Reading Time: 5 minutes

For over a decade, the One-Time Password (OTP) delivered via SMS has been the universal security standard across the UAE’s financial landscape.

The ritual is familiar to every customer: initiate a transaction, exit the banking app, anxiously wait for a text message, and rush to enter the code before the timer runs out. This fragmented experience is now officially coming to an end. Under CBUAE Notice 2025/3057, all financial institutions in the UAE – including banks, insurers, payment providers, and wealth managers – must phase out SMS and email-based OTPs by March 31, 2026.

This transition couldn’t come at a more pivotal moment. The UAE digital banking platform market is projected to grow at a CAGR of 20.2% through 2033, with digital wallet transactions in the region already exceeding $2.3 billion annually. In this hyper-competitive digital landscape, the mandate to implement in-app biometrics represents more than just a compliance exercise – it’s a strategic opportunity to redefine customer engagement.

Why SMS Based OTPs No Longer Serve the UAE’s Digital Ambitions

The Central Bank’s decision aligns with the UAE’s vision to establish the world’s most advanced digital economy. For the BFSI sector specifically, SMS based OTPs present two critical limitations:

Security Vulnerabilities:

SMS messages travel over unencrypted networks, making them increasingly susceptible to sophisticated attacks, such as SIM swapping, smishing campaigns, and SS7 protocol exploits. In a region that handles over $18 billion in digital transactions annually, these security gaps represent an unacceptable risk.

Experience Fragmentation:

Every time a customer leaves your app to retrieve an SMS, you create unnecessary friction. In the UAE, where smartphone penetration exceeds 97% and consumers expect seamless digital experiences, this context-switching contradicts the broader national push toward frictionless services.

Beyond Basic Compliance: The MoEngage Strategic Advantage

While most platforms can help implement basic biometric authentication, MoEngage enables UAE financial institutions to transform this security checkpoint into a strategic asset. Here’s how our approach creates measurable business impact:

Authentication as a High-Intent Engagement Moment

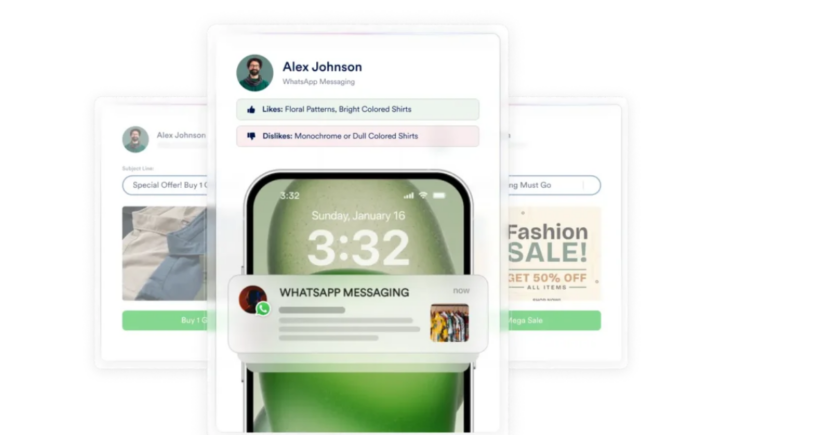

With biometric verification, each authentication becomes a powerful signal of customer intent. MoEngage helps you capitalize on these moments.

-

Intent Recognition:

Our platform can distinguish between different authentication contexts – routine balance checks versus active purchase intent – and tailor the subsequent experience accordingly.

-

Actionable Strategy:

When a customer authenticates after clicking a “New Investment” button, MoEngage can immediately trigger a personalized journey featuring their most relevant investment options based on previous behavior and risk appetite.

Creating Resilient Authentication Orchestration

The UAE’s digital infrastructure, although advanced, remains susceptible to downtime and connectivity issues. MoEngage ensures authentication reliability through:

-

Intelligent Channel Fallbacks:

If biometric authentication fails due to connectivity issues, MoEngage automatically orchestrates fallbacks across WhatsApp, push notifications, or other preferred channels.

-

Contextual Adaptation:

Our platform recognizes environmental factors (such as location or network quality) and adjusts authentication requirements accordingly, balancing security and accessibility.

Evolving from “Verified” to “Trusted” Relationships

While compliance requires verification, building customer lifetime value involves trust. MoEngage helps UAE financial institutions establish dynamic trust frameworks, such as:

-

Behavioral Trust Scoring:

By analyzing patterns across device usage, transaction history, and engagement consistency, MoEngage builds sophisticated trust profiles that evolve with each customer interaction.

-

Experience Calibration:

High-trust customers can enjoy streamlined experiences for routine transactions while maintaining the security needed for sensitive operations, creating the ideal balance between convenience and protection.

Unlocking the Power of First-Party Authentication Data

The shift to in-app authentication creates unprecedented opportunities to harness clean, first-party data – a critical advantage in the post-cookie era.

-

Enhanced Customer Understanding:

MoEngage captures the contextual signals surrounding each authentication event – time patterns, location consistency, and behavioral sequences – providing deeper insights than ever possible with third-party SMS gateways.

-

Personalization Engine:

This authenticated data feeds our AI-powered recommendation system, enabling hyper-relevant offers precisely when customers are most receptive – immediately after proving their identity.

Measuring and Optimizing the Authentication Journey

SMS based OTPs were essentially unmeasurable black boxes. With MoEngage’s in-app analytics, UAE financial institutions gain visibility into:

-

Friction/Dropoff Points:

Identify exactly where and why authentication attempts fail, and A/B-test different approaches to resolve bottlenecks.

-

Conversion Optimization:

Track how different authentication experiences impact downstream behaviors like loan applications completed, investment funds transferred, or policies purchased.

-

Customer Sentiment:

Measure how authentication changes affect customer satisfaction through integrated feedback mechanisms and sentiment analysis.

Implementation Pathways for UAE Financial Institutions

Phase 1: Assessment and Planning

- Audit current authentication dependencies

- Determine biometric implementation approach

- Design post-authentication engagement journeys

Phase 2: Pilot Implementation

- Roll out biometric authentication to select customer segments

- Test authentication-triggered engagement sequences

- Measure baseline metrics for optimization

Phase 3: Full Deployment and Optimization

- Scale to the whole customer base with refined journeys

- Implement advanced trust scoring and personalization

- Build continuous improvement feedback loops

Real-World Applications Already Delivering Results

MoEngage is already helping leading UAE financial institutions capitalize on this transition:

-

Interactive Transaction Completions:

Rather than ending with a static “Payment Successful” message, our banking clients use MoEngage to trigger contextual next steps: “That’s your third international transfer this month. Would you like to activate our Zero-Fee Global Account?”

-

Intelligent Service Recovery:

When a customer abandons an insurance claim upload after authentication, MoEngage triggers a real-time nudge: “We noticed you started your health claim. Our AI assistant can help complete it in under 3 minutes.”

-

Location-Aware Financial Guidance:

For retail banking customers, MoEngage can detect when they enter high-value shopping districts and send personalized spending power notifications: “Shopping at Dubai Mall? Your Platinum Card has AED 15,000 remaining in this month’s 0% installment plan capacity.”

-

Proactive Wealth Management:

Instead of generic portfolio alerts, our investment clients use MoEngage’s Sherpa AI to deliver personalized guidance: “Based on today’s Fed announcement, we recommend rebalancing your exposure to US tech stocks. Tap to view our analyst’s 2-minute video explanation.”

The Bottom Line: Transforming Compliance into Competitive Advantage

The CBUAE’s mandate to eliminate SMS based OTPs represents a pivotal moment for the UAE’s financial ecosystem. While every institution must comply, only forward-thinking organizations will capitalize on the tremendous engagement potential this transition creates.

The shift isn’t merely about changing an authentication method – it’s about fundamentally reimagining the customer journey. By partnering with MoEngage, UAE financial institutions can turn these newly created high-intent moments into powerful opportunities for deeper engagement, greater customer understanding, and ultimately, accelerated growth.

As we approach the 2026 deadline, the question isn’t whether your organization will implement in-app biometric authentication – it’s whether you’ll simply comply with the regulation or use this moment to leapfrog.

The post Turning Compliance into Conversion: Why the Death of SMS OTPs is an Opportunity for UAE BFSI Brands appeared first on MoEngage.