Key Takeaways

- Zero-downtime payment modernization lets you upgrade your system without interrupting live transactions.

- Monolithic platforms limit speed, scalability, and compliance, making payment process modernization a business priority.

- Microservices improve resilience, reduce audit complexity, and help institutions improve payments infrastructure faster.

- Real-time payments, new rails, and rising compliance demands are accelerating global payment system modernization.

- A phased approach, validation, canary rollout, and safe cutover can reduce risk and deliver predictable modernization outcomes.

Payments Modernization 3.0 marks the next major shift in how money moves. It goes beyond incremental upgrades and reflects a bigger change toward payment systems designed for real-time execution, continuous availability, and scale from day one.

The global payments industry is growing faster than many legacy cores can support. According to Mordor Intelligence, the international payments market is valued at USD 3.47 trillion in 2026 and is expected to reach USD 5.86 trillion by 2031. This growth is pushing enterprises to rethink payment system modernization as real-time payments, digital wallets, embedded finance, and cross-border capabilities become baseline expectations.

Legacy platforms were not built for this environment. Systems designed around batch processing and scheduled downtime struggle to deliver uninterrupted uptime, instant settlement, and elastic scaling. As a result, payment process modernization is no longer optional.

This blog explains how enterprises can modernize legacy payment platforms without downtime, while enabling modern payment rails, simplifying audits, reducing risk, and supporting future initiatives such as social security payouts and large-scale government programs.

Transform Your Payments Infrastructure with Ease

Modernize your payment systems without downtime or disruption. Let’s get your project on track.

Why Zero Downtime Matters in Modern Payment Systems

In a world where payment flows never stop, downtime instantly translates into lost revenue and shaken merchant confidence. This is one of the biggest challenges to modernizing payment systems, because even a brief outage impacts conversion rates and brand credibility.

For processors and fintech platforms, staying online 24/7 is no longer a technical preference; it’s a core requirement of payment modernization and the foundation of any payment system modernization program.

A planned 3-hour maintenance window can quickly spiral into real business damage:

- Failed transactions: Hundreds of thousands of payments decline during peak hours.

- Merchant churn: Businesses switch to competitors that offer better uptime guarantees.

- Reputational risk: Outages now surface instantly across social media and review platforms.

- Compliance impact: SLA breaches with card schemes or banks can trigger regulatory scrutiny.

This is why many enterprises are moving toward microservices-driven payment process modernization. It is especially relevant for industries handling cross-border transactions, social benefit transfers, and high-volume payouts where uptime is non-negotiable. These areas are often shaped by global social security payment modernization initiatives.

Zero-downtime modernization ensures that users experience a stable, predictable platform while the underlying architecture evolves safely behind the scenes. It forms one of the key components of payment modernization and sets the stage for every subsequent step in your transformation journey.

The Limitations of Legacy Payment Platforms and the Strategic Benefits of Microservices

Modern payment businesses can’t afford slow releases or rigid architectures. As more enterprises adopt payment modernization strategies, the cracks in legacy systems become impossible to ignore. These constraints slow growth, limit scalability, and complicate compliance, making legacy payment platform migration a priority rather than a long-term wishlist item.

The Limitations of Legacy Payment Platforms

Even though legacy payment systems still process high volumes, their monolithic design makes it difficult to innovate or support new rails. These issues surface quickly during any phase of payment modernization, especially when real-time, cross-border, or government-driven payouts come into play. Use cases are also seen in social security payment modernization efforts across markets.

Here’s where they struggle the most:

- A single change disrupts everything: A small tweak in authorization affects fraud checks, reporting, and settlement. This complexity becomes a major roadblock in payment process modernization.

- Scaling is inefficient and costly: When one module faces load spikes, the whole system must scale, driving up costs and limiting payment processing scalability.

- Maintenance windows are unavoidable: Planned downtime risks merchant revenue and contradicts the goals of modern payment processing modernization programs.

- Adding new rails is slow: Integrating RTP, digital wallets, or cross-border APIs becomes a long, interconnected project.

- Incident recovery takes longer: Logs blend, responsibilities blur, and the lack of clear boundaries becomes a drag on operational speed.

- Compliance becomes harder: Complex, interconnected modules make PCI DSS, PSD2, and ISO 20022 audits more time-consuming and expensive.

These challenges often lead enterprises to initiate legacy payment platform migration as part of a long-term transformation roadmap.

Also Read: Banking Legacy Software Modernization: Strategies & Steps

The Strategic Benefits of Microservices

Microservices offer the key business benefits of modern payment systems by giving payment companies the flexibility, stability, and speed needed to keep up with market expectations.

- Independent teams can ship updates safely.

- Only the required service scales are used, reducing infrastructure waste.

- Zero-downtime deployments have become standard practice.

- New payment rails and cross-border features can be added without touching core logic.

- Clear observability improves MTTR and operational stability.

- Compliance becomes easier thanks to cleaner domain boundaries.

Together, these advantages create strong momentum for payment system modernization, helping businesses improve payment infrastructure without disrupting active transaction flows.

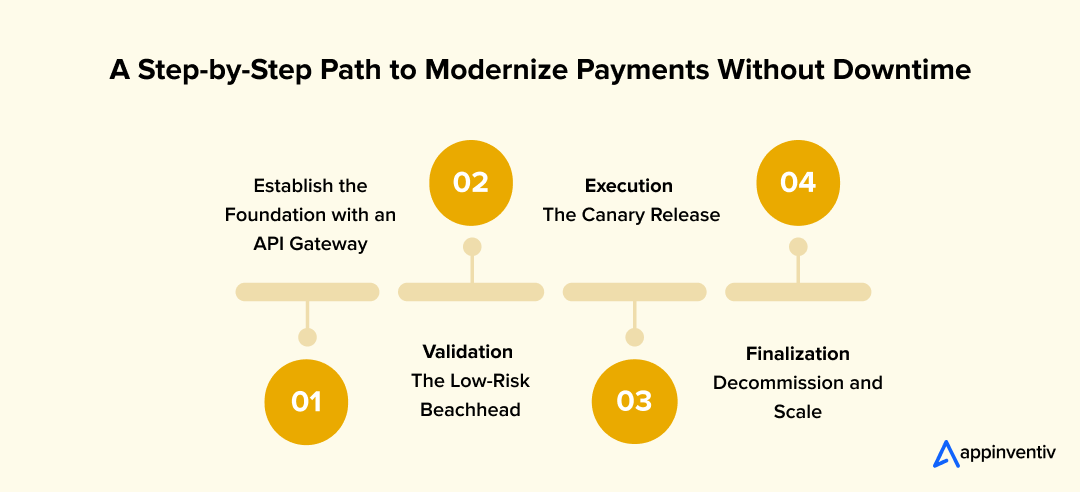

A Step-by-Step Path to Modernize Payments Without Downtime

Migrating a legacy payment core is a high-stakes operation where even the smallest disruption can affect revenue and trust. This is why enterprises rely on a structured, proven approach for payment modernization, anchored in zero-downtime execution. The Strangler Fig Pattern remains one of the most effective steps to Modernize Payments, allowing teams to gradually introduce new components without compromising live transaction flows.

This phased method is widely used across industries, from commercial payment processors to government-led programs like social security payment modernization, where continuity is critical. Each step plays a specific role in reducing risk and speeding up transformation.

Step 1: The Foundation- Establish the API Gateway

Before touching core logic, the first phase of payment modernization begins by setting up a strong abstraction layer.

- An API Gateway becomes the intelligent router between the monolith and the new microservices.

- This layer supports controlled cutovers, essential for zero downtime in any payment process modernization roadmap.

- Legacy SMEs also guide the transition, ensuring that edge cases carry over accurately during the migration of legacy payment platforms.

This foundation allows you to move forward confidently without interrupting existing merchant integrations.

Step 2: Validation- The Low-Risk Beachhead

Modernizing a complex core requires proof before full rollout. This is where payment application modernization usually begins.

- Start with safe domains like Reporting or Notifications.

- Run the new service in Shadow Mode to compare outputs with the monolith.

- This ensures full accuracy before routing any live traffic.

This validation step protects uptime and reduces errors early in the payment processing modernization journey.

Step 3: Execution- The Canary Release

Zero downtime depends on gradual progression, not sudden switches.

- Route 1% of traffic to the new service through the Gateway.

- Increase the load step-by-step: 1% → 5% → 25% → 50% — only when telemetry is clean.

- Keep rollback routes ready for instant fallback.

This controlled approach aligns with the components of payment modernization, ensuring errors never reach end users.

Step 4: Finalization- Decommission and Scale

Once a service handles 100% of traffic reliably, the monolithic equivalent can finally be retired.

- Remove legacy code to reduce technical debt.

- Apply the same blueprint to critical areas like Fraud or Settlement.

- This repeatable method helps organizations improve payment infrastructure while maintaining complete stability.

Enterprises that follow this process often see real world results from payment process modernization, including shorter release cycles, lower failure rates, and better scalability.

Also Read: Microservices vs Monolithic: the Best Startup Choice

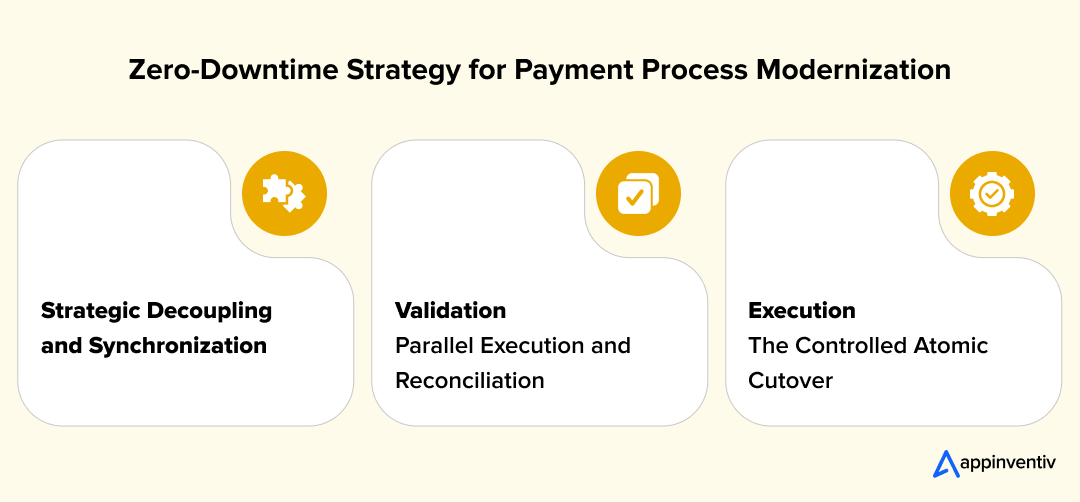

How to Move Payment Data Safely During the Migration

Migrating payment data demands absolute precision, compliance, and uninterrupted uptime. In most enterprise scenarios, this is one of the most sensitive phases of payment modernization, especially for companies running aging platforms or undergoing large-scale legacy payment platform migration. The goal is simple: shift to modern services without losing state, slowing down transactions, or risking data mismatches.

This method is also widely used in high-volume government systems, including social security payment modernization, where accuracy and continuity are non-negotiable. The same principles apply to organizations pursuing payment application modernization as part of a broader architectural overhaul.

1. Strategic Decoupling and Synchronization

The journey starts with separating the tightly coupled monolithic schema into domain-specific databases.

- Each microservice receives its own database, reducing risk during payment system modernization and improving resilience.

- Real-time replication through CDC streams ensures new services stay aligned with the legacy system even during heavy load.

This keeps production traffic flowing without interfering with ongoing modernization steps.

2. Validation: Parallel Execution and Reconciliation

Before any cutover, new services must prove they can match the monolith with 100% accuracy.

- Dual-write shadowing allows the new service to process real activity without influencing outcomes.

- Automated reconciliation compares both ledgers continuously to validate correctness.

This is a critical safeguard during any phase of payment modernization, especially when payment records must stay perfectly balanced.

3. Execution: The Controlled Atomic Cutover

A safe go-live depends on a measured, reversible switch.

- Start by routing read operations to the new service to test speed, load tolerance, and latency.

- After the final synchronization window, write access moves to the microservice, establishing it as the new source of truth.

- Rollback remains available until full stability is confirmed.

This disciplined process supports both enterprise needs and larger public-sector transformations that mirror social security payment modernization requirements.

Seamless Data Migration, Zero Downtime

Ensure safe and efficient data migration with our proven strategies. Protect your revenue and reputation.

Cost of Payment Process Modernization

The price of modernizing a payment system swings a lot from one company to another. Some teams are trying to move away from systems that haven’t been touched in years. Others only need to fix a few bottlenecks. Because of that, the budget usually boils down to one thing: how tangled the current setup is and how much of it needs careful rebuilding.

A few areas tend to drive most of the spend:

- Reworking the architecture: If the core still bundles authorization, fraud checks, and settlement in one tight block, separating them becomes a major effort. This is often where companies spend the most time and money.

- Moving live data safely: Payments can’t pause. That means setting up CDC jobs, dual-writes, and reconciliation steps so nothing breaks while the system switches over. This part demands skilled engineers and many patient iterations.

- Meeting compliance requirements: PCI DSS, PSD2, ISO 20022, tokenization changes, encryption updates—each comes with its own checklist. These tasks usually run alongside the main build and require teams that understand audits inside out.

- Upgrading infrastructure: Introducing new payment gateways, message queues, and monitoring tools is unavoidable once a system moves toward real-time processing. These upgrades naturally increase cloud and ops spending.

- Preparing for real traffic: Before a single user hits the new system, teams need canary rollouts, rollback options, automated QA, and continuous monitoring. This groundwork prevents late-night outages later.

Most mid-sized and large enterprises land somewhere between $40k-$400k for a full modernization. The more technical debt hiding under the hood, the higher the final number goes.

Also Read: Cost to Build a FinTech App: What You Need to Know

Common Migration Risks and How to Avoid Payment Modernization Failures

Modernizing a payment core isn’t just an engineering upgrade; it’s a live operational shift that influences business continuity from day one. As companies adopt payment modernization across mission-critical systems, they often move from a predictable monolith to a more flexible but more complex distributed architecture. This transition brings a new category of risks that must be anticipated early, especially in large-scale initiatives such as social security payment modernization, where uptime and accuracy matter every second.

These issues tend to surface across multiple phases of payment modernization, and many organizations encounter similar challenges during legacy payment platform migration. Addressing them upfront is essential to protect both revenue and customer trust.

1. Distributed Data Inconsistency

In a distributed system, a delay between services can leave a transaction in an uncertain state, money is deducted, but the confirmation is missing. This is one of the most critical risks enterprises try to prevent during payment processing modernization.

How we avoid it:

- Idempotency stops the same charge from being applied twice.

- Saga Pattern rollbacks ensure ledger accuracy and consistency across all services.

These guardrails keep the payment trail clean and reliable.

2. Latency Compounding Across Services

Network calls can stack up when too many services wait for each other, leading to slow checkouts and SLA violations. This issue becomes more noticeable as companies scale and work on payment processing scalability across regions.

How we avoid it:

- Critical steps stay synchronous, while non-essential work moves into background queues.

- Timeout budgets prevent cascading delays.

This ensures speed even as the ecosystem grows.

3. Fault Propagation Across the System

If one peripheral service lags or crashes, it shouldn’t affect the core payment path. However, without proper boundaries, such errors can ripple through the system.

How we avoid it:

- Circuit breakers isolate failures instantly.

- Graceful degradation ensures core payments stay online.

This resilience is fundamental to long-term payment system modernization.

4. Fragmented Observability

With many microservices processing parts of a transaction, tracking failures becomes harder without unified visibility. Poor observability slows down incident recovery and complicates payment application modernization efforts.

How we avoid it:

- A unique Trace ID follows the payment across all services.

- Distributed tracing reveals the entire flow during investigations.

Teams can fix issues faster and maintain consistent platform health.

Compliance and Audit Needs When Moving to Microservices

Shifting to a distributed architecture changes how compliance and security work. In a monolith, controls sit at the perimeter. With microservices, every service carries its own security layer, an essential part of payment modernization, especially for high-volume systems and public initiatives such as social security payment modernization, where enterprise cloud data protection is critical.

Many enterprises discover that payment system modernization actually makes compliance easier. Clearer boundaries reduce audit scope, remove legacy blind spots, and accelerate the migration of legacy payment platforms, making the entire modernization effort more manageable.

1. Strategic Isolation to Reduce Scope

Instead of securing the entire platform at the highest level, microservices allow sensitive domains to be isolated cleanly.

- Cardholder data moves into hardened services.

- Fewer components fall under strict PCI DSS and PSD2 audit zones.

This architectural clarity is a key component of payment modernization, reducing both audit effort and operational risk.

2. The Unified Audit Trail

Distributed systems shouldn’t mean fragmented compliance.

- All services stream logs into a central, immutable repository.

- Each transaction receives a Correlation ID to trace its full lifecycle.

This approach aligns with modern payment application modernization, giving auditors complete visibility without manual stitching.

3. Automated Governance

Regulatory compliance becomes continuous rather than annual.

- Policy checks run inside the CI/CD pipeline.

- Any code that fails encryption or access rules is blocked instantly.

This supports ongoing payment processing modernization, ensuring each release is secure and audit-ready without slowing down teams.

Key Trends Driving Payments Modernization

The payments world isn’t slowing down. It’s moving faster than most legacy systems can keep up with, which is why key trends driving payments modernization are now front and center for enterprises. What once sat on long-term roadmaps has turned into immediate priorities, especially as merchants, regulators, and end users demand more than monolithic platforms can deliver. This urgency is reshaping how organizations plan their payment modernization and long-term architecture strategy.

Here are the forces driving that shift:

- Real-time expectations: People want money to move instantly. If a message can be delivered in a second, a payment shouldn’t take minutes. Older cores hit performance ceilings quickly, prompting companies to accelerate payment system modernization.

- New rails and expanding wallets: BNPL, open banking APIs, digital wallets, and new cross-border payment modernization standards add complexity every year. Integrating them into a monolith slows launches and limits flexibility.

- Stricter compliance requirements: Regulations such as ISO 20022, PSD2, tokenization rules, and advanced fraud mandates require clearer boundaries and auditable logs—something legacy architectures struggle to maintain.

- Growing traffic spikes: Seasonal surges, cross-border flows, and embedded finance partners create unpredictable load. Modern systems scale services individually; legacy systems force everything to scale together, raising costs and limiting the scalability of payment processing.

- Higher merchant expectations: Uptime, speed, reliability, and simple integrations now outweigh pricing. Merchants switch quickly when performance lags, increasing pressure to adopt modernization practices for payment processing.

Together, these shifts are pushing payment companies away from rigid, aging systems and toward cloud-ready, modular architectures that support continuous innovation without breaking under pressure.

Stay Ahead with Payment Modernization

Adapt quickly to new payment trends and secure your future with cloud-ready solutions.

How Appinventiv Helps Modernize Payment Systems Without Disruption

Modernizing a legacy payment core is one of the most delicate operations a financial institution can undertake. At Appinventiv, we don’t just upgrade code; we safeguard your business continuity. As a leader in financial technology consulting services specializing in payment process modernization services, we partner with your stakeholders to navigate the complex shift from rigid monoliths to agile microservices, ensuring that technical evolution never comes at the cost of operational stability or revenue.

Our approach is built on a foundation of rigorous risk management. Our specialized payment processing software developers are experts at implementing zero-downtime strategies, such as the Strangler Fig pattern. We don’t rely on guesswork; we validate. By running new architectures in “Shadow Mode” alongside your live systems, we prove performance and data integrity under real production loads before a single transaction is ever switched over.

The result is a platform that is not just modern, but future-ready. Whether you need to integrate emerging cross-border rails, adapt to ISO 20022 standards, or improve payments infrastructure for better throughput, we help you turn your legacy system from a technical bottleneck into a scalable competitive advantage.

We’ve successfully modernized payment systems for leading global brands like KFC, IKEA, Flynas, and Domino’s, among others. By leveraging our deep expertise and cutting-edge tools, these companies have transformed their payment processes and set new benchmarks in their respective industries.

With Appinventiv, payment process modernization translates into measurable, real-world outcomes that strengthen your growth foundation. Let’s talk!

FAQs

Q. What is Payments Modernization 3.0?

A. Payments Modernization 3.0 is the next big shift in how money moves. It’s where payment modernization moves beyond patching old systems to focus on real-time payments, cloud-native platforms, open APIs, and smarter data flows. The idea is simple: build payment systems that are fast, flexible, and ready for everything from digital wallets to instant cross-border transfers.

Q. How can institutions modernize their payment systems?

A. Most institutions start payment system modernization by breaking the monolith into smaller, independent services. They introduce an API gateway, move toward real-time processing, modernize fraud controls, and update how data is stored and shared. It’s usually done in stages, often through a zero-downtime payment process modernization approach, so active transactions aren’t disrupted.

Q. Why is Payments Modernization Important in Today’s Digital Economy?

A. Today’s customers expect payments to be quick, available around the clock, and easy to use. That’s why payment modernization matters so much. It helps institutions keep up with digital wallets, instant payments, open banking, and the growing pressure for better speed, transparency, and reliability. In short, it keeps them competitive.

Q. What are the cost implications of payments modernization?

A. The cost of payment process modernization depends on how old the current system is and how much needs to be rebuilt. Expenses often include new infrastructure, microservices development, security upgrades, and data migration. While the upfront investment may feel heavy, the long-term payoff usually comes through lower downtime, better scalability, and fewer maintenance problems.