location, and device type, increasing revenue while tailoring offers to individual customers.

You get what you pay for

Most often, all that customers want is to be treated fairly. Customers do have every right to be outraged if they discover they are being charged more than their next-door neighbor while shopping. However, it is safe to say that discriminating in pricing is not only legal but also smart business practice.

Usually, customers are misled into thinking they are getting better deals than they actually are. So, sometimes the price you pay is more than what someone else would pay. It’s more common than you think and moving forward, you will hopefully be able to spot price discrimination in action.

Wonder what goes inside a consumer’s mind? Get a better understanding of how consumer behavior works!

This article was originally published in 2019. The content has been updated with new information.

![What are the latest Hootsuite product features? [Nov 2025]](https://mgrowtech.com/wp-content/uploads/2026/01/What-are-the-latest-Hootsuite-product-features-Nov-2025-X-Twitter-ads-The-practical-2025-guide-for-social-marketers-media-analytics-tools-120x86.png)