Key takeaways:

- The “great wealth transfer” is redefining client expectations. Legacy platforms cannot meet the digital-first demands of the next generation of HNWIs.

- Modern wealth management software is not an IT expense. It is a core business driver for operational efficiency, client retention, and scalable compliance.

- Artificial intelligence and machine learning are essential for delivering predictive insights, true personalization, and scaling advisory services profitably.

- The cost of custom wealth management software development ranges between $40,000 and $400,000 or more.

If you’re running a wealth management firm in 2025, you would have probably watched your competitors roll out sleek client portals while you’re still managing spreadsheets. Or maybe you’ve seen advisory firms acquire new clients faster because their technology actually works the way clients expect it to. What’s more? Your team is even frustrated with manually updating spreadsheets, chasing down data from multiple custodians, and generating reports that take hours to compile.

The financial services landscape has changed dramatically over the past few years. Clients don’t just want portfolio performance anymore. They want real-time updates, mobile access, personalized insights, and integration with everything else in their financial lives. They’re comparing your experience to Schwab, Wealthfront, and other fintech enterprises.

That gap between what your clients want and what your current systems deliver is the real cost of delaying wealth management software development.

But why does this matter to you? Because the digital transformation in wealth management is happening now, and those who don’t adapt will be left behind. On the other hand, organizations that have invested in robust wealth management platform development report measurable improvements in client retention, advisor productivity, and operational efficiency.

Indeed, wealth management software is transforming how financial advisors, wealth managers, and investment firms operate. Gone are the days of relying on spreadsheets and manual processes to track portfolios and handle client relationships. Today, smart financial platforms are relying on wealth management software to offer real-time insights, AI-powered analytics, and automated solutions that help wealth managers stay efficient and effective.

Interested in custom wealth management software development? Then you have landed at the right place. This guide will walk you through everything you need to know about wealth management app development: what you need to build, how to approach it, what it’ll cost, and most importantly, whether custom development makes sense for your firm. By the end, you’ll have a clearer understanding of how to build these platforms to elevate your business in 2025 and beyond.

Take your firm to the next level with next gen financial technology.

We offer tailored wealth management software development services that streamline operations and enhance client experiences.

Understanding the Purpose of Wealth Management Software

Modern wealth management software is the central nervous system for your entire advisory firm. It’s not just a single “app.” It’s an integrated ecosystem that connects every moving part of your business: financial planning, investment management, client communication, and regulatory compliance.

Think of it this way:

- For Your Advisors: It’s their command center. It kills the “grunt work.” No more stitching together data from five different systems or spending a week building reports. It automates the mundane so they can spend their time on what matters: talking to clients and thinking strategically.

- For Your Clients: It’s a transparent, 24/7 window into their entire financial life. It’s the secure portal they use to see their net worth, track their goals, and message their advisor. It builds trust.

- For Your Firm: It’s your engine for scale and your compliance shield. It ensures everyone is following the same rules and investment models, creating an ironclad audit trail.

In short, today’s wealth management platform development is all about cloud-native, API-first systems that can plug into anything, from your custodian to a hot new fintech tool.

Traditional vs. Modern Wealth Management Software Development: What’s Actually Changed

The difference between legacy systems and modern wealth management app development isn’t just about prettier interfaces or faster performance. It is about fundamentally different approaches to how wealth management operates. Traditional systems were built around advisor workflows and batch processes. Modern platforms flip that model; they’re built around client needs and real-time data.

Let’s break down what are the major differences between traditional and modern wealth management platforms:

| Aspect | Traditional Systems | Modern Platforms |

|---|---|---|

| Data Architecture | Siloed data across multiple systems; manual data reconciliation | Unified, integrated data sources; real-time synchronization |

| Client Experience | Monthly statements; limited portal functionality; advisor-driven communication | Real-time dashboards; mobile-first design; self-service access |

| Update Frequency | Batch processing; end-of-day updates | Event-driven; real-time updates as markets move |

| Reporting | Manual, time-consuming report generation; limited customization | Automated reporting; highly customizable; hundreds of reports monthly |

| Integration | Limited third-party integrations; manual data entry | Comprehensive APIs; seamless custodian and data provider connections |

| Scalability | Struggles as assets and client count grow; performance degradation | Designed to scale; cloud-native architecture |

| Security | Legacy security models; perimeter-based defense | Zero-trust architecture; continuous monitoring; encryption throughout |

| Compliance | Static compliance rules; manual monitoring | Configurable compliance frameworks; automated monitoring and alerts |

| AI/Analytics | Minimal analytical capability; limited insights | Machine learning; predictive analytics; behavioral intelligence |

| Advisor Productivity | Manual workflow; significant administrative burden | Automated workflow; intelligent tools free advisors for strategy |

| Cost of Ownership | Lower initial cost; high ongoing manual labor | Higher initial investment; lower ongoing operational costs |

| Technology Stack | On-premises; monolithic architecture; aging infrastructure | Cloud-based; microservices; continuously updated |

| Deployment Time | Months to years for updates or customizations | Rapid iteration; continuous deployment capabilities |

| Regulatory Adaptation | Requires development effort to accommodate new regulations | Configuration updates accommodate regulatory changes |

The Market Is Shouting. Are You Listening?

You might be wondering, is the demand for wealth management software really growing that fast? The answer is yes, rapidly. The global wealth management software market is projected to reach $12.7 billion by 2030, growing at an annual rate of 14.0% from 2025 to 2030 (source). But what’s driving this growth? Well, here are the major drivers that fuel this trend:

Clients Demand Hyper-Personalization

The “moderate growth” model is dead. Your clients want to know how their investments align with their values (ESG), how that new beach house purchase will affect their retirement goal, and they want the answer now. Hyper-personalization for business is moving from a ‘nice-to-have’ to a ‘must-have,’ and it’s all powered by AI.

AI Is the New Co-Pilot

Artificial intelligence is now the critical layer for differentiation. Now, simple robo-advisors don’t suffice the needs anymore. You need AI and machine learning for predictive analytics. Imagine your platform flagging a client who is at high risk of churning, or suggesting a tax-loss harvesting opportunity before you even look for it. That’s the power of custom software development for wealth management.

Regulatory Compliance

With financial regulations constantly evolving, it’s crucial for wealth management software to stay updated and automatically ensure compliance. This is another area where automation is helping firms stay ahead of the curve.

Types of Wealth Management Software

Wealth management software isn’t a single product you plug in and forget about. Different firms operate in their own way, support different types of clients, and care about different outcomes. Because of that, the software world around wealth management has evolved into a handful of specialized categories. Here are some of the most common ones you’ll come across:

1. Portfolio Management Software

This is the “day-to-day dashboard” of most advisors. It helps track client investments, monitor how they’re performing, and automatically rebalance portfolios when things drift off course.

Who uses it:

Financial advisors, asset managers, and investment teams who need a constantly updated view of what’s happening inside each client’s portfolio.

2. Financial Planning Tools

Planning goes beyond just picking investments. Financial planning tools help advisors walk clients through retirement needs, education costs, future goals, and interactive “what if” scenarios.

Who uses it:

Advisors offering more holistic guidance, RIAs, and family offices that want to support big-picture financial decisions.

3. Trading Platforms

These are built for action. They connect directly to the markets, support buying and selling securities, and often include real-time pricing and algorithmic trading features.

Who uses it:

Wealth managers, investment firms, and active traders who deal with fast-moving strategies.

4. Investment Accounting Software

These systems handle the behind-the-scenes math most people would rather not think about — returns, taxes, payouts, and compliance reporting.

Who uses it:

Accounting teams inside wealth firms, compliance officers, and multi-family offices that manage complex holdings.

5. Client Lifecycle Management (CLM) Systems

Think of this as workflow support. From onboarding and KYC/AML checks to ongoing servicing, CLM tools make the operational side feel a lot less messy.

Who uses it:

Advisory firms, private banks, and any business trying to stay compliant without adding extra paperwork.

6. CRM and Communication Tools

CRM platform development helps keep track of client details, past conversations, preferences, and follow-ups so nothing slips through the cracks.

Who uses it:

Basically everyone, especially firms that want deeper, more personal relationships with their clients.

7. Analytics and Reporting Platforms

For firms that lean heavily on data, these tools turn raw numbers into clean summaries, trends, benchmarks, and client-friendly reports.

Who uses it:

Firms that prioritize data-driven decision-making and client transparency.

Depending on your business offerings and client’s demands, you may need a single solution or an integrated ecosystem combining several of these categories.

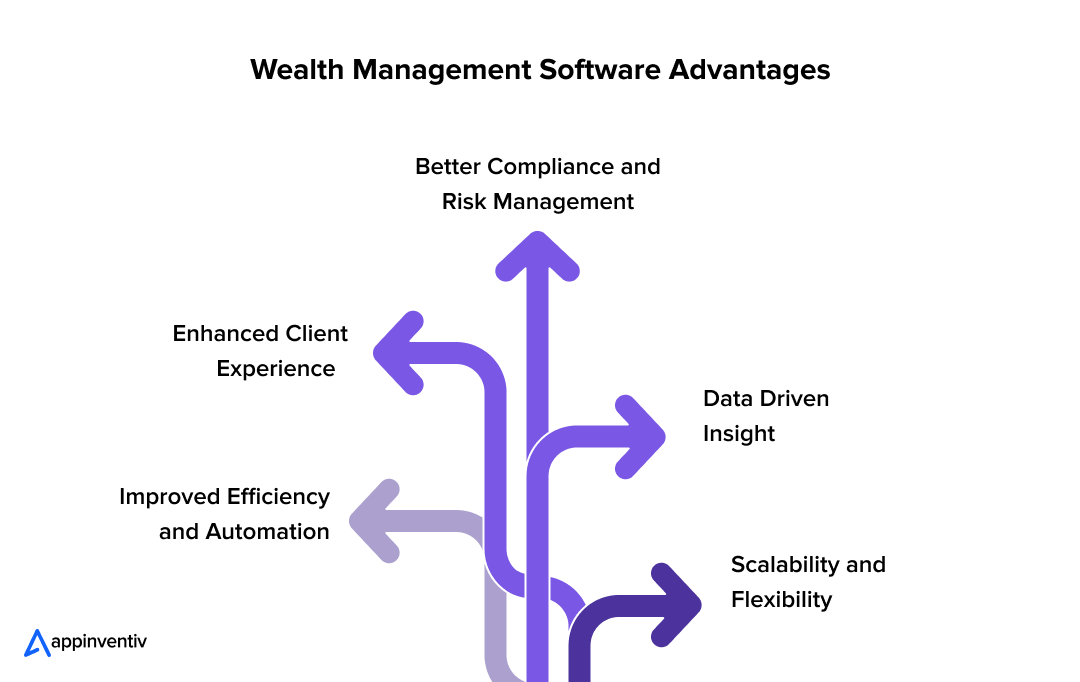

Key Benefits of Wealth Management Software Development

The financial advisory world has changed. You can’t treat wealth management software as a luxury anymore. It’s something you genuinely need to compete. But beyond the hype, what does this actually do for your business? Let’s walk through the real advantages.

Enhanced Operational Efficiency

Here’s what happens when you implement decent wealth management software: your team stops drowning in administrative work. Portfolio rebalancing, transaction processing, report generation; these tasks that used to eat up entire days; automation handles them in just a few minutes.

Your advisors get their time back. They’re no longer stuck doing data entry. Instead, they’re having strategic conversations with clients and thinking about business development.

Improved Client Experience

Your clients aren’t comparing you just to other advisors anymore. They’re comparing you to their AI-powered banking software, their investment tools, everything they use. They expect real-time updates, personalized recommendations, and a seamless experience. Period.

Modern wealth management platforms actually let you deliver that. Real-time portfolio visibility, custom dashboards that show what matters to specific clients, alerts when something changes. Clients feel informed because they actually are informed.

Robust Compliance and Risk Management

Compliance is honestly a nightmare for most firms. Regulations keep changing. Documentation requirements keep expanding. Your compliance team spends half their time just checking records manually, making sure everything’s aligned with whatever new rule came down last quarter.

Modern wealth management software changes this equation. Comprehensive audit trails automatically track everything. Compliance monitoring happens continuously rather than through manual spot-checks. Documentation gets generated automatically as part of normal workflow. Your compliance team can focus on actual strategy instead of paperwork theater. The regulatory violation risk drops significantly because you’re catching issues before they become problems.

Scalability and Flexibility

Growing your firm shouldn’t require building a whole new technical infrastructure. Cloud-based wealth management software actually scales with you. You need more processing power? You get it instantly. You need to add another office with 20 advisors? No massive IT project required.

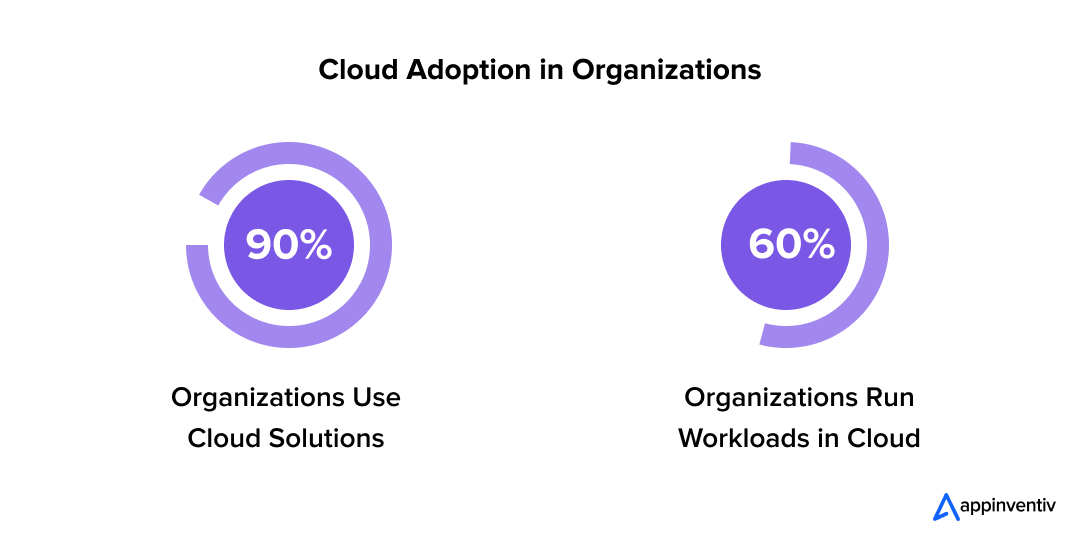

The market confirms this. According to Statista data on cloud adoption, over 90% of organizations now use cloud solutions, and roughly 60% run more than half their workloads in the cloud. Organizations made this shift because cloud works. You get scalability without the capital investment and operational headache.

Data-Driven Insights

When your data lives everywhere, one system says a client has $2.5 million, another system says $2.3 million, contact information is outdated in one place but current somewhere else, you’re operating blind. You’re making decisions on incomplete or conflicting information.

Unified systems eliminate that chaos. Everything comes from one authoritative source. Your advisors see the real picture. Your firm sees the real picture. Better data equals better decisions. For your clients, that means more accurate advice. For your firm, that means smarter business choices. That consistency matters more than people realize until they actually experience it.

Features of Wealth Management Software

Wealth management platforms aren’t just fancy dashboards. At their best, they make money conversations simpler, keep clients informed without overwhelming them, and give advisors room to focus on strategy instead of paperwork. Different firms prioritize different things, but most platforms end up sharing a handful of common building blocks — plus a few newer wealth management software features that are starting to show up more often.

Here’s a breakdown of what usually goes into the stack, and why it matters.

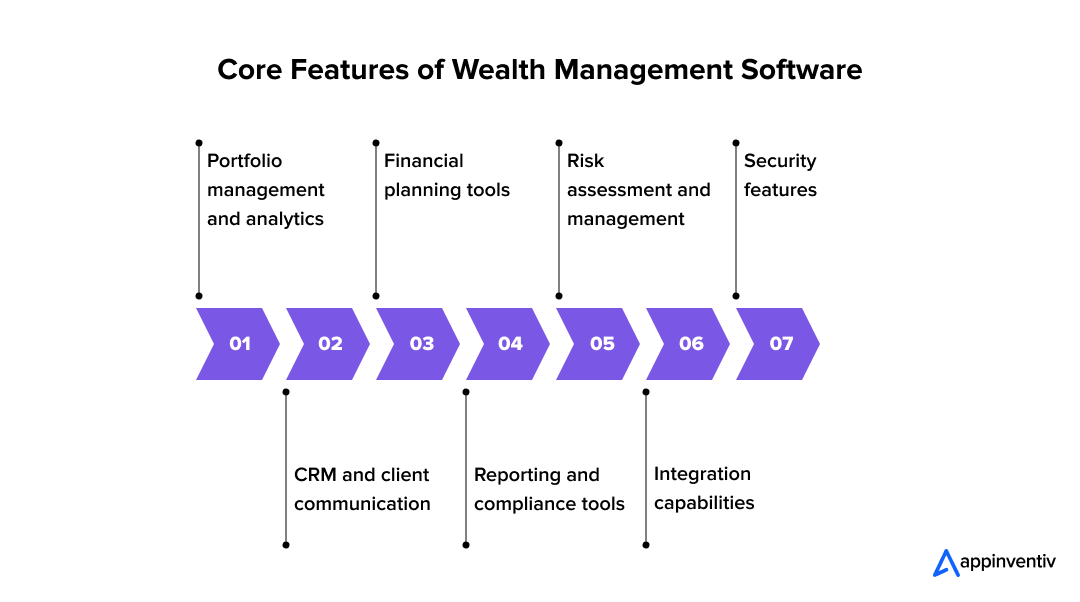

Must Have Features of Wealth Management Software

When evaluating wealth management software or planning custom development, certain capabilities are table stakes. You need them; clients expect them.

1. Portfolio Management and Analytics

Every advisor needs a clear picture of how a client’s money is performing. Instead of waiting for monthly statements, portfolio management feature shows what’s happening right now, which assets are growing, which ones are underperforming, and where the risks are hiding. With automated rebalancing and easy-to-read performance reports, advisors can react quickly and explain the “why” behind every move, without digging through files.

2. Financial Planning Tools

Helping someone reach retirement, buy a home, or plan for children’s education isn’t simple math. Good planning features run “what if” scenarios and show how different choices affect long-term wealth. It lets advisors have meaningful conversations rather than giving general advice. Clients can actually see the impact of saving a little extra or shifting their investment mix and that makes planning feel real rather than theoretical.

3. CRM and Client Communication

Clients want to feel remembered, not managed like tickets in a queue. A built-in CRM feature keeps track of their preferences, life events, and past conversations so advisors can reach out at the right time and in the right way. Whether it’s sending a quick reminder about tax season or sharing a market update when volatility spikes, communication feels personal instead of generic.

4. Risk Assessment and Management

Markets can turn quickly, and not every client has the same appetite for risk. These features help advisors measure whether a portfolio still matches a client’s comfort level. If investments start drifting, the software can suggest ways to rebalance before a small dip becomes a big problem. It’s proactive, not reactive, and that builds trust.

5. Reporting and Compliance Tools

Regulators like clean records and complete transparency. Advisors? They prefer spending time on strategy rather than paperwork. Automated compliance and reporting tools generate audit trails, monitor rule changes, and highlight anything that might need attention. It reduces manual work and makes conversations with auditors far less stressful.

6. Integration Capabilities (APIs, Third-Party Services)

Most advisors use more than one system. Market feeds here, banking tools there, and research dashboards somewhere else. Integrations pull all those moving parts into one view. Instead of flipping between tabs and trying to reconcile numbers manually, advisors get a single source of truth that is fast, consistent, and accurate.

7. Security Features

Nothing is more sensitive than financial data. Modern platforms protect that information with multi-factor authentication, strong encryption, and role-based access. Even if someone tries to break in, the layers are designed to keep them out. And in case of a system crash or outage, backups ensure nothing gets lost. It’s safe with peace of mind built in.

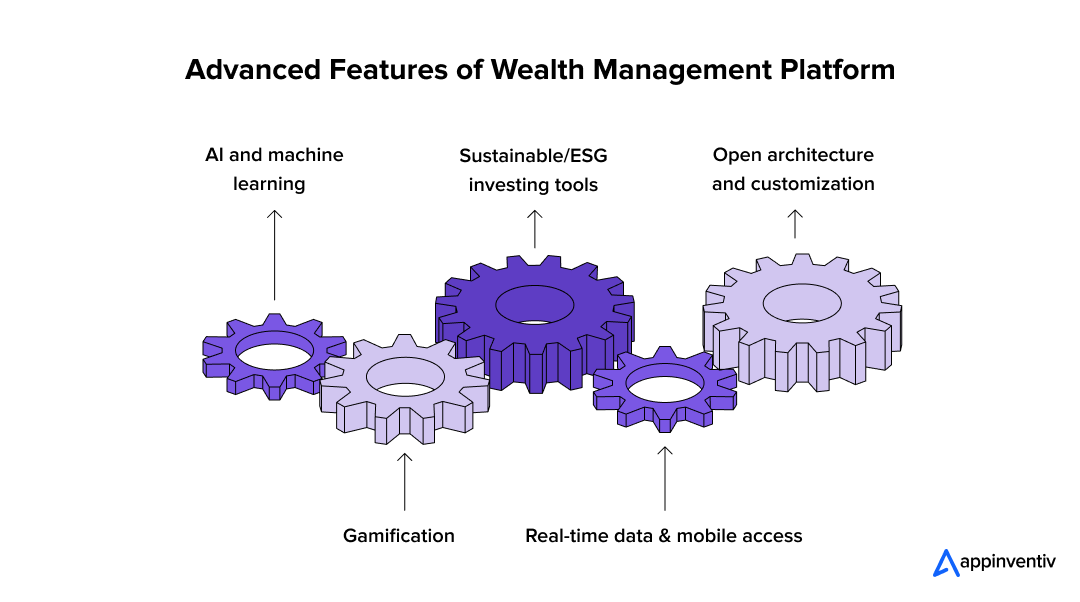

Advanced and Emerging Features of Wealth Management Software

As client expectations evolve, so do the features behind wealth management platforms. Newer capabilities are helping advisors deliver deeper insight, stronger engagement, and more personalized service at scale. Here are some advanced features of wealth management software:

1. AI and Machine Learning

AI isn’t here to replace advisors. It’s here to sharpen their instincts. It analyzes past trends, flags opportunities, and suggests adjustments before a human would spot them. Robo-advisor platforms can help with repetitive tasks and basic investment recommendations, while advisors focus on complex decisions, emotions, and planning. Together, they scale smarter, not harder.

2. Gamification

Money management feels intimidating for many people. The gamification feature softens that. Goal trackers, visual dashboards, badges for hitting savings milestones; these add a sense of progress and motivation. Younger investors, in particular, respond well because it turns financial growth into something they can see and celebrate.

3. Sustainable/ESG Investing Tools

A growing number of investors want their money to support causes they care about: climate impact, diversity leadership, ethical practices. ESG features measure how companies stack up against those standards. Advisors can build portfolios that match values without sacrificing returns, and clients get reports that show real-world impact.

4. Real-Time Data and Mobile Access

Life doesn’t happen behind a desk. By giving clients access through mobile apps, they can check performance, track progress, and respond to market changes from anywhere. It reduces anxiety and creates a sense of partnership. Advisors aren’t just information givers, they’re guides.

5. Open Architecture and Customization

No two firms operate the same way. Open architecture lets businesses plug in new tools, remove old ones, and adapt as regulations or client expectations change. It keeps the platform flexible rather than locked into one vendor’s idea of “how things should work.” As the firm grows, the software grows with it.

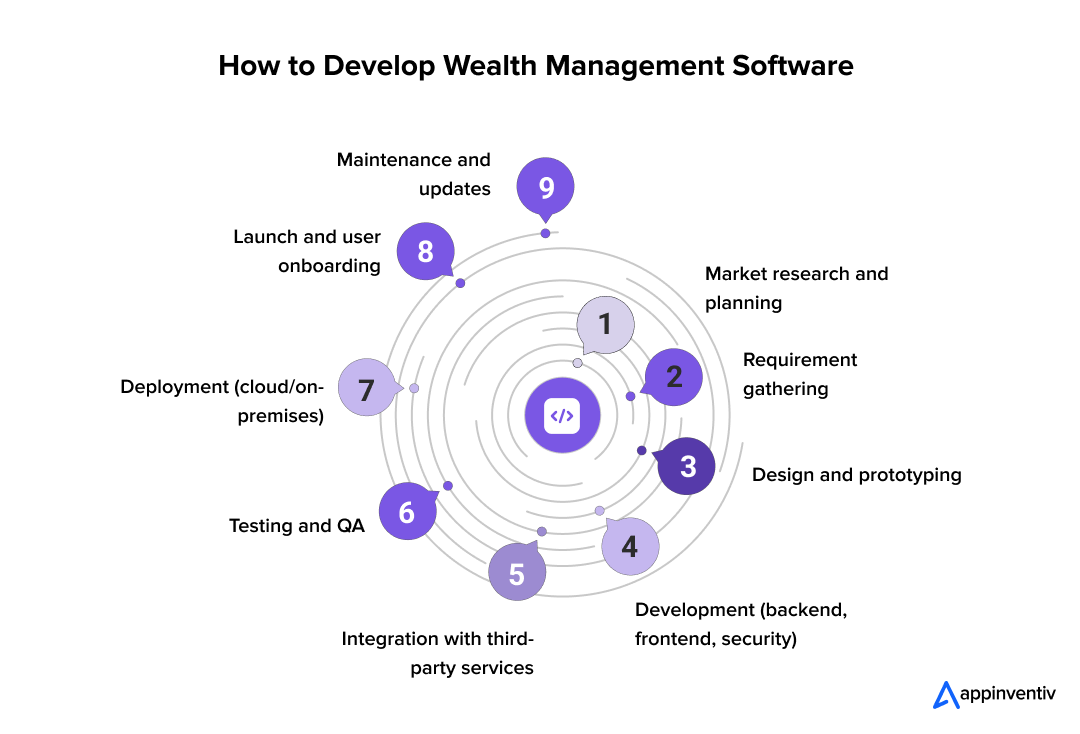

Wealth Management Software Development Process: A Step by Step Guide

Building a wealth management platform isn’t just a “tech project.” There are a lot of moving parts, from regulations and data security to keeping the user experience clean. If you’re planning something similar, here’s a simple walkthrough of how teams typically approach it.

1. Market Research and Planning

Before a single line of code is written, you need clarity on who you’re building for. Wealth management clients expect very specific tools, and they’re not shy about switching platforms if something feels off.

Typical tasks at this stage:

- Talking to financial advisors and clients to see what they actually use day-to-day.

- Looking at competitor platforms to spot gaps or areas you can improve.

- Shortlisting wealth management features that truly matter, instead of drowning the product in “nice-to-have” add-ons.

Doing this upfront saves countless hours later and keeps the product grounded in real needs.

2. Requirement Gathering

Once you have an idea of the direction, it’s time to get more detailed. This is where teams sit together, sometimes in long meetings, and hash out what the platform must do.

Typical tasks at this stage:

- Listing core features (portfolio dashboards, CRM tools, compliance checks, etc.).

- Creating user personas to understand different types of investors or advisors.

- Documenting compliance requirements so nothing slips through.

This step might feel time consuming, but it prevents last-minute surprises.

3. Design and Prototyping

Now the ideas start to take shape. Designers sketch out how everything will look and flow. A good UI/UX design doesn’t shout; it should feel familiar in the first five minutes.

Typical tasks at this stage:

- Building wireframes and clickable prototypes.

- Testing them with a small pool of users, even informal feedback, helps.

- Making sure everything works smoothly on mobile, since many clients check their portfolios on the go.

A clear layout reduces training time later, which advisors will appreciate.

4. Development (Backend, Frontend, Security)

Once everyone agrees on how things should look, wealth management software developers turn the blueprint into an actual product. Backend developers handle data, logic, and integrations. Frontend developers focus on what users interact with.

Typical tasks at this stage:

This stage is where the platform starts feeling real.

5. Integration with Third-Party Services

Wealth management tools rarely work in isolation. They often pull pricing data, connect with banks, or sync with accounting systems.

Typical tasks at this stage:

- APIs are used to bring external data into the platform.

- Teams run tests to make sure numbers match across systems.

- Data privacy rules are reviewed to avoid accidental violations.

These integrations make the platform more useful out of the box.

6. Testing and Quality Assurance (QA)

Before anyone goes live, the platform gets tested on various aspects. Sometimes more than users expect. Bugs show up in strange places, and it’s better to catch them early.

Typical tasks at this stage:

- Unit tests: Tiny tests that check individual components.

- User acceptance testing (UAT): Advisors test the platform and share honest feedback.

- Security testing: Ethical “hackers” attempt to break into the system.

Good QA prevents hefty penalties later.

7. Deployment (Cloud or On-Premises)

After approval, the software gets pushed to its real environment. Firms can choose cloud hosting or keep everything on-site, depending on comfort with data control.

Typical tasks at this stage:

- Picking a reliable cloud provider if going that route.

- Setting up automated backups and fallback plans.

- Ensuring the platform is reachable from multiple devices.

A smooth deployment means fewer calls on launch day.

8. Launch and User Onboarding

This is when clients finally see the platform. It’s exciting and a little nerve-wracking. The goal here is to make everyone feel comfortable fast.

What teams usually prepare:

- Short video walkthroughs or tooltips built right into the UI.

- Live chat or support for the first couple of weeks.

- Quick surveys to catch friction points early.

Good onboarding can turn skeptical users into fans.

9. Maintenance and Updates

Software isn’t a “launch and forget” situation. Markets shift, regulations change, and new features can give your platform an edge. Thus, you need to upgrade your software to meet the changing demands.

Typical tasks at this stage:

- Fixing bugs as users stumble across them.

- Pushing updates that improve performance or design.

- Adding new and emerging features.

This steady care is what makes a platform feel polished over time.

Deployment Options: Cloud, On-Premises, or Hybrid?

Choosing how to deploy your wealth management software is a crucial decision that impacts scalability, security, compliance, and cost. Here are the main deployment models.

| Deployment Model | Pros | Cons | Best For |

|---|---|---|---|

| Cloud Deployment | – Rapid scalability as your firm grows

– Lower upfront infrastructure costs – Automatic updates and easier disaster recovery – Accessible from anywhere, supporting remote teams and clients |

– Data is stored off-site, which may raise concerns for some clients

– Ongoing subscription costs |

Firms prioritizing flexibility, fast deployment, and global accessibility. |

| On-Premises Deployment | – Full control over data security and compliance

– Customizable to unique internal processes – Can meet strict regulatory or client requirements |

– Higher upfront and ongoing maintenance costs- Longer implementation timelines- Requires dedicated IT resources | Large institutions, private banks, or firms with strict security/compliance needs. |

| Hybrid Deployment | – Balances flexibility and control

– Enables gradual migration to the cloud – Customizable for complex workflows |

– More complex to manage

– Integration and data synchronization challenges |

Firms with mixed requirements, or those transitioning from legacy systems to modern architectures. |

Choosing the right deployment model depends on your firm’s size, regulatory environment, growth plans, and internal expertise. Many modern firms start with cloud or hybrid models to maximize agility while maintaining the necessary security and compliance standards.

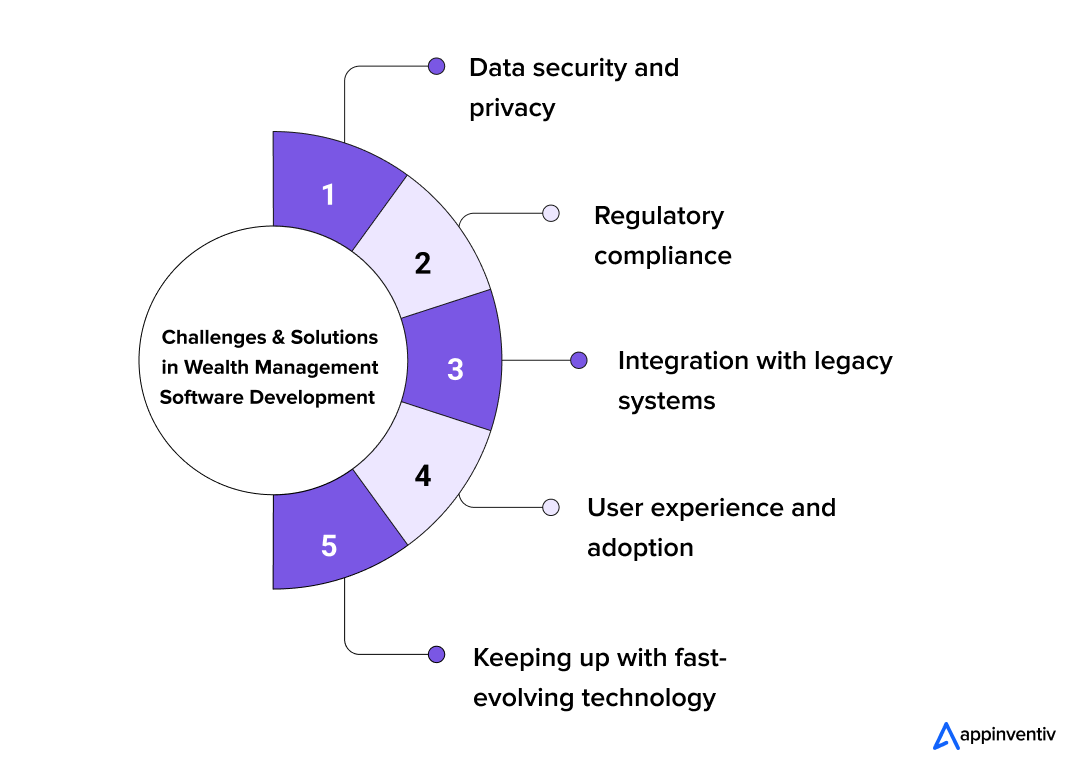

Challenges in Wealth Management Software Development & How to Overcome Them

Wealth management software sounds straightforward on paper. But once you start building, you quickly run into issues that don’t show up on the surface. Old systems, new regulations, security risks; it’s a long list. Here are a few challenges teams usually face, along with ways companies try to handle them without slowing down operations.

1. Data Security and Privacy

Financial data is personal. It’s tied to identity, lifestyle, and sometimes even health. That’s what makes it a prime target for cyber attackers. One incident, even if it’s small, can shake client confidence and drag a brand through months of damage control.

What usually helps:

- Encryption: Keeps data unreadable if someone intercepts it.

- Multi-Factor Authentication: Adds an extra wall for anyone trying to slip in.

- Frequent Security Checks: You catch issues before someone else does.

It’s a lot to manage, but these measures help firms stay on the right side of regulatory laws like GDPR and PCI-DSS.

2. Regulatory Compliance

Financial software regulations don’t sit still. They shift based on politics, market risks, and global events. Keeping up with laws such as MiFID II, Dodd-Frank, and GDPR can feel never-ending. Missing one update can lead to panic, paperwork, and penalties.

What usually helps:

- Built-in Compliance Features: They automate checks in the background.

- Audit Trails: Every action is recorded, which makes reviews faster.

- Regular Updates: Changes roll into the software without constant manual fixes.

Staying proactive saves more headaches than most firms realize.

3. Integration with Legacy Systems

Many wealth management companies still depend on systems built years ago. They’re reliable, but not exactly friendly when you try to connect them with modern tools. Moving away from them overnight isn’t realistic; there’s too much risk.

What usually helps:

- API Connections: They let old and new systems exchange data smoothly.

- Gradual Updates: Rolling out changes in small pieces avoids disruption.

This slower, controlled path to upgrade legacy banking systems keeps advisors working while the tech quietly evolves behind the scenes.

4. User Adoption and Experience

Some software looks brilliant in demos but feels overwhelming in everyday use. If advisors find it confusing, they’ll rely on spreadsheets. If clients don’t understand it, they stop logging in. Either way, adoption dips and ROI follows.

What usually helps:

- Clear, simple design: The fewer the clicks, the better the experience.

- Onboarding Support: Videos, walkthroughs, and real people answering questions.

- Feedback Surveys: Real-world usage will always reveal improvements you didn’t think of.

When users enjoy the experience, efficiency becomes a pleasant side effect.

5. Keeping Up with Technological Advancements

Technology never stops moving. New tools promise smarter insights, faster processing, and leaner operations. The tricky part is staying updated without rebuilding everything from scratch every two years.

What usually helps:

- Modular Architecture: You add new tech without tearing apart core systems.

- Cloud Platforms: Easy scaling when markets get busy.

- Agile Delivery: Constant small improvements instead of stressful big launches.

This flexible approach makes it easier to introduce AI, blockchain, and automated reporting when the business is ready, not rushed.

Boost your security and compliance with next-gen wealth management platforms.

With a fraud detection accuracy of 98% and a 99.50% transaction SLA, Appinventiv ensures your platform stays secure and compliant.

Build vs Buy Wealth Management Software: Making the Right Decision

One of the biggest decisions is whether to build custom wealth management software development or implement an existing platform. This isn’t a trivial choice. This is a crucial decision that determines the success of your investment and project goals.

Custom development makes sense if:

You have distinctive business models or serve specialized client segments where generic solutions feel constraining. You have competitive advantages you want to protect through differentiated technology. You have internal technical expertise to guide development and maintain systems long-term. Your budget can support substantial investment and longer timelines.

Off-the-shelf solutions make sense if:

Your requirements align reasonably well with existing platforms. You want faster time-to-value and lower capital investment. You prefer not managing ongoing technology maintenance. Your budget is constrained. You want to leverage innovations developed by specialized vendors serving hundreds of institutions.

Here is a brief table outlining the key differences between off-the-shelf and custom wealth management software:

| Factor | Custom Development | Off-the-Shelf Solutions |

|---|---|---|

| Initial Cost | $40K-$600K+ depending on complexity | $50K-$500K implementation fees |

| Time to Launch | 12-36 months for enterprise implementations | 3-6 months typical deployment |

| Customization | Complete flexibility; tailor to exact workflows | Limited; must adapt processes to platform |

| Competitive Differentiation | High—unique features competitors can’t replicate | Low—competitors may use identical system |

| Scalability | Designed for your growth trajectory | Pre-built for mid-to-enterprise scale |

| Internal Resources Needed | Dedicated technical team for ongoing maintenance | Minimal internal tech resources required |

| Feature Updates | You control roadmap and timing | Vendor controls features and release dates |

| Integration Complexity | Can build custom integrations as needed | Limited to vendor’s pre-built integrations |

| Ongoing Maintenance | Your responsibility; 15-20% of dev costs annually | Vendor manages all updates and patches |

| Regulatory Compliance | Flexible—you adapt code for new regulations | May lag regulatory changes; vendor dependent |

| Learning Curve | Customized to your workflows; steeper initially | Standardized interface; easier adoption |

| Vendor Lock-in Risk | Low—you own the code | High—dependent on vendor’s viability |

| Long-term ROI | Higher if differentiation drives revenue | Lower but more predictable |

| Security Control | Full control over security architecture | Trust vendor’s security standards |

| Best For | Premium advisors, niche segments, strategic advantage | Mid-market firms, standardized needs, faster deployment |

Which Option is Right for You?

The choice between custom and off-the-shelf software depends largely on your firm’s specific needs and long-term goals. If you have unique requirements or anticipate significant growth, investing in a custom-built solution is truly the best option. However, if you need a cost-effective solution that can be deployed quickly, an off-the-shelf platform may be the way to go.

The Costs of Wealth Management Software Development

Anyone who gives you a flat price for a custom development without a deep discovery phase is just guessing. It’s like asking, “How much does a house cost?” Remember, a beach-front mansion is different from a starter home.

Typically, the costs of wealth management software development are driven by three factors:

- Complexity: A simple portfolio tracker is 10x cheaper than a multi-custodial platform with an AI analytics engine.

- Integrations: Every third-party API (custodian, market data, etc.) adds time and complexity.

- Security & Compliance: Building to meet SEC/FCA standards, with full audit trails and pen-testing, is a non-negotiable (and significant) cost.

That said, you need a ballpark. Based on our fintech software development services, here’s an average cost and timeline breakdown of wealth management software development based on different project complexities.

| Platform Type | Features | Cost Range | Timeline |

|---|---|---|---|

| The MVP Software Development | – Basic portfolio management

– Client data management – Simple reporting tools – Basic compliance features |

$40,000 – $200,000 | 4-6 months |

| The Advanced Platform | – Portfolio management with real-time analytics

– Client relationship management (CRM) – Integration with third-party data sources – AI-powered investment suggestions |

$200,000 – $400,000 | 6-12 months |

| The Enterprise Grade System | – Full portfolio management with advanced risk analytics

– Customizable dashboards – Advanced compliance tools – AI/ML for personalized financial advice – Full integration with other financial systems |

$400,000 – $600,000 | 12+ months |

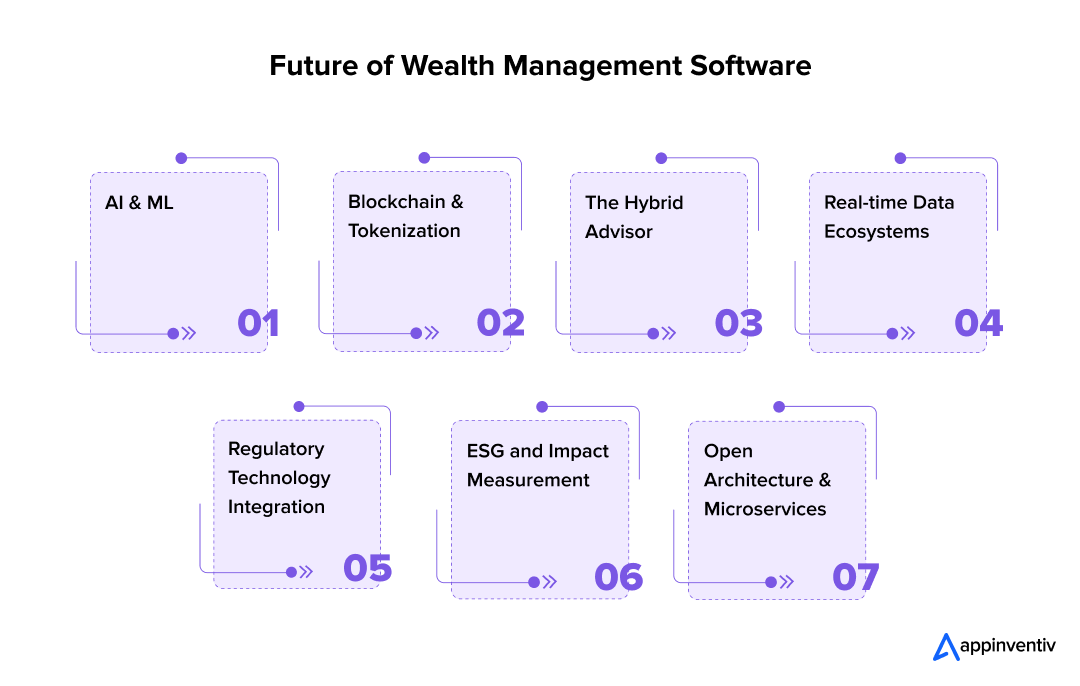

Tech Trends Shaping the Future of Wealth Management Software

The future trends of wealth management software are all about making advice smarter, faster, and more personal. Several trends are reshaping wealth management software engineering trend. Understanding these helps you make decisions that age well.

AI and Machine Learning

AI and ML in banking and wealth management are moving from diagnostic (what happened?) to predictive (what’s next?) and prescriptive (what should you do?). Leading firms are implementing sophisticated AI for portfolio optimization, predictive analytics, behavioral coaching, and automated tax strategies. Organizations that haven’t begun AI integration will face competitive disadvantages within 2-3 years.

Real-time Data Ecosystems

APIs enabling instantaneous portfolio reconciliation and live market data are becoming standard infrastructure. This shift accelerates wealth management software development toward event-driven architectures that respond immediately to market changes.

Regulatory Technology Integration

As compliance gets more complex, platforms incorporating advanced regulatory monitoring and automated compliance documentation get premium valuations. RegTech capabilities increasingly determine competitive positioning.

ESG and Impact Measurement

Client demand for sustainable investing options continues to intensify. Platforms with robust ESG capabilities and impact measurement tools differentiate themselves from competitors lacking these features.

Open Architecture and Microservices

Monolithic systems are giving way to modular, API-driven architectures. This enables flexibility, easier scaling, and faster innovation. Organizations choosing development partners should prioritize this architectural approach.

Blockchain & Tokenization

This is still on the horizon, but it’s coming. The ability to “tokenize” illiquid assets (like a piece of a building or a work of art) will completely change portfolio construction. Your platform will need to handle it.

The Hybrid Advisor

The future isn’t “human vs. robo.” It’s “human plus robo.” Clients will use a slick digital platform for nearly 90% of their needs, but will have seamless access to a human advisor for the big, complex life moments.

Why Appinventiv Is the Right Partner for Wealth Management Software Development

Building a next-generation wealth management platform takes more than just code. It requires financial expertise, design precision, and an understanding of how digital experiences influence trust. That’s exactly what Appinventiv provides to its clients.

With 10+ years of industry experience and 200+ FinTech products delivered across global markets, we’ve helped financial institutions, neobanks, and startups reimagine how clients interact with money. Our wealth management software development services are designed to enhance security, improve financial literacy, and reduce operational costs by up to 30% without compromising on user experience or compliance.

Don’t just take our words for it. Here are some of our proven success stories in financial innovation

- Mudra – AI-Based Budget Management App for Millennials

Appinventiv partnered with Mudra to create an AI-powered budget management app that helps users take control of their spending through intelligent analytics and automation.

The Results?

- Personalized budgeting and predictive spending analytics.

- Real-time financial tracking powered by AI.

- Designed for scale, enabling high user engagement and retention.

This project reflects our ability to combine AI-driven personalization with intuitive UI/UX design. This is exactly what wealth management software needs to deliver data-backed financial insights effortlessly.

- Edfundo – Financial Literacy and Smart Money Management App for Kids and Teens

For Edfundo, a UAE-based startup, Appinventiv built the world’s first smart money management and financial literacy platform tailored for children and teens.

- Multi-role architecture for parents, educators, and children.

- Integrated banking and learning experience for safe financial education.

- Enhanced user engagement through gamification and intuitive financial tools.

Edfundo stands as a testament to how we build secure, educational, and scalable financial platforms that drive inclusion and awareness while maintaining enterprise-level compliance.

Here are some specific facts and figures that present the stark reality of our wealth management expertise:

| Metric | Result |

|---|---|

| FinTech Products Delivered | 200+ |

| Years of FinTech Expertise | 10+ |

| Fraud Detection Accuracy | 98% |

| Security SLA for Transactions | 99.50% |

| Cost Reduction in Operations | 30% |

At Appinventiv, our approach to wealth management software development focuses on four core pillars: security, scalability, personalization, and compliance.

What does this mean to you? It simply means that whether you’re looking to build a full-scale digital wealth platform from scratch or modernize legacy systems, our team of 1600+ tech experts is here to help. They architect a secure and scalable solution tailored to your specific needs that aligns with your firm’s vision, growth targets, and regulatory framework.

Why wait? Partner with us today to create a financial ecosystem that’s not just intelligent, but impactful, future-ready, and built on trust.

FAQs

Q. How much does it cost to develop a wealth management software?

A. The cost of software development for wealth management largely depends on the scope and complexity of the platform.

- A basic MVP with essential portfolio and compliance tools typically costs between $40,000 and $200,000.

- Mid-level, feature-rich solutions with integrations and analytics range between $200,000 and $400,000

- Enterprise-grade, AI-driven systems can reach $400,000–$600,000+.

Appinventiv’s FinTech projects usually deliver up to 30% cost optimization through modular architecture and reusable frameworks.

Q. What’s the typical timeline for developing a wealth management platform?

A. Timelines vary depending on the project’s size and complexity:

- MVP (basic features): 3–6 months

- Advanced platform: 6–12 months

- Enterprise solution: 12+ months

We follow an agile development model, which allows us to iterate, test, and release features faster without compromising on compliance or performance.

Q. How do you ensure security and compliance in wealth management software?

A. We implement multi-layered data encryption, multi-factor authentication (MFA), and role-based access control (RBAC) to safeguard sensitive information.

Our compliance frameworks are aligned with GDPR, MiFID II, and Dodd-Frank regulations. Every deployment undergoes security audits, ensuring a 99.50% transaction SLA and 98% fraud-detection accuracy, benchmarks we’ve consistently met across our FinTech projects.

Q. How do leading financial institutions modernize their wealth management systems?

A. Modernization starts with migrating legacy systems to the cloud, integrating AI-driven analytics, and adopting API-first architectures that allow seamless interoperability with CRMs, trading systems, and banks.

Leaders also invest in real-time data analytics and personalized dashboards to improve client engagement and reporting accuracy; approaches Appinventiv has successfully implemented for solutions like Mudra and Edfundo.

Q. What tech stack is best for wealth management software development?

A. A modern wealth management platform typically leverages:

- Frontend: React, Angular, or Vue.js

- Backend: Node.js, .NET Core, or Java Spring Boot

- Databases: PostgreSQL, MongoDB, or Oracle

- Cloud & Infrastructure: AWS, Microsoft Azure, or Google Cloud

- Security & Compliance Tools: OAuth 2.0, JWT, and ISO-certified encryption libraries

At Appinventiv, we tailor the stack to each firm’s scalability, regulatory, and integration needs.

Q. How are AI and machine learning reshaping wealth management software?

A. AI and ML are redefining how wealth managers interact with clients. They power robo-advisors, predictive analytics, and automated portfolio rebalancing, enabling faster, data-driven decisions.

Machine learning models also enhance risk assessment, client segmentation, and behavioral analysis, leading to more personalized advisory experiences. Our FinTech solutions have shown that AI integration can boost client engagement by up to 30% while reducing manual workload significantly.

Q. Who uses wealth management software development?

A. Wealth management software is primarily used by financial advisors, investment firms, wealth managers, and private banks. These professionals rely on the software to serve high-net-worth individuals (HNWIs) and institutional clients, offering them a way to manage complex portfolios and ensure their financial goals are met effectively.