Reading Time: 6 minutes

The financial services industry is at a turning point. Competition is fierce, customer expectations are changing rapidly, and delivering personalized, meaningful engagement has become non-negotiable. For organizations in the BFSI (Banking, Financial Services, and Insurance) sector, keeping up isn’t just about innovation; it’s about survival. But at the center of this transformation is one powerful tool: data.

To better understand how marketers in the BFSI space are working with data to fuel their engagement and retention strategies, we surveyed 200 senior leaders across North America, including CMOs, VPs, Senior Directors, and Department Heads. We also spoke with BFSI industry practitioners from Movable Ink and Treasure Data to gain deeper insights into the top industry challenges and opportunities for creating data-driven customer experiences.

This blog breaks down the survey findings, highlights the trends shaping the industry, and explores a path forward for BFSI brands determined to lead the way.

The Current State of Data & Analytics in the BFSI Industry

The sheer volume and complexity of financial transactions and customer interactions require BFSI brands to develop robust omnichannel data strategies to maintain a competitive edge and ensure maximum retention.

This aligns with our survey findings, which revealed that 66.27% of senior BFSI industry leaders claimed data is critical to achieving their business goals. This underscores a fundamental shift in industry perception, moving data from a supporting function to a central pillar of strategic decision-making. But the question arises, “What data are BFSI marketers looking at for customer engagement?”

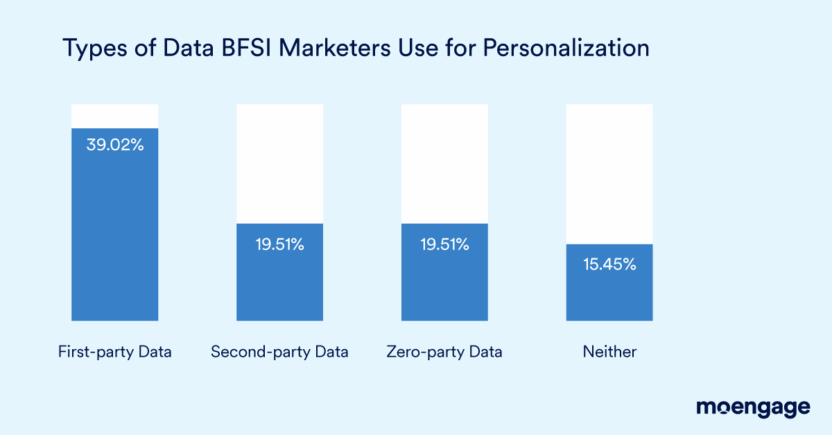

Data Types BFSI Leaders Are Prioritizing

Among BFSI marketers, first-party data emerged as the most widely used source of customer insights, with 39.02% of respondents leveraging data directly collected from their owned platforms, such as mobile apps and websites. This is no surprise as first-party data is compliant and a reliable source for understanding customer intent/preferences, especially with increasing privacy regulations and the decline of third-party cookies.

19.51% of marketers prioritize second-party data sourced via partnerships. While this data can complement the insights derived from zero/first-party data, its effectiveness depends heavily on the quality and trustworthiness of the partner. If the partner’s data collection or privacy practices are not up to par, it can pose risks.

Meanwhile, zero-party data, also used by 19.51% of BFSI leaders, is emerging as a game changer. This data is explicitly shared by customers during onboarding and surveys, such as their communication preferences, preferred financial products/services, financial goals, etc.

Surprisingly, 15.45% of BFSI marketers are either using third-party data or aren’t relying on actual customer insights when building engagement programs. This represents a huge missed opportunity as this prevents brands from effectively understanding their customer needs and wants, resulting in poorly targeted campaigns and disengaged customers.

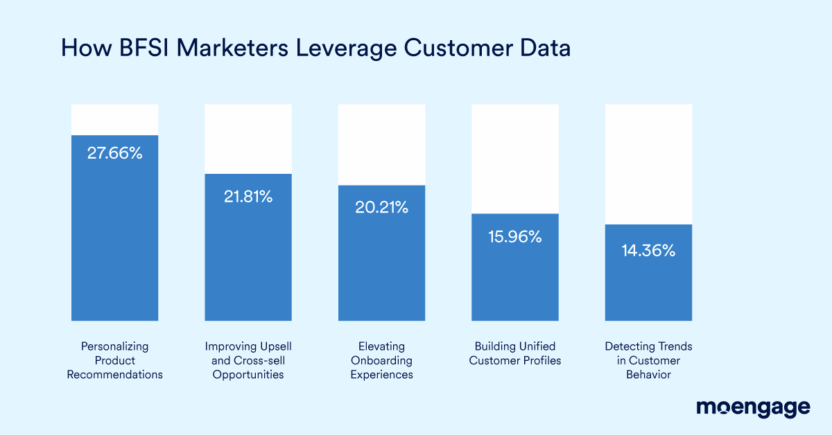

What BFSI Marketers Are Doing With This Data

The ability to turn raw data into meaningful experiences is key. Through insights derived from the data they prioritize, BFSI marketing leaders are making tangible improvements in their customer engagement campaigns.

The top 3 use cases include:

- Personalizing product recommendations (27.66%) to offer tailored credit, insurance, or investment options. For example, banks are analyzing transaction histories to recommend savings plans that align with a customer’s goals, such as retirement planning.

- Upselling and cross-selling (21.81%) by uncovering customer needs at the right moments, like offering term insurance when a loan is approved.

- Improving onboarding journeys (20.21%) to reduce customer early-stage drop-offs and build trust from the very first interaction. For example, creating personalized onboarding workflows based on declared customer preferences or demographics, which makes customers feel understood and valued.

While these data use cases are critical, there are many untapped opportunities. As Robbie Freeman, Director – Strategy at Movable Ink, points out, “What’s often overlooked in the BFSI industry is the power of aggregating and contextualizing transactional-level data to gamify customer experiences.” This highlights the potential for BFSI brands to move beyond traditional marketing and take inspiration from other industries by empowering customers with data-driven insights about their own financial health through innovative approaches, such as gamification.

Data Challenges: What’s Holding BFSI Leaders Back?

Despite recognizing data’s importance, seamless data-driven engagement remains a challenge, primarily due to the complexity of integrating data from disparate, often legacy, systems.

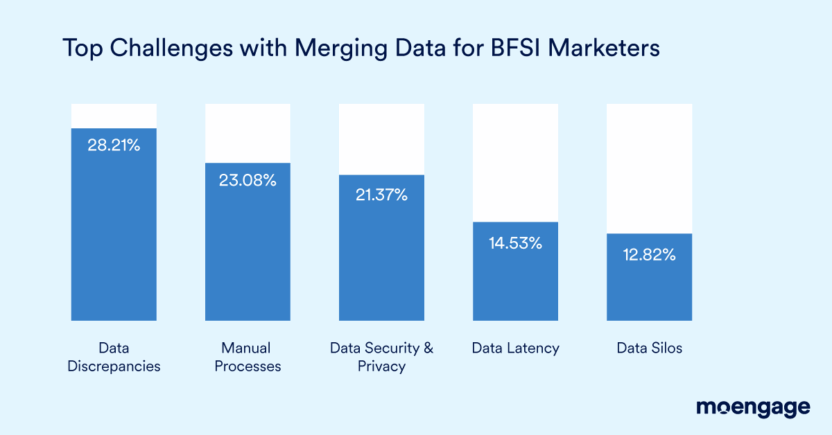

Top pain points for BFSI marketers are:

- Data discrepancies (28.21%): Inconsistent and unreliable datasets from siloed systems lead to conflicting information and undermine the accuracy of insights, which is critical in financial services.

- Manual processes (23.08%): Using outdated tech stacks and spreadsheets (still used by 26% of the respondents), marketers are compelled to manually integrate data from different sources and extract insights. This leads to errors, delays, and an inability to act on real-time customer behavior.

- Security concerns (21.37%): Ensuring data privacy and compliance across multiple systems is a difficult feat.

Strategies to Address Data Challenges

To overcome these hurdles and unlock the full potential of their data, BFSI brands must fundamentally rethink their approach:

- Move beyond legacy tools and processes: Reliance on spreadsheets, manual data integration, and legacy platforms is unsustainable. Instead, adopting modern data orchestration systems or CEPs (Customer Engagement Platforms) ensures that all your data is in one place and you can extract actionable insights, allowing you to move ahead without any data discrepancies.

- Prioritize data governance and quality: Establish clear data ownership, define data standards, leverage automated tools for data validation and cleansing, and conduct periodic data audits.

- Foster a data-driven culture: Educate your team on the importance of good data quality, proper data entry procedures, and the impact of inaccurate data on the customer experience. Empower them by training them to become hands-on with the company’s martech stack.

As Alex Manly, Senior Director – Strategy at Movable Ink, states, “BFSI brands must use data orchestration and dynamic content delivery systems to address data challenges and create highly impactful customer experiences.”

Trends and Investment Priorities for 2025

BFSI brands are actively moving towards data-driven transformation, with investment priorities this year focused on advanced technologies.

Investments in AI and predictive analytics are at the forefront, accounting for 25.30% of planned investments. AI can uncover patterns in large datasets that humans might miss and also predict customer actions ahead of time, enabling marketers to take on a more proactive approach.

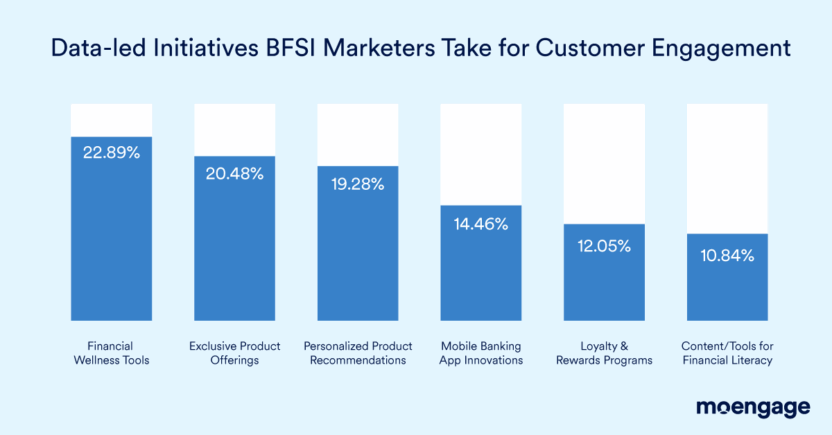

BFSI leaders are leveraging data and AI for high-impact customer engagement initiatives, such as:

- Creating financial wellness tools (22.89%) to empower customers with tailored advice and resources. This increases brand engagement and develops loyalty.

- Designing exclusive product offerings (20.48%) such as premium accounts, packages with discounts/incentives, etc., to elevate the customer experience.

- Delivering personalized recommendations (19.28%) based on the customer’s demographics or where they are in the buying journey. This ensures every brand touchpoint is relevant and valuable.

Highlighting the strategic benefits of integrating data with AI, Kazuki Ohta, Co-Founder and CEO of Treasure Data, notes, “We’re seeing financial services companies use AI to speed up decision-making. Teams can use these insights to build audiences and assemble personalized journeys faster, increasing customer engagement and retention.”

Future-Proofing BFSI Strategies with Smarter Data Systems

The future of customer engagement for financial services lies in the strategic use of data (and AI). Collecting information without actionable insights is no longer enough. Financial brands need to shift from siloed systems and spreadsheets to unified solutions built for scalability, efficiency, and precision.

An AI-led Customer Engagement Platform that seamlessly integrates with various analytics tools and customer data platforms is critical to overcoming challenges like data discrepancies, latency, or manual workarounds. By empowering leaders and marketers to manage, analyze, and act on data in real-time, such platforms pave the way for highly compliant, personalized, and impactful customer engagement strategies.

Curious to know how a CEP like MoEngage can transform your data challenges into customer engagement opportunities? Take a demo today and step into the future of BFSI marketing.

The post The State of Data in Financial Services: Trends & Strategies for 2025 appeared first on MoEngage.