Social media and banking haven’t always been a natural match. One moves fast. The other is built on caution, credibility, and compliance.

However, customers are already talking about money on social media, getting advice there, and making financial decisions.

The good news? We rounded up 9 practical tips to help banks use social media to build trust, stay compliant, and engage audiences across generations.

Key takeaways

- Banks are prioritizing digital over traditional marketing. Nearly 62% of bank marketing budgets now go to digital efforts.

- Social media is now a key source of financial advice. Many customers, especially younger ones, use social media to learn, research, and make decisions.

- Trust drives engagement on social. Audiences respond to education, transparency, and real stories, not sales pitches.

- Platform choice matters: YouTube reaches all ages, while TikTok and Instagram skew younger. Facebook and LinkedIn resonate with older and professional audiences.

- Compliance is essential for safe social media use. Clear governance, approvals, and monitoring help banks move faster without adding risk. Tools like Hootsuite make this easier to manage at scale.

Banks should be on social media because it’s where people are learning about money, comparing institutions, and figuring out who they trust.

Let’s take a closer look at why social media matters:

For certain generations, social media is a go-to source for financial information

For many investors, especially younger ones, social media is shaping how they make financial decisions.

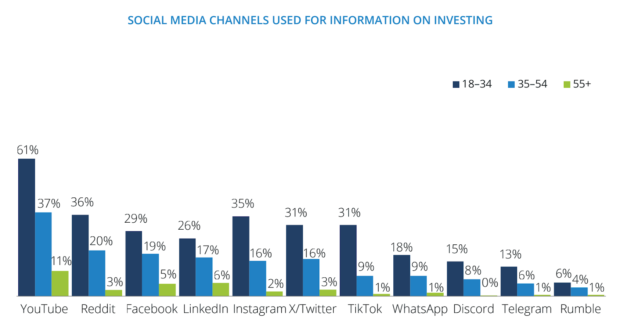

29% of investors say they use social media and message boards to get ideas for investing decisions, according to new research from the FINRA Foundation.

Platforms like YouTube, Reddit, Facebook, and LinkedIn are the most popular social media platforms for this kind of information.

Source: FINRA Foundation

For banks, this comes with both opportunity and responsibility. Audiences are actively seeking financial education, but trust is fragile.

This is why clear, accurate, and transparent information matters more than ever, especially in regulated industries where credibility is everything.

Gen Z uses social media to get financial advice

For Gen Z, financial guidance lives on social media.

According to a recent poll from Gallup, 42% of Americans ages 18 to 29 say they turn to social media for financial advice. And 61% of investors under 35 have acted on recommendations from financial influencers.

Gen Z’s affinity for finfluencers isn’t a surprise. Financial influencers — especially those on TikTok — know how to deliver content that speaks to this generation.

Source: Vivian Tu / Your Rich BFF

Your bank’s social media marketing strategy can take inspiration from their work, creating bite-sized videos focusing on financial literacy, including advice and strategy.

Digital is now the main channel for bank marketing

Digital is no longer “one channel.” It’s the channel in the banking industry.

Today, digital marketing represents nearly 62% of bank marketing budgets, making online channels the primary way banks reach, educate, and engage customers.

This means social media isn’t optional or experimental. It’s a core part of the marketing mix. If digital is where most of the budget is going, social media needs to play an active role in how banks show up.

Your competitors are online

Nine out of 10 banks state that social media is important, and 88% report being very or somewhat active on their accounts.

If you’re not active online, know that your competitors are. And they’re scooping up all your potential social media followers, telling them why their bank is better than yours.

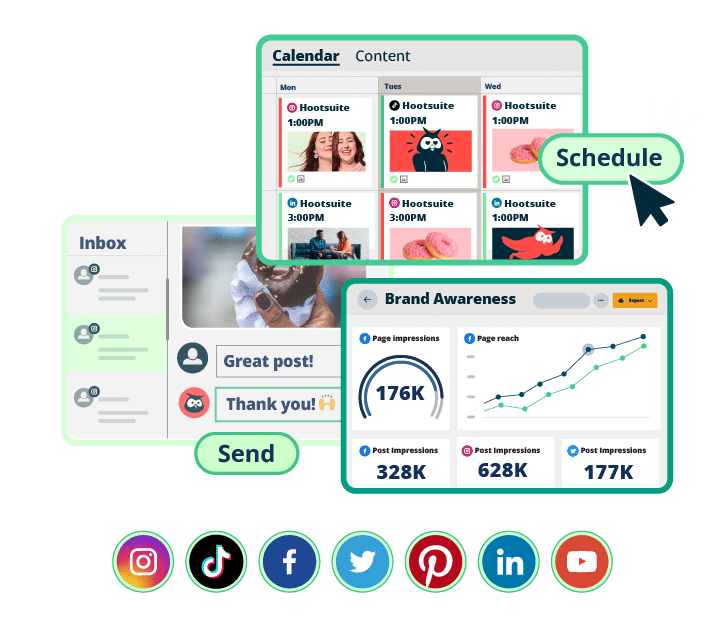

#1 Social Media Tool for Financial Services

Grow your client base with the tool that makes it easy to sell, engage, measure, and win — all while staying compliant.

Check out these nine tips for running an effective (and compliant) social media strategy for banks:

- Start with a social media audit

- Choose the right platforms

- Use social media to build trust

- Stay on top of compliance and risk management

- Educate your internal team

- Put a social media governance policy in place

- Connect social media to your broader marketing strategy

- Humanize your brand with people-forward content

- Engage with your audience

1. Start with a social media audit

To get a full-picture of what you’re working with, do a social media audit.

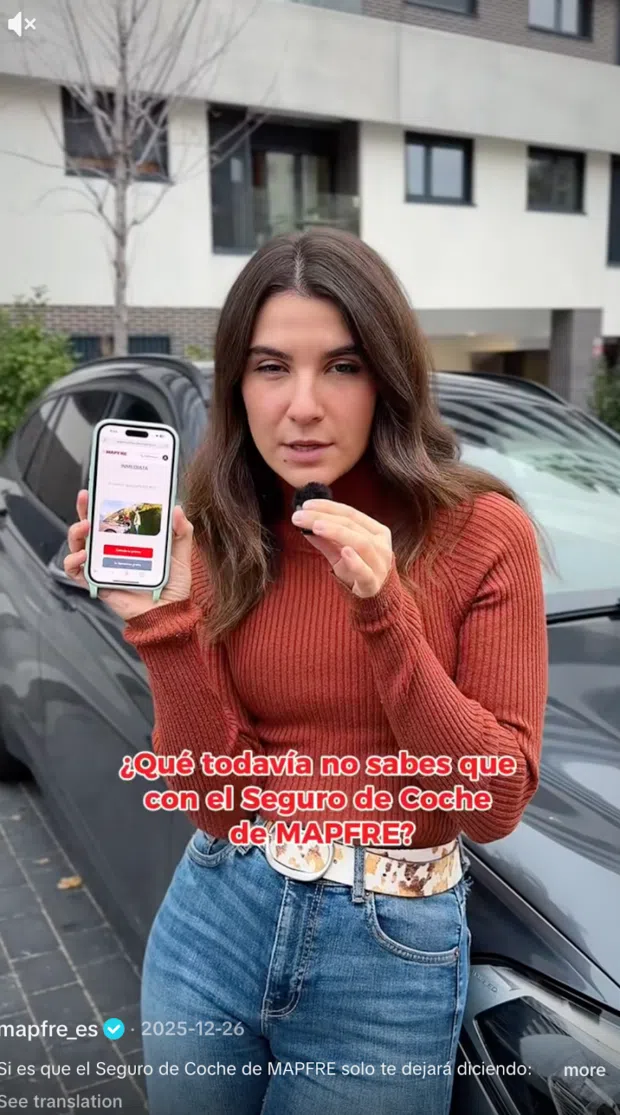

Global insurance giant MAPFRE, for example, conducted a social media audit and discovered over 80 official social media pages spread across different platforms.

Source: MAPFRE

By consolidating these accounts into one platform using Hootsuite, they gained a clearer view of their social media activity and significantly boosted their online presence.

The results were impressive:

- 2M+ followers on social networks

- 31% increase in online interactions

- 200M+ comments received per year

2. Choose the right platforms

When it comes to social media success, choosing the right platforms is key.

“You can have the best product and content, but if you can’t distribute to your audience on the proper platform, you’re not going to hit your goal,” shares Leen Li, Chair of the Wealthsimple Foundation.

To find the right platforms, her organization invested in paid content across YouTube, TikTok, and Instagram to “see what the first $1,000 could get us.” After crunching the numbers, the results clearly favored YouTube.

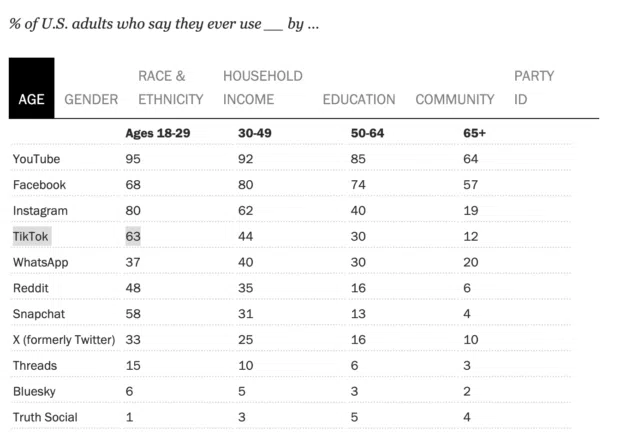

According to new data from Pew Research Center, YouTube has the broadest reach across all age groups, making it a strong foundation for most banks. Facebook, on the other hand, continues to offer solid reach among adults 30 and up.

Gen Z, however, prefers bite-sized financial videos over booking an appointment with an advisor, making TikTok and Instagram smart investments for reaching them.

TL;DR: You don’t need to be everywhere. Instead, show up where your audience already spends time, with content that matches how they prefer to learn and engage.

3. Use social media to build trust

Trust is a big deal for Gen Z, especially when it comes to money.

Nearly 1 in 5 Gen Z adults who don’t invest say it’s because they don’t trust financial institutions. Yet, many say they would invest more if they had better opportunities to learn.

At the same time, Gen Z tends to trust people, not logos. However, they’re very skeptical about finfluencers who try to sell them something.

For banks, the takeaway is simple. Whether you’re partnering with a creator or publishing from your brand account, don’t shy away from personal stories and practical insights. Focus on education first.

And remember: trying to teach and sell in the same breath can break trust fast.

User-generated content (UGC) can also go a long way in building trust. Securian Financial’s #LifeBalanceRemix social media campaign, for example, boosted community engagement with UGC (while achieving serious results).

Source: jaredspurgeon46

Using a mixture of social listening, UGC, and social engagement, the campaign saw:

- 2.5M impressions on Twitter and Instagram

- 1,000+ participants contributing content

- $35,000+ return on investment

4. Stay on top of compliance and risk management

Where you operate will dictate which compliance and risk management rules you need to follow. Highly regulated industries like finance can face serious risks if compliance isn’t properly managed across social media initiatives.

A security breach, whether from unauthorized social media activity or cyber attacks, can result in major financial and reputational damage.

For example, financial technology service provider SIX (operating in Switzerland) manages services for 130 banks. With such a big network, the company is highly susceptible to cyber threats, especially across social media platforms that require constant vigilance.

Source: sixgroup

To combat this, SIX implemented automated cyber security measures (powered in part by Hootsuite) to monitor and address threats, such as unauthorized profiles or malicious content.

The results speak for themselves:

- 30-40 automated alerts generated per month

- 1-2 non-compliant content takedowns a month made possible

- < 24 hour content takedown time achieved

And speaking of compliance: We’ve already mentioned FINRA a few times, so here are some tips to stay compliant with them and tips on staying compliant with the SEC on social media.

5. Educate your internal team

Include a phase in your social media strategy dedicated to educating your internal team on your industry’s regulations and your own social media guidelines.

If your team members understand what compliance looks like, they will be far less likely to accidentally post something that may get you in trouble.

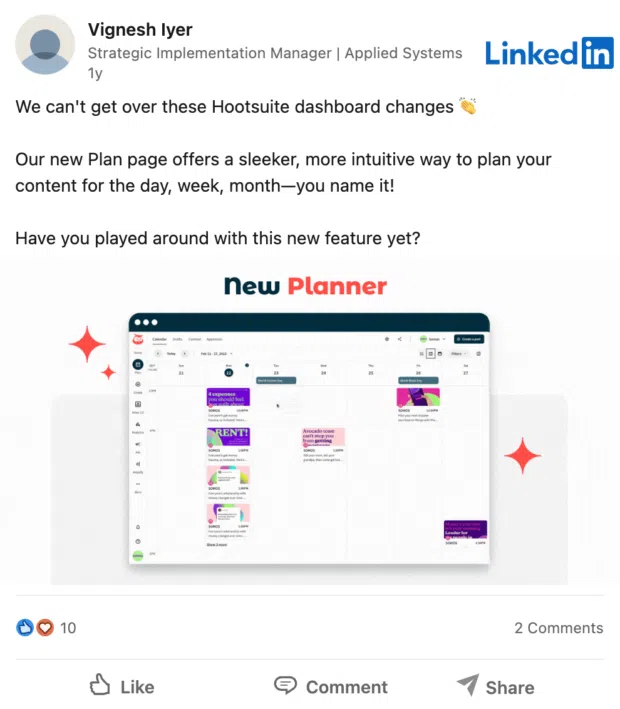

Hootsuite can also make this easier. Amplify, our employee advocacy platform, allows content admins to push a steady stream of pre-approved, curated content that your employees can share on their social accounts.

Amplify’s a great way to extend your organization’s reach while reducing risk with on-brand, compliant social media posts. We use it ourselves, and we’ve also introduced an educational component into the strategy.

After implementing Amplify, we saw impressive results:

- 250% YOY increase in sourced revenue

- 80% Amplify sign-up rate — up 9% YOY

- 4.1M employer brand impressions in Q1 attributed to employee posts via Amplify

6. Put a social media governance policy in place

A social media governance policy lays out the rules of engagement for all employees. This can be a document outlining all of the ‘needs to know’ for your content creators.

Your policy should align with your guidelines for email, text, and all other communications with clients and the public. Overall, it will help you operate within your industry’s regulations.

Since social media management is part of the company’s overall security and compliance policies, the chief information officer and chief risk officer may be involved in creating social media policies.

Hootsuite can even partner with you to deliver custom social media governance training for your employees.

7. Connect social media to your broader marketing strategy

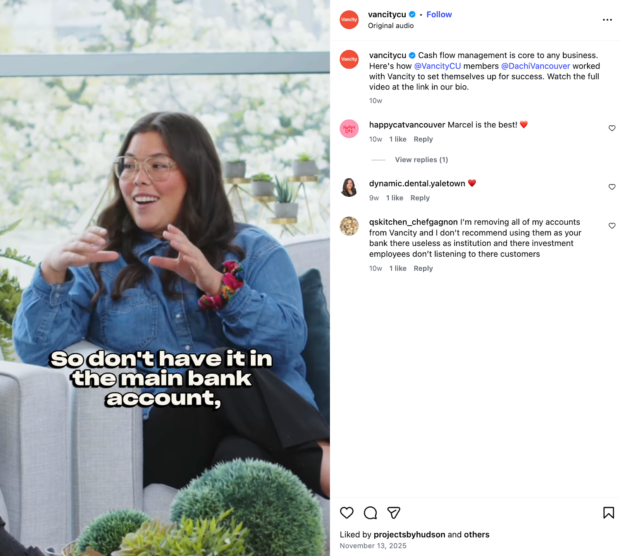

Investors in younger generations (aged 18-34) aren’t exclusively relying on social media for financial advice. They use it in conjunction with other sources to gather information.

Source: vancitycu

So, creating a network of digital information (like linking your social posts back to your blog and from your blog to vetted sources) will help you build a reliable reputation.

This can be as simple as adding a CTA like, “click the link in our bio.”

8. Humanize your brand with people-forward content

You can improve your social media engagement by posting about the people within your company. Share employee stories, your client’s experiences and testimonials, and behind-the-scenes updates.

You’ll give off the impression that you care about the people who work within your organization, which is important in an industry often seen as impersonal.

Source: Kennebec Savings Bank

Your efforts to humanize your brand will pay off. For example, Armanino LLP, a top 20 CPA and consulting firm, used Hootsuite Amplify to empower employees as brand ambassadors.

This boosted the firm’s reach and reputation with:

- 14,707 website clicks from employee posts

- 19.2M people reached with employee content (+638% year-over-year)

- $232,375 in potential ad value created through employee advocacy

9. Engage with your audience

The beautiful thing about social media is that it’s a two-way street — and a powerful way to improve customer experience. People are reaching out to you who want to engage, to have a conversation.

Good customer service isn’t just about fielding complaints, either. Being open and receptive to talking with your audience humanizes your institution and helps build customer loyalty.

Source: SoFi

Respond to tweets and threads, engage with comments on Instagram, TikTok, and LinkedIn, and be sure to message back on Messenger.

Social Trends Report for Financial Services

Get a glimpse into the future of financial services on social media and build a strategy you can bank on.

Social media and banking: How to measure success

Banks measure social media success by tracking the right metrics, using tools built for regulated industries, and regularly adjusting based on performance.

Here’s how to do that in practice:

Use the right tool

Hootsuite’s all-in-one solution helps credit unions, banks, and other financial institutions measure and manage every aspect of their social media presence.

You can get help with scheduling, reporting, and creating compliance content for credit unions and banks.

Hootsuite Analytics will give you an overall view of what’s working and what’s not in your strategy, but there are other features the financial sector loves:

- Scheduling: Plan posts across multiple platforms to stay consistent. You can reach your audience at optimal times using our Best Time to Publish tool, even across different time zones.

- Benchmarking: Compare your performance against competitors and industry standards to see where you stand. You can do this using Hootsuite Analytics or check out our complete guide to social media benchmarks for financial services (it’s updated quarterly!).

- Social listening: Monitor what people are saying about your brand, competitors, and industry trends in real time. This helps you stay proactive in managing your reputation and addressing concerns before they escalate.

- Community management: Hootsuite allows you to manage customer inquiries and responses from one dashboard, helping you with consistent communication.

- Compliance and risk management: Hootsuite’s monitoring tools ensure that your content stays compliant with financial regulations while protecting your brand from cyber threats. Learn more about ways to protect your brand.

Track the right metrics

To gauge the effectiveness of your social media efforts, focus on key performance indicators (KPIs) that align with your business goals.

Here are a few popular metrics you might want to consider:

Review results and adapt your strategy

The social strategies that work are the ones that are regularly reviewed and adapted. Take a look at your metrics using Hootsuite Analytics to see what’s working and what’s not, and adjust your budget and strategy accordingly.

If a particular type of content performs better, lean into that. If engagement drops, reassess your approach. Your data is going to be the best indicator of what’s working and what’s not, letting you adjust your strategy for the best results and best use of your social media budget.

FAQ: Social media for banks

How do banks use social media safely and compliantly?

Banks use social media safely and compliantly by setting clear governance rules and using Hootsuite to manage approvals, monitoring, and publishing in one place. This helps teams stay consistent, compliant, and confident as they engage customers across platforms.

What are the best social media practices for banks and financial institutions?

The best social media practices for banks focus on education, consistency, and trust. Successful banks share helpful content, respond promptly to questions, follow platform rules, and monitor performance regularly to improve results without cutting corners on compliance.

What social media platforms are best for banks?

The best social media platforms for banks depend on their audience and goals, but YouTube, Facebook, LinkedIn, and Instagram are the most commonly used. LinkedIn works well for thought leadership, YouTube is ideal for long-form content, like webinars and podcasts, and Instagram and TikTok are popular with younger audiences.

How do banks manage social media risk and compliance?

Banks manage social media risk and compliance by combining internal policies with monitoring and approval workflows in tools like Hootsuite. That way, they can catch issues early, reduce risk, and still show up on social without slowing down.

Hootsuite makes social marketing easy for financial service professionals. Manage all your networks, drive revenue, provide customer service, mitigate risk, and stay compliant — all from one easy-to-use dashboard. See the platform in action.