The UK loyalty landscape in 2026 reflects a mature, value-conscious, and increasingly pragmatic market. Loyalty programs can be considered as an institution in the country, and not just a concept. However, their effectiveness and the amount of value they deliver (for both to customers and the business) is under sharper scrutiny than ever. When viewed through the lens of Antavo’s Global Customer Loyalty Report 2026, the UK stands out not for radical experimentation but for its focus on ROI, data usage, and tangible outcomes. UK marketers are confident in loyalty’s potential, if only the local customer sentiment were as positive.

All the statistics in this article are from Antavo’s Global Customer Loyalty Report 2026. Make sure to download it for more regions, global and industry-based findings on loyalty and AI.

Loyalty confidence is high, but UK brands aren’t complacent

UK loyalty program owners broadly mirror the global “golden age of loyalty” narrative, but with a slightly more cautious tone. 81% of UK marketers say they’re satisfied with their loyalty program, closely aligned with the global average of 83%. More tellingly, 92% are confident loyalty delivers value they wouldn’t get otherwise, slightly above the global benchmark

However, our statistics suggest that UK marketers are more outcome-focused in why they value loyalty. While engagement remains the top success metric, UK respondents over-index on data collection and ROI compared to global peers. For example, 74% cite customer data as a key satisfaction driver, significantly higher than the global average (60%). This reflects the UK market’s long-standing emphasis on CRM maturity, GDPR compliance, and first-party data strategies. So it can be summized that in the UK, loyalty programs should work, not just be liked.

ROI matters, but UK budgets are a bit conservative

UK marketers are among the most disciplined globally when it comes to measurement. 91% of UK program owners actively track loyalty ROI, and the reported returns skew positive, with brands who track it reporting an average 5.4X ROI (completely aligning with the global average).

Yet this performance comes with pressure. UK respondents are more likely than average to flag poor ROI as a red flag that would trigger program reassessment. This suggests a market where loyalty is no longer a “nice-to-have retention layer,” but a performance channel expected to justify its budget.

Interestingly, UK companies allocate slightly less of their marketing budget to loyalty and CRM (49%) than the global average (51%), which may explain this heightened focus on efficiency. So the takeaway is that loyalty investment in the UK is highly strategic and not given lightly.

AI adoption is strong, but expectations are higher

It’s safe to say that the United Kingdom is one of the most AI-forward loyalty markets in Europe. Stats show that 61% of UK loyalty teams already use AI-powered tools, well above the global average of 51%, and UK marketers rate their AI preparedness at 7.1 out of 10, again exceeding the global score

This adoption is driven less by hype and more by necessity. UK teams cite data fragmentation and difficulty translating insights into action as their biggest analytics challenges. As the 2026 report highlights, many brands risk “data blindness”: having rich loyalty data but lacking the clarity to operationalize it. And UK leaders are the most determined to avoid this.

Consumers are value-driven and increasingly selective

On the consumer side, the UK tells a more cautious story. Only 33% of UK consumers say they’re more likely to join a loyalty program than last year, well below the global average of 43%

This doesn’t signal declining interest, but rather market saturation: UK consumers already belong to an average of 4.7 programs, significantly higher than the global average of 3.7.

What motivates them is clear and uncompromising. According to our findings, 83% join loyalty programs primarily to save money, and UK consumers over-index on frustration when rewards feel unattainable. 57% say it takes too long to earn rewards, and 47% find rewards unattractive, both higher than global averages

This reinforces a core theme of the Global Customer Loyalty Report: the perception gap. While 86% of UK marketers believe loyalty makes customers feel valued, only 54% of UK consumers agree. This is yet another sign of market maturity, where the customers are set in their ways, and their emotional loyalty must be earned through relevance, fairness, and ease, not brand rhetoric.

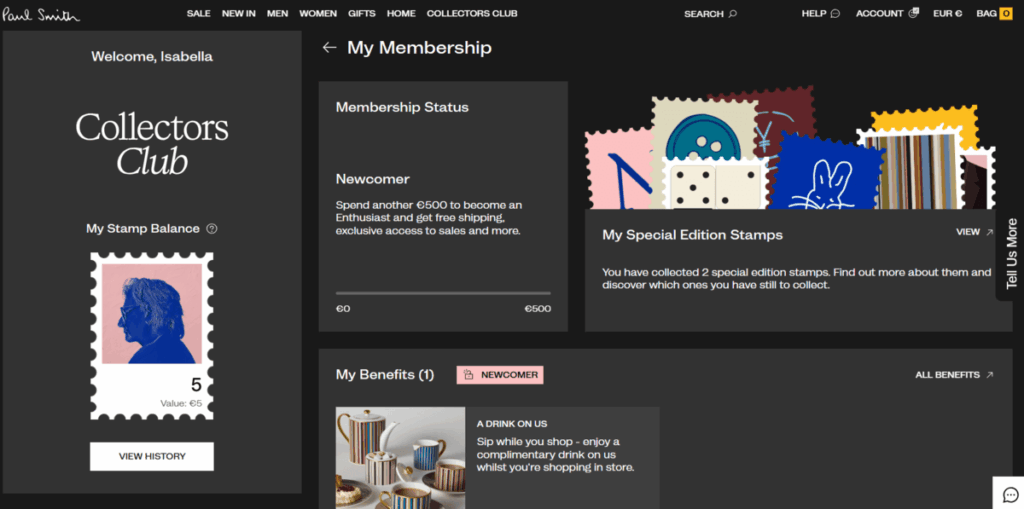

Promotions, access, and the UK’s answer to “ID in your pocket”

Promotions remain a powerful lever in the UK, with 64% of consumers saying offers influence their shopping behavior, slightly below global levels but still decisive. UK consumers strongly favor discount codes and “buy X, get 1 free” mechanics, reinforcing the idea that promotions are expected, and brands need to pick their approach carefully.

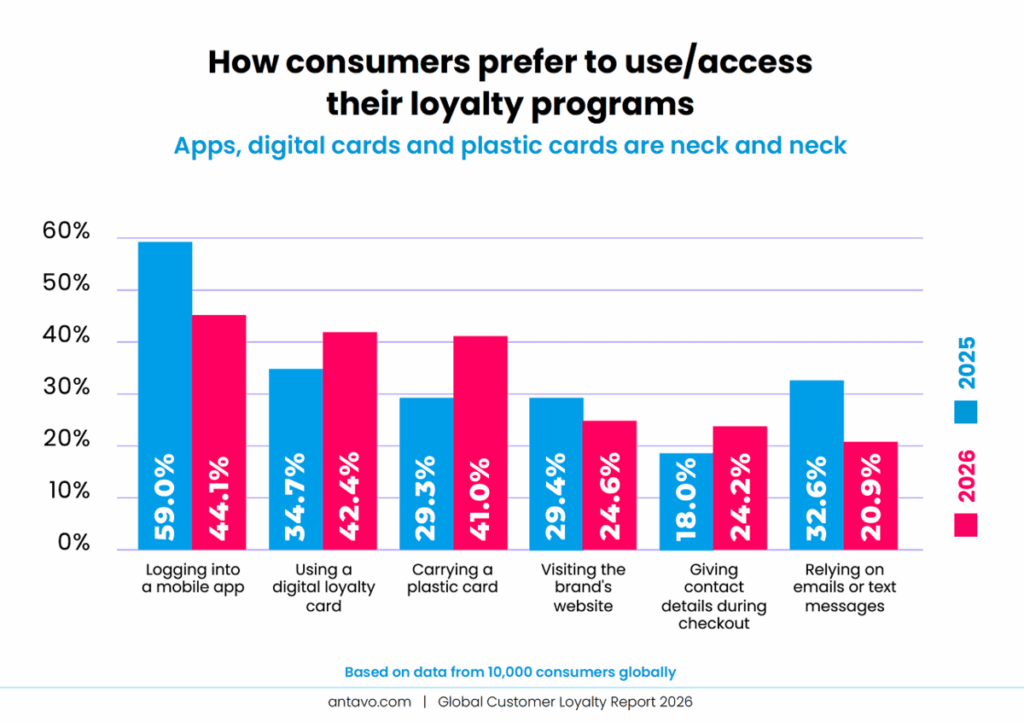

Channel preference also reflects pragmatism, our numbers say. The UK is one of the top markets for plastic cards and digital wallet passes, outperforming app-only usage. This aligns with the report’s insight that customers don’t want another app; they want frictionless identification, wherever they shop.

Key takeaways for UK loyalty leaders

The UK loyalty market in 2026 is not about experimentation for its own sake. It’s about proving value continuously to customers who are already overloaded with programs, and to leadership teams that expect loyalty to perform like a serious growth engine.

For UK brands, the opportunity lies in narrowing the perception gap: making rewards faster to reach, using data more intelligently, and letting AI turn insight into action.

If you’re exploring how to are looking for ways to launch or align your existing loyalty program with 2026’s UK loyalty trends, book a call with Antavo’s loyalty experts.